Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Digiday Research: PMPs have insufficient inventory to appease marketers

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

Earlier this month, we gathered over 100 marketers and agencies in Scottsdale, Arizona, for the Digiday Programmatic Marketing Summit.

During the summit, speakers and attendees discussed some of the biggest challenges in programmatic advertising, including the struggle for brands to bring programmatic in-house, the difficulty of scaling private marketplace deals and the responsibility advertisers have to remove their ads from extremist websites. Here are some data points from the event:

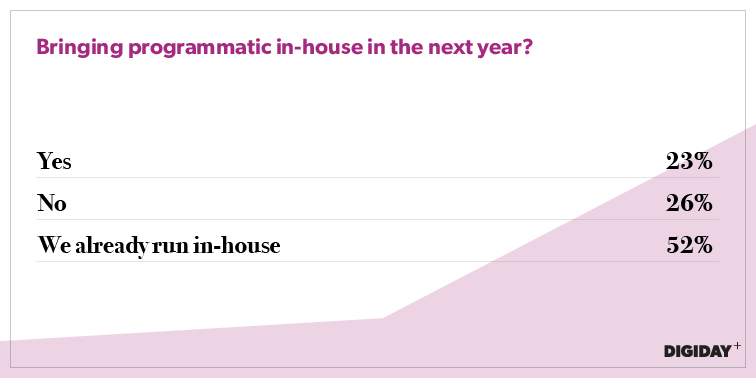

Bringing programmatic in-house

Brands taking control over their programmatic marketing sounds great in theory but is messy in reality, which is why there hasn’t been a flood of brands bringing their entire ad tech stack in-house. However, many brands are taking control over specific parts of their programmatic chain.

At the summit, pharma brand Bayer shared how it brought its data-management platform in-house in January, which helped the brand cut its video ad rates by 70 percent. But Bayer’s agency still controls its DSP. This kind of arrangement is becoming more common.

“Consumer data is the crown jewel for a brand,” said one attendee. “Bringing data platforms in-house is becoming popular because the data can be used outside media campaigns for direct mail, store promotions and consumer outreach.”

Since DSPs are only used in ad campaigns, less incentive exists for brands to invest in bringing them in-house. And since agencies have a lot more experience using DSPs to buy inventory, brands have further reason to be skeptical of operating their own DSPs. Some programmatic-adept brands, like Netflix, will go all-in on bringing programmatic in-house. But expect a trickle, not a flood, and expect DMPs to come in-house before DSPs.

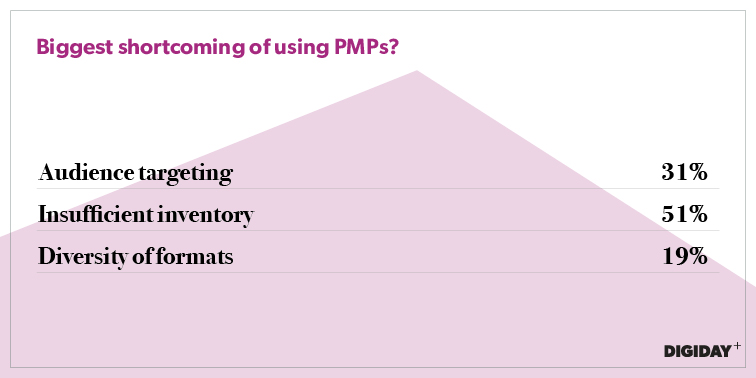

PMP shortcomings

With marketers spooked about having their ads appear next to extremist content, there’s been a trend to ditch open exchanges in favor of PMPs. With PMPs, advertisers get better control of what websites their ads appear on, and publishers get more visibility into what rates their inventory sells at.

Since PMPs are cobbled together on a publisher-by-publisher basis, they are difficult to scale. More than half of the respondents to Digiday’s survey said their biggest complaint with PMPs is insufficient inventory. And just 16 percent of respondents said they purchased more than 40 percent of their inventory from PMPs. For comparison, 37 percent of survey respondents said they purchased less than 20 percent of their inventory from PMPs.

Although these deals are growing, their growth is inhibited by the lack of programmatic direct in mobile. Only about 10 percent of programmatic direct inventory comes from mobile apps, even though eMarketer estimates that in-app ad spend in the U.S. reached $33.1 billion in 2016, which was greater than the $24.9 billion that was spent on desktop inventory in the U.S. in 2016.

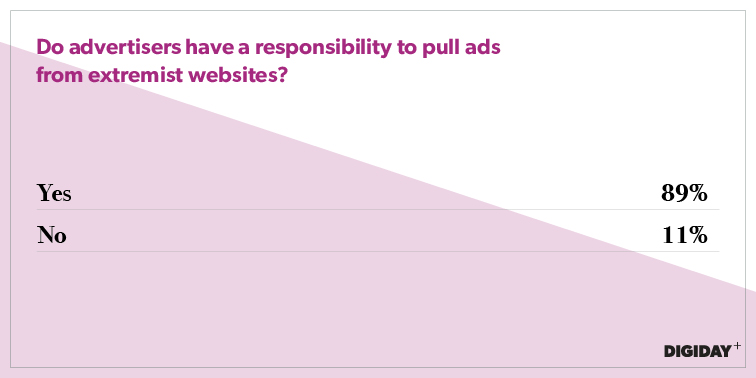

Advertiser responsibility

Since the presidential election, brands have faced pressure to pull their ads off sites that produce racist, sexist, hateful or outright false content. But these sites often provide cheap reach, so the ROI might justify the risk of getting called out by activists.

Overwhelmingly, marketers told Digiday that brands have a responsibility to pull their ads from extremist websites, even if they’re having good results. The bad news is that even if brands put their money where their mouth is, blacklists often fail in programmatic buying, and due to the perpetual reselling of inventory by SSPs, brands can still wind up on sites like Breitbart that they thought they’d cut out.

Despite the call for accountability, one attendee said he expects little to change because “nearly everyone in ad tech benefits from the lack of transparency.”

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.