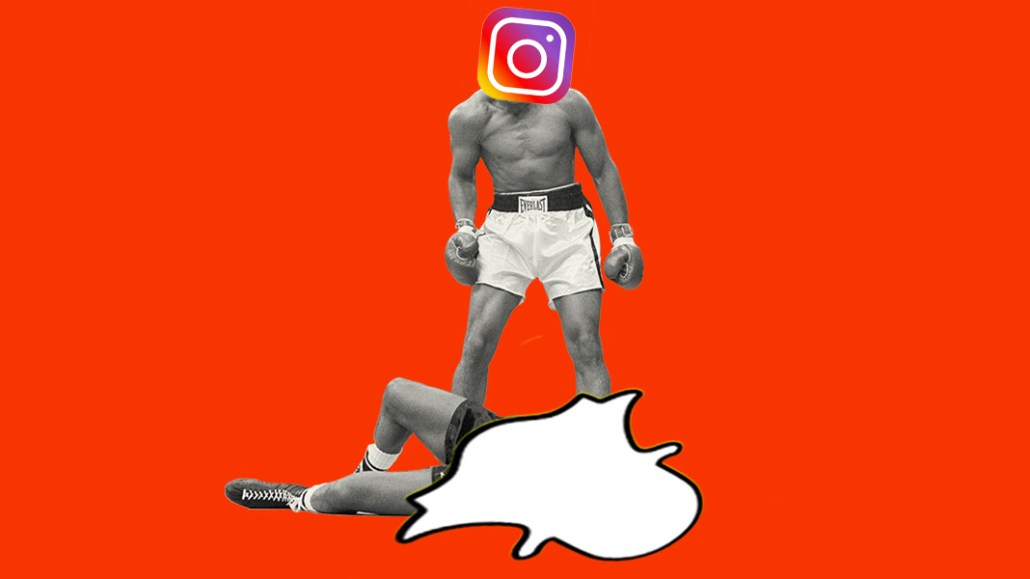

Scale matters: Advertisers are opting for Instagram over Snapchat

Instagram is mimicking Snapchat, and Snapchat is feeling the pain.

Eight months since Instagram rolled out its Stories feature and just over a month since it launched ads on it widely, it has already surpassed Snapchat. The feature not only has more people using it daily (200 million versus Snapchat’s last reported 158 million) but is also increasingly attracting more ad dollars. Agencies tend to drift where the action is, and, right or wrong, the general feeling is Instagram is on the upswing while the early buzz over Snapchat is fading.

“Many of our clients are deprioritizing Snapchat,” said Tom Buontempo, president at Attention, KBS’s social media arm, who declined to provide names of specific advertisers but whose clients include BMW, Carvel, Novartis and Spotify. “It’s no secret that Instagram has Snapchat in the crosshairs.”

Instagram Stories, like Snapchat, lets users create multiple ephemeral videos and string them together for a 24-hour period. Brands have increasingly been using Instagram Stories, both to post organic content as well as to run ads. A combination of Instagram’s pure reach, targeting and retargeting capabilities and a more interactive relationship with reps has made Stories an attractive bet for brands. Meanwhile, Snapchat’s growth has been a concern for the past few months, with Instagram Stories’ rapid rise coinciding with its slow-down. Since Instagram Stories launched in August, Snapchat’s growth has fallen 82 percent, according to TechCrunch.

While Capital One, Nike, Ben and Jerry’s, and Netflix were among 30 brands that tested out ads on Instagram Stories before they were widely rolled out in March, brands including Honda, Apartments.com, Chobani and Five Hour Energy have run ads on the platform more recently.

Honda, which ran an ad on Instagram Stories for its “Flipbook Series” campaign on April 10, to market the Honda Clarity, chose Instagram over Snapchat for the campaign, because it let the brand tap into the scale of its 1.4 million-plus existing Instagram fans, said Mike Dossett, associate director of digital strategy at RPA, Honda’s agency. Brands already have large audiences on Instagram and often have to do absolutely nothing to get instant engagement at scale on their Story posts. Plus, they can easily tap into Facebook’s underlying infrastructure.

“From buying and optimization to measurement and reporting, Instagram ads (including Stories) are embedded directly within the Facebook ads ecosystem that buyers know and understand,” he said. “That undoubtedly removes a barrier for advertisers with entrenched processes or less nimble buying protocols.”

For Ben and Jerry’s, it was all about scale. The brand was a part of a beta test between January and March, and ran ads on Instagram Stories to promote its new Pint Slices. The ice-cream maker saw a higher CPM rate than its usual benchmark, according to Jay Curley, Ben and Jerry’s senior global marketing manager, and the brand plans to run more ads over the summer.

“In general, we want to serve up relevant stories to our fans wherever they are,” he said. “We have a robust following on Instagram, and people are not only engaging with us on it but also consuming Stories there.”

It’s also far easier to buy ads on the platform as opposed to Snapchat. Unlike Snapchat, which does not have self-serve advertising options outside of on-demand geofilters (although one for Snap ads is expected soon), Instagram provides marketers with a unified dashboard for buying and tracking ads, making it easier for clients to target and track analytics across a more unified dashboard, said Attention’s Buontempo.

The larger Facebook ecosystem also provides for more nuanced targeting, said Ben Kunz, svp of marketing and content at Mediassociates. Brands can reach people with specific interests in ice cream, for example, or match targeting to their own CRM lists, with all of Facebook’s data toys at their disposal. Instagram also has more flexible buying options, letting buyers buy ads on a performance-based cost-per-click basis apart from a cost-per-thousand impressions basis.

“Both Instagram and Snapchat stories are clever full-screen immersive mobile ad experiences, but taking over a mobile screen is no longer exactly rocket science,” said Kunz. “So it’s not the ‘billboard’ space that matters; it’s the quality of the data behind it. Better audience data always equals better advertising performance.”

Still, it’s not a zero-sum game. Clients have been increasing their Instagram budgets overall to tap into Instagram Stories, said Danielle Johnsen Kerr, director of social and editorial strategy at Deutsch, but they aren’t necessarily shifting already-allotted Snapchat dollars to Instagram. Snapchat’s young audience is still a draw for advertisers, and they also spend a lot of time on the platform, spending an average of 25 to 30 minutes on Snapchat every day according to its S-1. Snapchat has also been making efforts to ramp up on measurement and to roll out more self-serve options. Ben and Jerry’s, for example, will also advertise on Snapchat in the summer.

“But it is dependent on the audiences our clients are trying to grab,” she said.

More in Marketing

WTF are tokens?

When someone sends a prompt or receives a response, the system breaks language into small segments. These fragments are tokens.

AI is changing how retailers select tech partners

The quick rise of artificial intelligence-powered tools has reshaped retailers’ process of selecting technology partners for anything from marketing to supply chain to merchandising.

YouTube’s upmarket TV push still runs on mid-funnel DNA

YouTube is balancing wanting to be premium TV, the short-form powerhouse and a creator economy engine all at once.