Secure your place at the Digiday Publishing Summit in Vail, March 23-25

How publishers are now approaching curation with a calculated embrace

As a Digiday+ member, you were able to access this article early through the Digiday+ Story Preview email. See other exclusives or manage your account.This article was provided as an exclusive preview for Digiday+ members, who were able to access it early. Check out the other features included with Digiday+ to help you stay ahead

By now, publishers’ skepticism toward curation is less a hot take, more a hard truth. The same old story of middlemen, murky margins and the nagging sense that someone else is getting rich off their inventory. But justified cynicism doesn’t pay the bills.

So rather than rehash familiar frustrations, what follows is about something more pragmatic: how publishers are learning to work the curation game without buying into it, making peace with a system they don’t trust but can’t afford to ignore.

Because at this stage, sitting it out isn’t a statement, it’s a financial risk. Programmatic dollars keep slipping away and the evidence is piling up that, when done right, curation isn’t just a necessary evil — it might actually be smart business.

Curation specialist Audigent’s latest data shows just how much.

Its curated marketplace deals — pre-packaged audience segments or inventory pools sold to multiple buyers via a single deal ID — are driving measurable gains so far this year.

In OpenX, curation on global campaigns increased bid competition for impressions by 20% and led to a 118% spike in impressions won between November and December last year.

PubMatic saw similarly strong results: global curated deals delivered up to a 10% revenue boost on discovered inventory and a 25% average eCPMs increase.

It’s not just one-off gains either. In Sharethrough, curated display deals globally outperformed open auctions by 33% in eCPMs, while online video saw an even bigger boost — 55% over open auction sales.

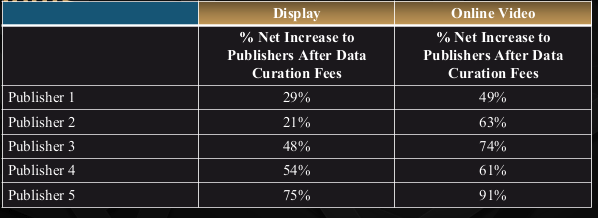

But those numbers come with an asterisk — they’re pre-fee. The real question is what’s left once the curation vendors take their cut. That net benefit is what matters: it’s the difference between a business model publishers can bank on and yet another layer of extraction dressed up as innovation. According to Augident, five unnamed in the U.S. publishers working with Magnite have run the math, and walked away with results worth talking about (see table below).

Meanwhile, Audigent’s curation of Index Exchange’s impressions showed even more dramatic lifts depending on the channel and vertical — CTV revenue climbed 13% in the U.S., mobile soared 70% and health vertical revenue skyrocketed over 260% with eCPNs doubling.

Of course, skeptics will argue that a curation vendor touting the benefits of curation is hardly surpassing — it’s their job to sell it. Fair enough. But for publishers, that’s exactly where the conversation starts: seeing the upside for themselves.

“Eventually, I think publishers will have to lean into curation in some shape or form as the reality is that the growth of curation could outweigh or even replace the open market in some shape or form over the long-term,” said Jeremy Gan, evp of revenue operations and data strategy at Daily Mail.

The complicated reality of playing the curation game

Once publisher execs like Gan see money in curation, the challenge is execution. That’s easier said than done when the number of curators keeps multiplying and impressions are often swept into curated marketplaces without publishers’ explicit consent.

To stay in control, publishers are treading carefully into candid conversations with vendors, knowing that what vendors don’t say about curation is often just as telling as what they do.

Are vendors clearly separating curated marketplace revenue from open programmatic auction earnings, or is it all bundled together? Do they provide insight to what’s inside these deals, and more importantly, who’s buying? And then there’s the question of fees. Curated packages often come with extra costs, meaning publishers might be paying a premium just to access advertisers — sometimes without even knowing the full tab.

The difference between unlocking new ad dollars or handing over even more control of them comes down to these details.

That’s why publishers are putting curators under the microscope, tracing the money, dissecting the tech and demanding transparency before they find themselves on the losing end of the deal.

“We’re starting to do quite a lot of testing on helping publishers on deal operations, where we can take them through using curation as a platform well as through our process to actually ensure that they’re able to actually deliver more money against their PMPs,” said James Leaver, CEO of curation firm Multilocal.

It sounds basic but in programmatic, transparency is trust. The more intel publishers have, the better they can track how much inventory lands in curated marketplaces, avoid direct sales overlap and ensure cohesive pricing. Put simply: curated marketplaces should complement direct sales, not cannibalize them, filling gaps in audience segments and categories that sales teams can’t reach on their own.

Taking control

Publishers reclaiming control over online advertising has been more wishful thinking that reality — plenty of attempts, little traction. However, curation feels different. It won’t hand them the wheel on ad dollars, but it might give them a strong grip on the supply chain, offering more control over inventory quality, pricing and partnerships — enough to shift the balance even if only slightly.

Terry Hornby, digital solutions director of commercial publisher Reach — home to tabloids The Mirror and the Express — believes that curation in its “purest form” could be a significant revenue maker for publishers, as long as they are pushing their SSP partners to give straight answers on how, and with who, curation tech players are bundling and pricing their inventory.

“A publisher knowing what inventory they’re giving to the buy side, packaging it up in their own way, and then having that discussion with the [curation] player and displaying it in the platform like that — that’s perfect curation because then you’re essentially saying: Here’s my ‘cost-of-living content’ for example, I don’t mind that going with other people’s cost-of-living content, and we’re going to price it X. So they’re in control of price and the way it’s packaged up. And everybody in the chain is adding value, it’s not just people adding themselves to take a margin.”

If they’re not already, publishers need to get curious about what exactly curation is, and how it can work for them, he added. The fact that many still wryly label the method “ad networks 2.0” may soon be moot. As one candid senior exec, on condition of anonymity said when referencing publisher appetite for curation: “We’re all drowning. If we see a floating log [revenue from curation] we’ll jump on it.”

When it comes to curation, Sara Badler, chief advertising officer for the Guardian, North America, is all in.

“I love it [curation],” she said. “I know that everyone has different views on it, but I think that the more our partners want to help us curate deals that make sense for us, the better.”

She added that curation has been ongoing in the U.S. with publishers like DotDash Meredith (where Badler was CEO of enterprise and partnerships when she left in 2023) using it for several years. “We did that at DotDash all the time. We would have them trade deals around tent-pole events. It was kind of just an extra little bit of help. And so I definitely don’t think it’s a bad thing.”

Curation is an opportunity the Guardian wants to invest more into and the publisher is working with some of its DSP and SSP partners on what the Guardian’s strategies could look like.

“Evaluating your partners, having early business reviews, all that stuff you can kind of build on guidelines, or what you think is best in terms of tentpoles. Take the Super Bowl for example — the DSPs can put together deal IDs that they think will make sense for buyers if they’re going to activate more display inventory than before. That might be something for sure,” she added.

Green shoots

None of this would matter if the ad dollars weren’t flowing. While exact spending on curated marketplaces is hard — woven as they are into private deals and customized auction dynamics — the momentum is hard to miss. Advertisers are buying in.

Just look at Multilocal. Over the past 24 months, the curation specialist has tracked a clear shift in ad dollars away from the open market and toward curated deals. The proof: the growth in the number of deals currently running across CTV (+32%), Native (+233%), Video (+117%), and Audio (+600%) compared to the previous year.

More in Marketing

‘The conversation has shifted’: The CFO moved upstream. Now agencies have to as well

One interesting side effect of marketing coming under greater scrutiny in the boardroom: CFOs are working more closely with agencies than ever before.

Why one brand reimbursed $10,000 to customers who paid its ‘Trump Tariff Surcharge’ last year

Sexual wellness company Dame is one of the first brands to proactively return money tied to President Donald Trump’s now-invalidated tariffs.

WTF is Meta’s Manus tool?

Meta added a new agentic AI tool to its Ads Manager in February. Buyers have been cautiously probing its potential use cases.