Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Digiday Research: Social media platforms are losing traction with content marketers

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

Social media platforms such as Facebook and Google’s YouTube have long formed the backbone of brands’ content marketing distribution strategies. But distribution channels besides social platforms are growing in importance for companies’ content marketing efforts.

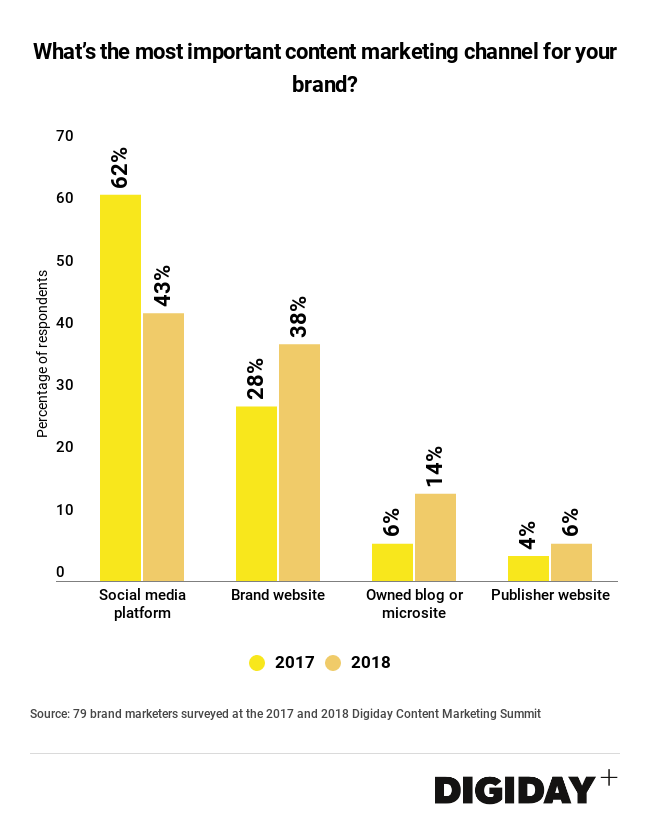

In a survey of brand marketers by Digiday at its Content Marketing Summit this month, 43 percent of marketers said social media platforms are the most important content marketing channel for their companies. That’s a nearly 20 percent drop from the 62 percent of marketers who favored social media platforms in 2017. Companies are increasingly turning their attentions to their owned and operated sites instead, which offer advantages including the ability to collect more data and have less of it obscured by walled gardens.

Facebook’s changes could go a long way to explaining marketers’ shifting attitudes. The company altered the algorithm powering its news feed in January of this year, deemphasizing content from publisher and company pages in the process.

Meanwhile, prices for paid distribution are going up, forcing marketers to look at their spending on the platform with greater scrutiny. As one attendee at the summit put it, “Facebook now is a customer service platform — people use it to complain but not really to do marketing or content marketing.”

And enthusiasm for Facebook’s own branded content program, Anthology, has tailed off. Many companies were turned off by the program’s massive 7-figure price requirement.

Other major platforms all have large audiences for marketers to reach, but each has its flaws. Instagram is hurdling Facebook as a preferred platform for advertisers according to one marketer at the event and Instagram has long since been favored to Snapchat by marketers. But marketers know to view campaigns on Instagram with some skepticism due to its multiple fraud problems. Meanwhile Amazon’s Spark program failed to garner meaningful traction.

Measurement is another issue potentially driving content marketers away. Measurement in general is problematic for content marketing and one of the key points of discussion at the Content Marketing Summit was content marketing’s reliance on “soft” metrics like lifts in brand awareness, rather than conversions or sales generated.

Platforms have done little to solve marketers’ campaign metrics woes so it’s not unreasonable that brands are favoring other channels to host their content marketing. Earlier research by Digiday found that the lack of data provided by “walled gardens” was one of the most common issues hindering reliable campaign attribution measurement for marketers.

While social media platforms win in the size of the audience they offer marketers, they can’t compare to the level of transparency marketers gain from their owned sites. Although social media platforms are still the preference of most marketers for content marketing, it’s quality of data, not quantity of audience, that is shifting marketers’ behaviors.

More in Marketing

In graphic detail: How Anthropic’s Pentagon refusal is paying off in downloads, brand trust and enterprise deals

OpenAI’s Pentagon deal seemed to spark uproar among its users, many of whom were against it. Anthropic’s refusal to agree to the terms was seen by users as the more trustworthy alternative.

How AI could disrupt retail media’s $38 billion search ad market

ChatGPT and other AI chatbots could divert shoppers from retailer sites, putting the $38B retail search market at risk.

‘Brand safety is moving from fear to curiosity’: Zefr’s Raddon on content-level accreditation – and what it exposes about the industry

The threat is no longer a discrete piece of bad content that a keyword list or a domain block can catch. Its volume.