Secure your place at the Digiday Publishing Summit in Vail, March 23-25

In Graphic Detail: Why platforms are turning social video into living room TV

If 2025 was the year YouTube really turned the screw on traditional TV, 2026 is shaping up as the year the rest of big tech does the same.

To see why the living room has become a battleground the major platforms can’t ignore, here are five charts that lay it out in graphic detail.

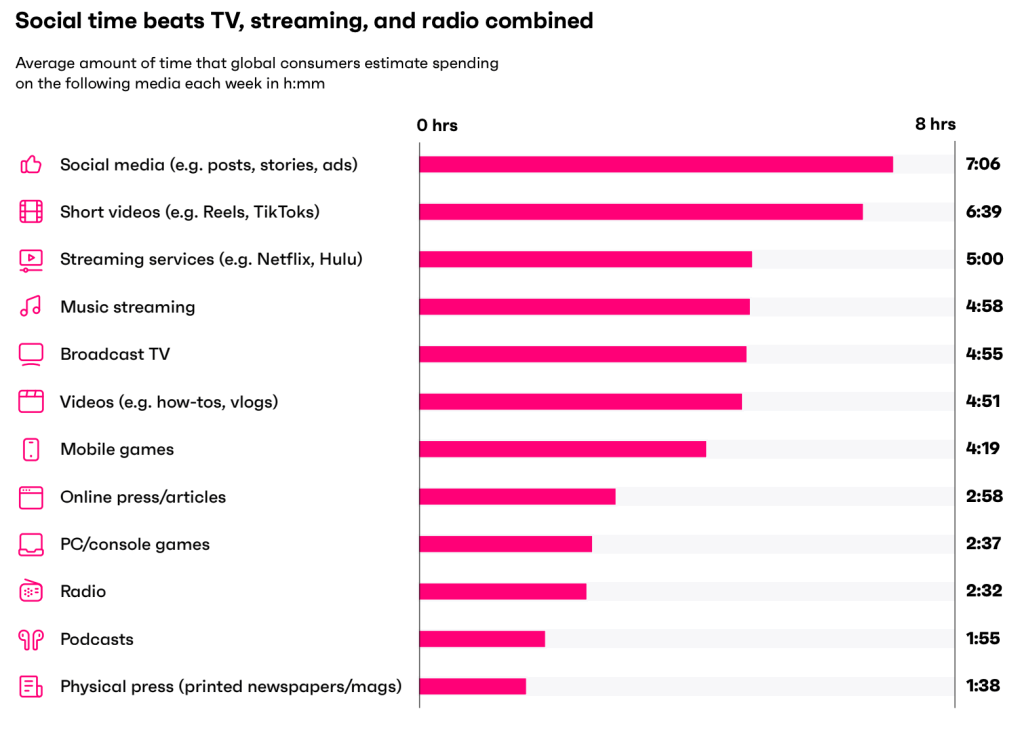

Social media is increasingly social entertainment

Let’s start with this before going into the research. Short-form video is swallowing a growing amount social media time, which already commands more attention than ever

According to GWI’s Connect the Dots 2026 report, on average, global consumers spend about seven hours and six minutes on social media every single week. And it’s also no surprise that a further six hours, 39 minutes are spent on short-form videos. Given that short-form videos predominantly live on social media, together these formats take the lion’s share of consumer attention – far more than any other type of media.

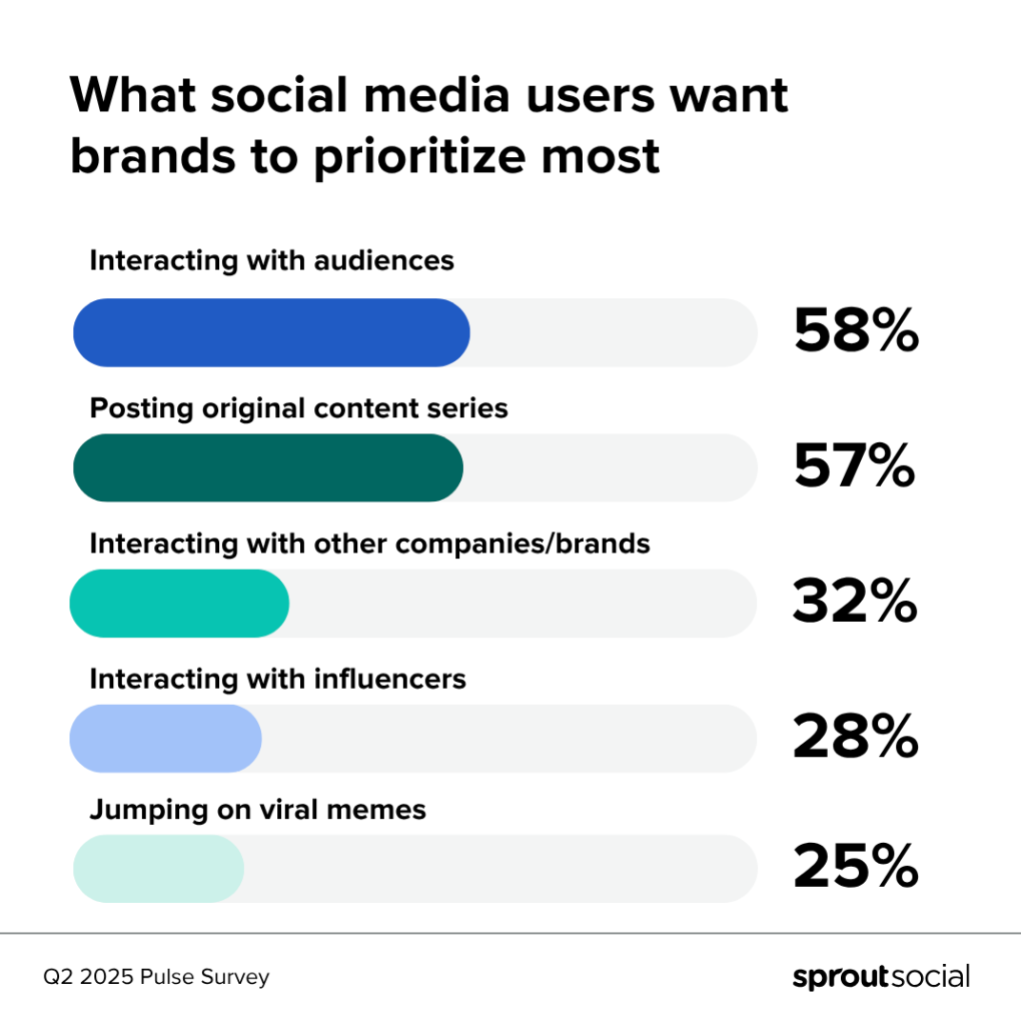

Consumers want more serialized content

For brands to maintain their loyal audience, they need to give them more of what they want so they don’t disengage. And what they want to see is more original content series.

When social media users were asked what they want brands to prioritize most, more than half (57%) said they want the brands they follow to post more original content series, according to Sprout Social’s 2026 trends, which cited a Pulse Survey conducted last year.

These series allow brands to delve deeper into a topic than they necessarily would have been able to on a single image post. And similar to any TV series, this episodic content allows consumers to get to know the characters, which ultimately keeps them engaged, and coming back for more.

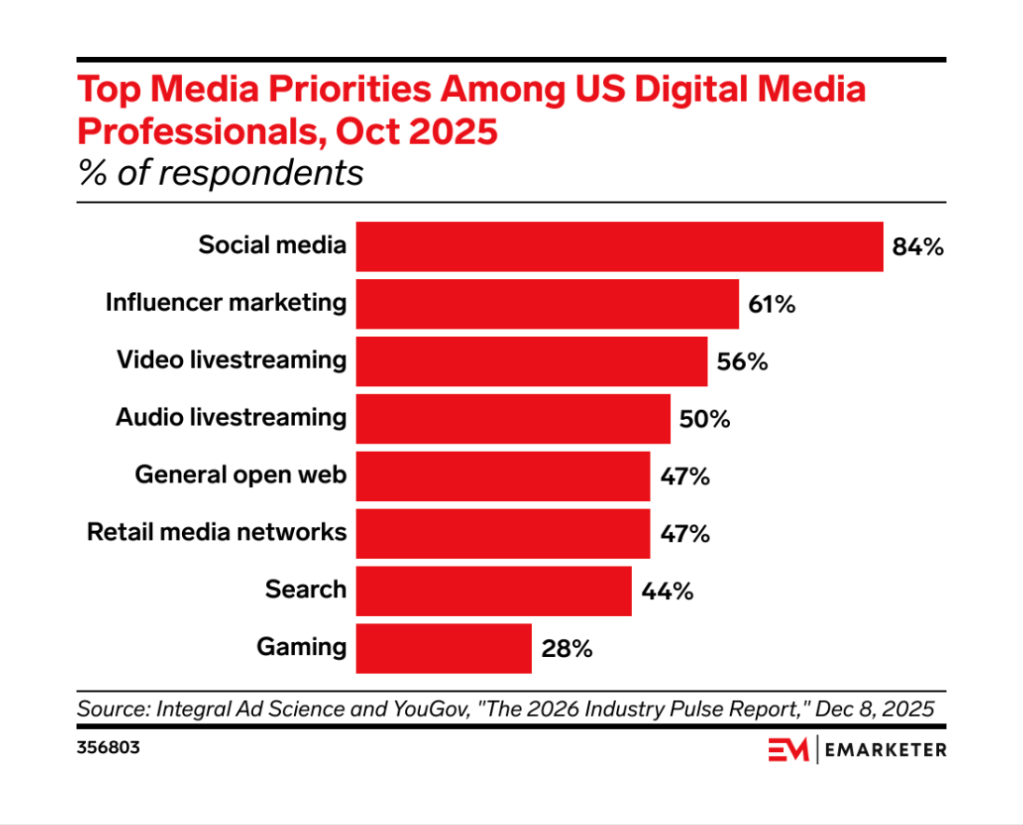

Advertiser priorities have shifted according to consumer behavior

Ad dollars go where attention flows. The majority (84%) of U.S. advertisers said that social media is their top priority, according to eMarketer, citing The 2026 Industry Pulse Report by IAS and YouGov, last month. This was followed by influencer marketing (61%), video streaming (56%) and audio streaming (50%).

Creators are integral to good performing content

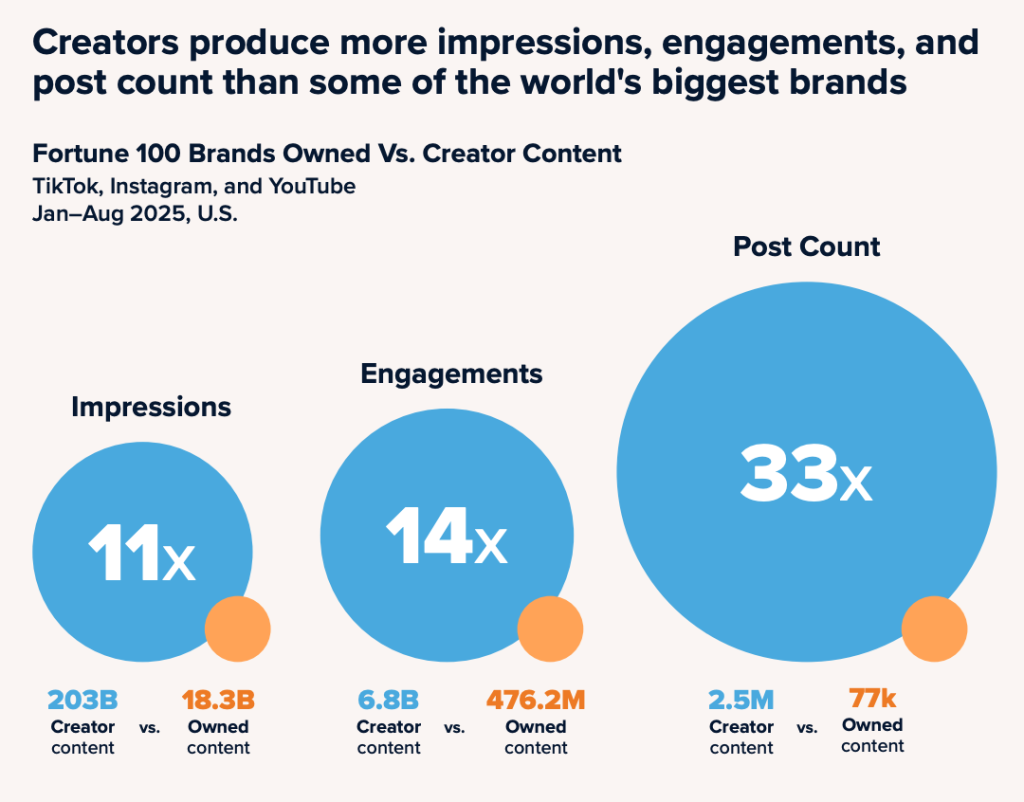

Content creators aren’t just making goofy videos in their bedrooms anymore. They’ve become real audience magnets. That’s why platforms need them: creators can command just as much attention as the world’s biggest brands.

Between January and August 2025, CreatorIQ conducted an analysis of Fortune 100 brands in the U.S. across TikTok, Instagram and YouTube, according to the company’s The State of Creator Compensation report. During that time period, those brands published 77,000 posts on their own channels, while creators produced 2.5 million posts that featured those brands. The creator content produced 11 times more impressions and 14 times more engagement than the brands themselves, per the report.

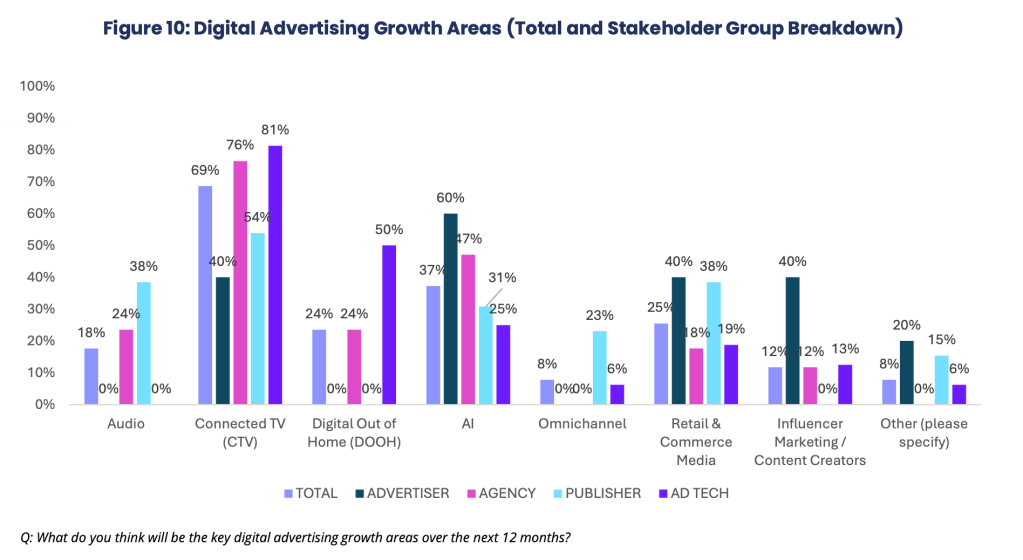

CTV has become the biggest growth area for ad spend

CTV is expected to see the biggest growth when it comes to ad spend over the next 12 months. That’s according to IAB Europe’s Attitudes to Digital Advertising 2026 report. More so than AI, retail and commerce media.

The majority (69%) of those surveyed said they believe CTV will be a key growth area in 2026. Broken down, 40% of advertisers felt that way, along with 76% of agencies, 54% of publishers and 81% of ad tech professionals.

That’s not to say other digital media areas won’t grow, but priorities have been tweaked given where attention is headed, so ad dollars will naturally follow.

More in Marketing

‘Nobody’s asking the question’: WPP’s biggest restructure in years means nothing until CMOs say it does

WPP declared itself transformed. CMOs will decide if that’s true.

Why a Gen Alpha–focused skin-care brand is giving equity to teen creators

Brands are looking for new ways to build relationships that last, and go deeper than a hashtag-sponsored post.

Pitch deck: How ChatGPT ads are being sold to Criteo advertisers

OpenAI has the ad inventory. Criteo has relationships with advertisers. Here’s how they’re using them.