Secure your place at the Digiday Publishing Summit in Vail, March 23-25

In Graphic Detail: Here’s what the creator economy is expected to look like in 2026

Creators and the creator economy aren’t going anywhere, given the market has truly embraced just how important they are to the industry, and it’s no longer a nice-to-have.

Which is why Digiday has charted how the creator economy is expected to expand in 2026, including revenue, the types of creators brands are planning to work with, along with what platforms will be key for that content.

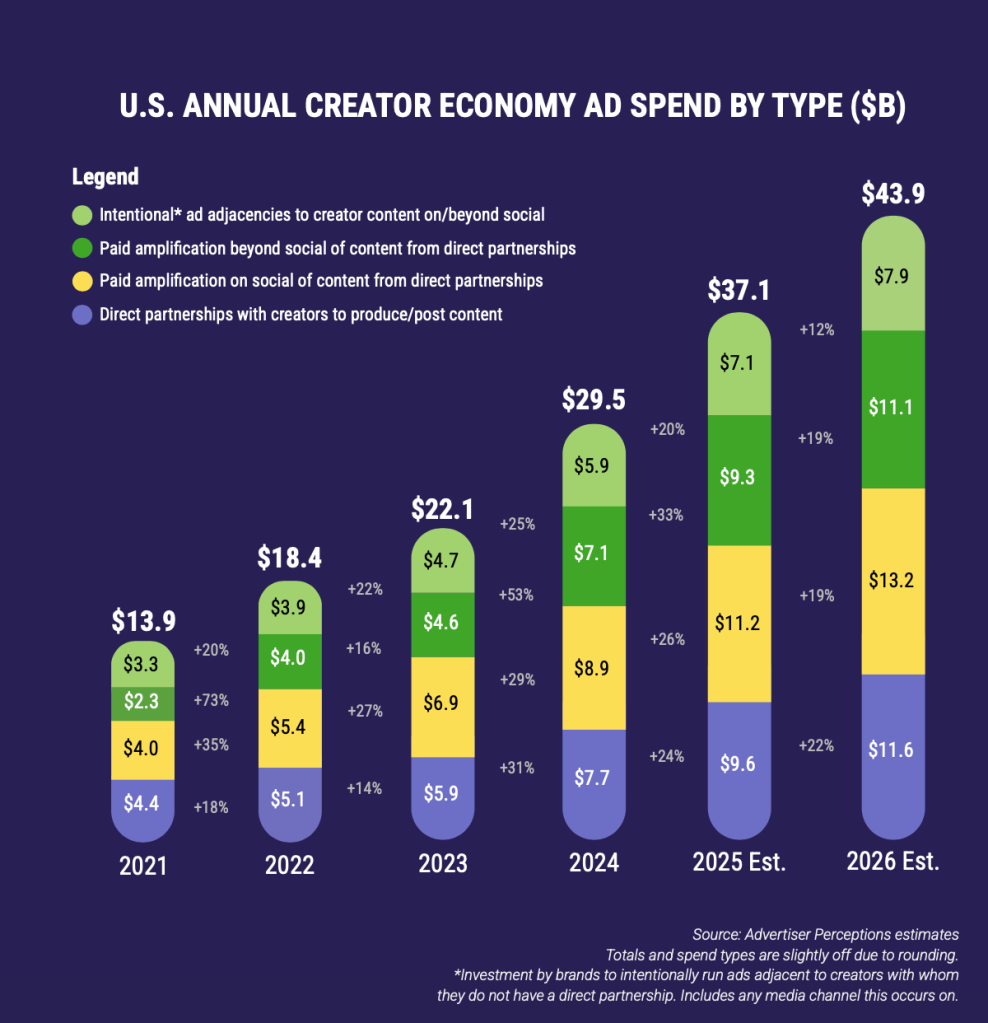

U.S. annual creator economy ad spend set to rise by around 18%

The IAB’s latest report noted that this year, the U.S. annual creator economy ad spend is set to reach $37.1 billion. But it also forecasts that next year, that figure is set to increase to $43.9 billion.

What’s interesting is where the bulk increases are coming from.

Looking at how that ad spend will be split, the IAB report, which cites Advertiser Perceptions data, stated that $13.2 billion is expected to come from paid amplification of content from those direct partnerships on social media – increasing 48% from $8.9 billion spent on it this year.

An additional $11.1 billion is set to be spent on paid amplification of the content from direct partnerships beyond social media, increasing 56% on 2025’s $7.1 billion total.

Added to that, $11.6 billion will be spent on direct partnerships with creators to produce and post content, up 21% from $7.7 billion this year.

While $7.9 billion is expected to account for intentional ad adjacencies to creator content on or beyond social media, up 33% from $5.9 billion this year.

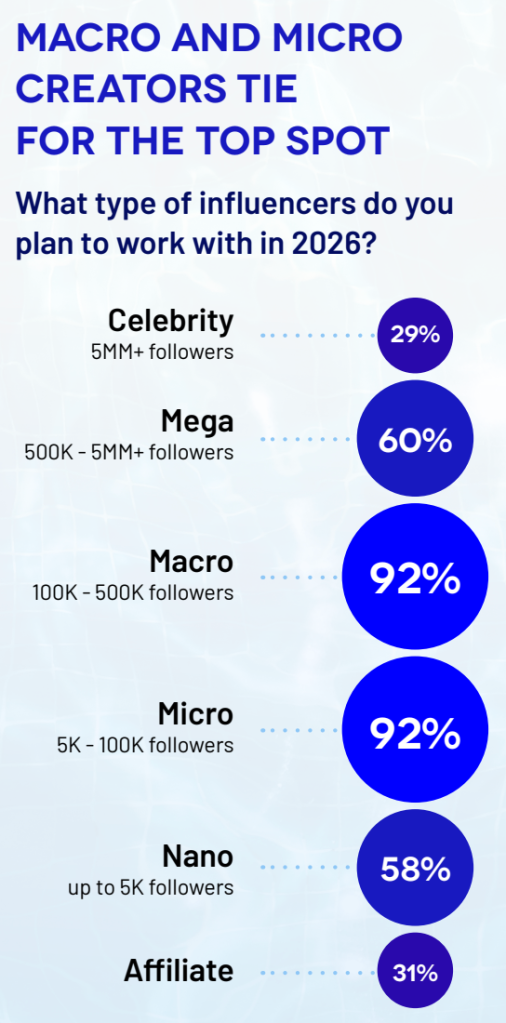

Marketers intend to work with a mix of macro and micro influencers next year

As the creator economy evolves and marketers have figured out how they’re trying to measure success, the types of creators they want to work with has shifted. Initially it was all about celebrities, or mega influencers like MrBeast – which certainly have the reach, but rarely have the time (or capacity) to have regular one-on-one engagement with their loyal followers. Not to mention, the bigger the creator, the more budget that’s needed to pay them.

However, for 2026, 92% of marketers said that they intend to work with both macro (100,000 to 500,000 followers) and micro (5,000 to 100,000 followers) influencers, according to Linqia’s 2026 State of Influencer Marketing report – demonstrating that a one-size-fits-all approach doesn’t necessarily work, but a combination, depending on the goals of each campaign or creative, will drive better results.

That’s not to say other influencer types are void next year. A minority (29%) of marketers said they’re aiming to work with celebrities next year, while 60% are planning to work with mega (500,000 to 5 million followers) influencers and 58% intend to partner with nano (up to 5,000 followers) influencers over the next 12 months.

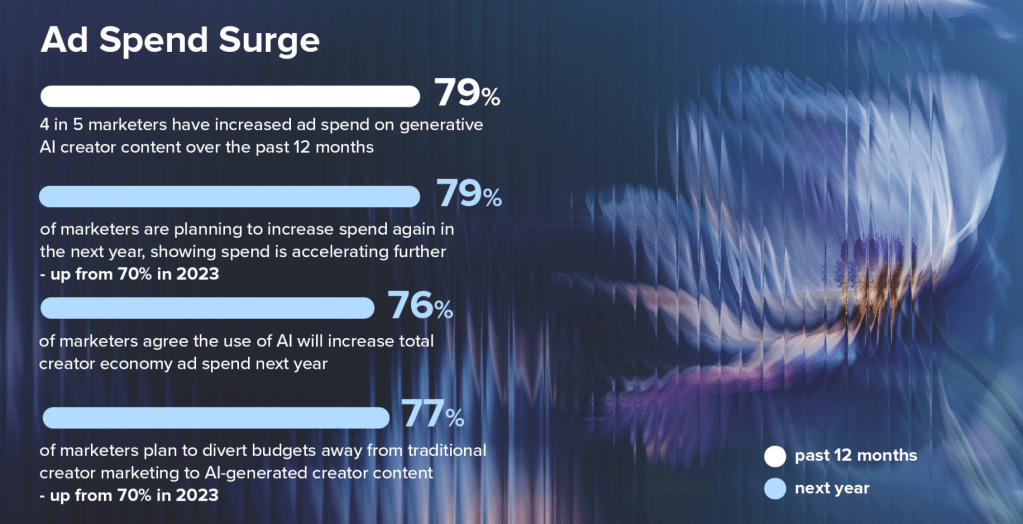

Marketers plan on increasing spend on AI-generated creator content

What’s really had a lasting impact on the creator economy this year though, is generative AI. Over the past 12 months, 79% of marketers increased ad spend on generative AI creator content, according to Billion Dollar Boy’s The Real Impact of AI on the Creator Economy report. And this move is only set to increase in 2026.

Next year, 79% percent of marketers are planning to increase spend again in generative AI creator content, up from 70% in 2023, per the report. A further 76% of marketers surveyed said they agree the use of AI will increase total creator economy ad spend next year, while a majority (77%) said they plan to divert budgets away from traditional creator marketing to AI-generated creator content in 2026, Billion Dollar Boy’s report said.

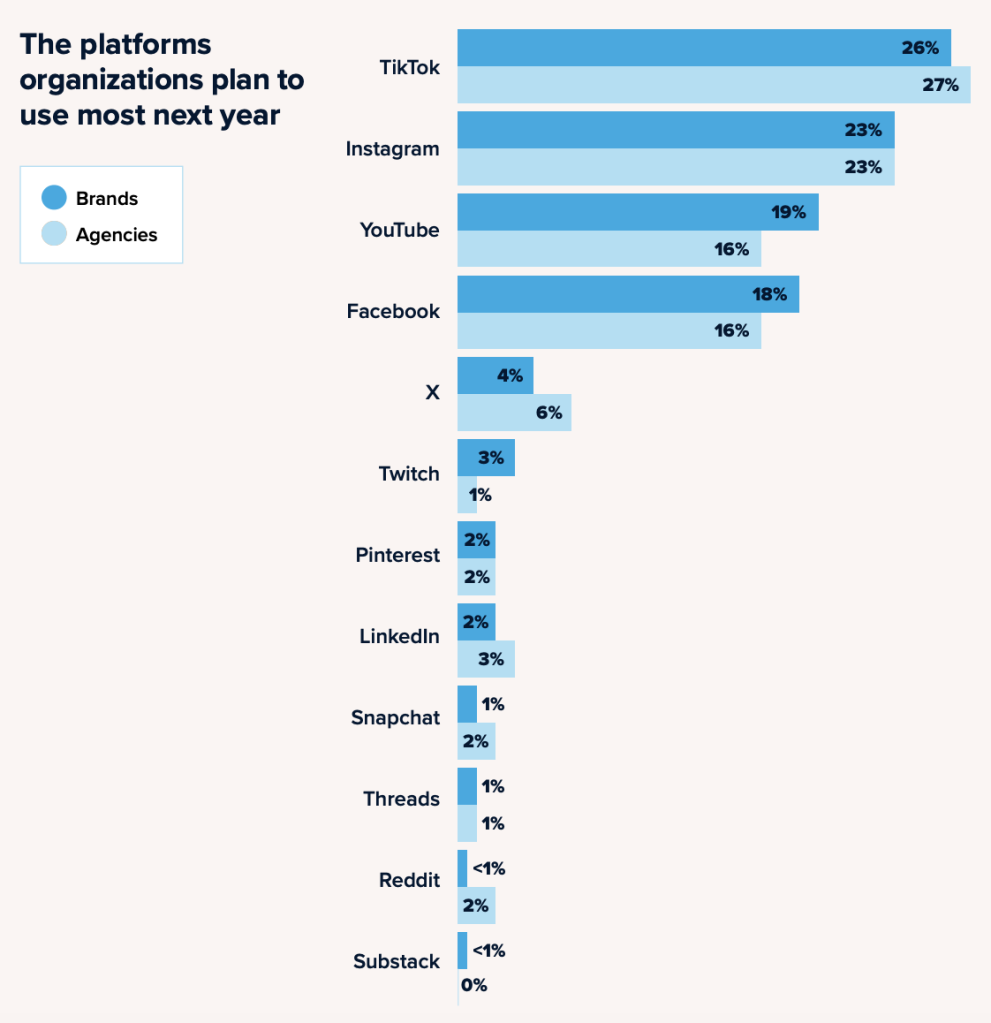

TikTok, Meta and YouTube are top platforms for creator marketing in 2026

Unsurprisingly, 2026 will likely see more of the same when it comes to the top platforms that agencies and brands use for creator marketing.

Around a quarter of brands (26%) and agencies (27%) intend to use TikTok the most next year, despite the ongoing uncertainty around its U.S. existence as we close out 2025, according to CreatorIQ’s The State of Creator Marketing 2025-2026 report.

Next in line is Instagram, with 23% of brands and agencies stating they will use that platform the most in 2026. In third place is YouTube – despite being the monetization king for creators – which saw 19% of brands and 16% of agencies saying this will be the most used platform next year. And Facebook is a close fourth position, with 18% of brands and 16% of agencies citing it as the platform they plan to use the most next year, per the report.

Equally unsurprisingly, the likes of Substack, and Threads are at the bottom of the chart – Substack has yet to incorporate ads of any kind, while Threads is still very early days with its offering. And while Reddit has had a successful year to date, less than 1% of brands and 2% of agencies surveyed said that they’re planning to use it most next year, according to CreatorIQ’s report.

For creators, YouTube, Instagram and TikTok remain priorities for next year

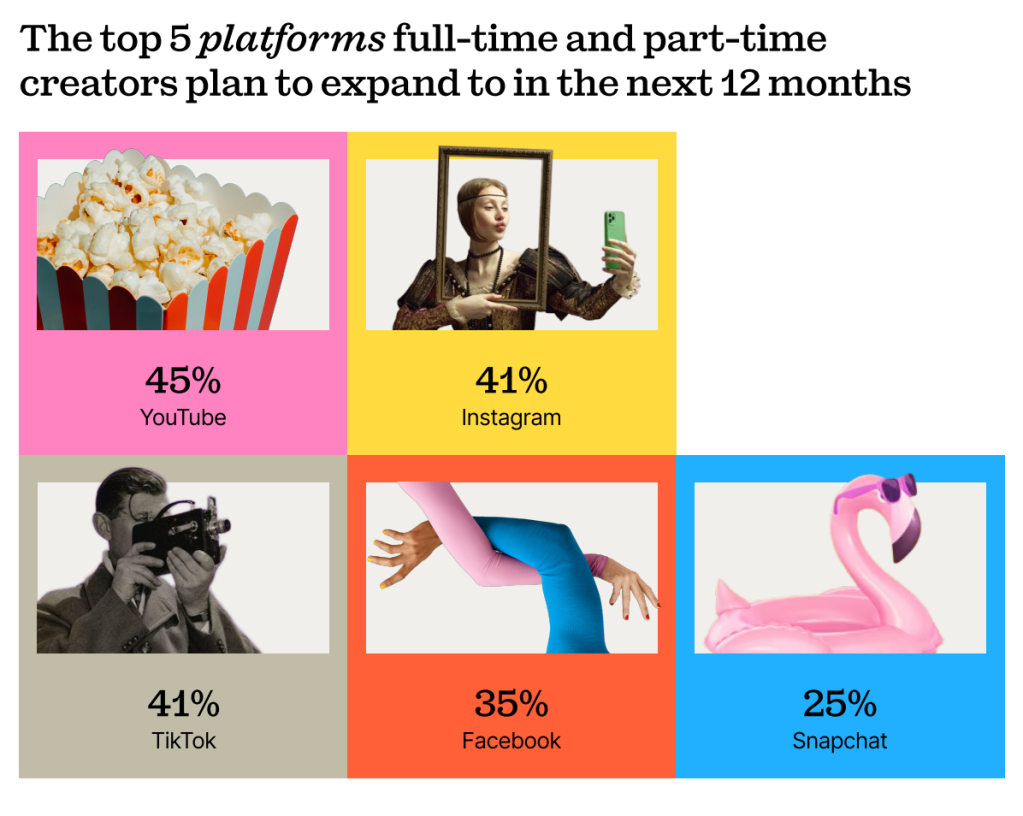

Thinking about the platforms, while the top players which full and part time creators intend to expand into in 2026 are the same, their order varies slightly from the order of which platforms marketers intend to use most.

According to Epidemic Sound’s The Future of the Creator Economy Report 2025, 45% of full and part time creators plan to expand to YouTube next year, while 41% of those surveyed equally plan to expand into Instagram and TikTok. Fourth in line is Facebook with 35% of creators wanting to expand into it next year – which makes sense if Meta is trying to position it as an underappreciated platform.

While Snapchat was towards the bottom of the priority list for brands (1%) and agencies (2%) according to CreatorIQ, it seems the platform is winning the attention of creators themselves. A quarter (25%) of full and part time creators plan to expand into Snapchat in 2026, which is likely thanks to the increased and improved efforts around monetization, such as its unified program, that Snap has implemented over the past 12 months.

More in Marketing

‘Nobody’s asking the question’: WPP’s biggest restructure in years means nothing until CMOs say it does

WPP declared itself transformed. CMOs will decide if that’s true.

Why a Gen Alpha–focused skin-care brand is giving equity to teen creators

Brands are looking for new ways to build relationships that last, and go deeper than a hashtag-sponsored post.

Pitch deck: How ChatGPT ads are being sold to Criteo advertisers

OpenAI has the ad inventory. Criteo has relationships with advertisers. Here’s how they’re using them.