Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Digiday Research: Insufficient inventory is still a challenge for private marketplaces

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

Key takeaways:

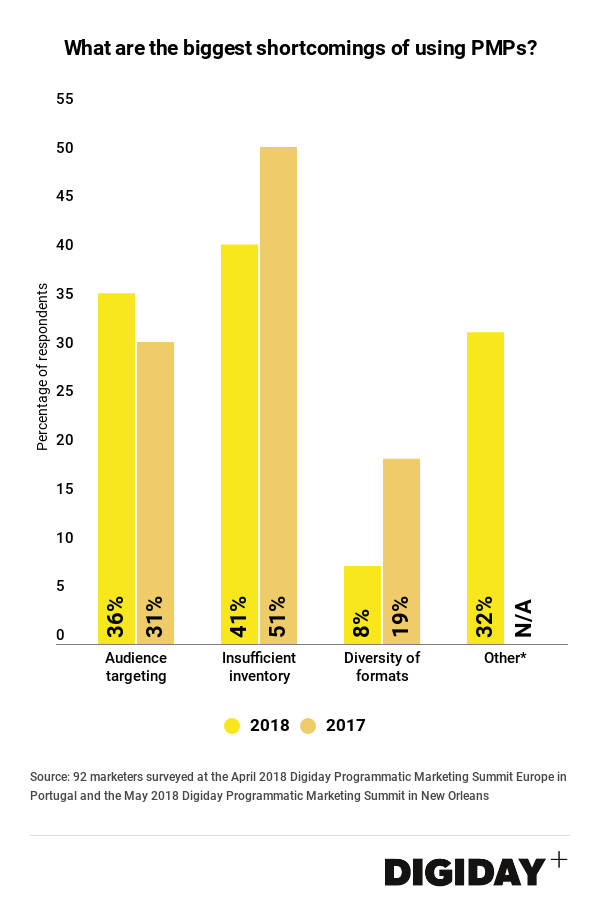

- Available inventory remains the greatest issue with private marketplaces, or PMPs

- Two common PMP issues cited by respondents were high inventory costs and technical challenges.

Virtually all publishers are increasing their number of transactions through a private marketplace, and spending on PMP’s is growing in the U.S. and Europe. In an industry continually clouded with transparency concerns, PMP’s have proven to be useful tools for marketers to ensure more brand-safe ad placements and are less vulnerable to ad fraud. Additionally the decline in third-party data available in programmatic exchanges as a result of the General Data Protection Regulation in Europe could increase the demand for PMP as buyers seek sources of first-party data.

Because of that, one might be tempted to think that the longstanding ills of PMPs, such as a lack of biddable inventory and issues with audience targeting, have been resolved. That’s unfortunately not the case according to the results of Digiday’s latest survey of 92 programmatic marketers. In fact, insufficient inventory is still the largest PMP challenge marketers face and the amount of marketers who say audience targeting is the biggest issue ticked up slightly from 31 percent in 2017 to 36 percent in 2018. Figures exceed 100 percent because respondents were allowed to select multiple answers.

The issue of audience targeting won’t likely be resolved until more inventory is allocated to PMPs. Because marketers only have access to a small amount of biddable inventory in PMPs, any audience targeting or frequency capping that advertisers implement severely reduces potential impressions they can buy. To that point, publishers at past Digiday events have encouraged marketers “to be more flexible with their targeting” in order for PMP’s to scale.

In the survey for 2018, an “other” option was introduced where respondents could write in their own issues. A frequent response amount respondents who choose to write in an “other” option was the problem of pricing. Many felt that PMPs were too expensive. One survey respondent claimed PMPs specifically lack, “pricing flexibility on floor prices.” Research from Pubmatic found that mobile inventory in PMPs cost 155 percent that of mobile inventory in open exchanges. Another common complaint of PMP’s people listed was the high level of technical expertise necessary to set up the deals and lack of resources for troubleshooting when problems go wrong. If it’s any consolation to marketers, one publisher confessed to Digiday that they were left clueless why a PMP deal with a $30,000 budget only transacted a fraction of that.

More in Marketing

Thrive Market’s Amina Pasha believes brands that focus on trust will win in an AI-first world

Amina Pasha, CMO at Thrive Market, believes building trust can help brands differentiate themselves.

Despite flight to fame, celeb talent isn’t as sure a bet as CMOs think

Brands are leaning more heavily on celebrity talent in advertising. Marketers see guaranteed wins in working with big names, but there are hidden risks.

With AI backlash building, marketers reconsider their approach

With AI hype giving way to skepticism, advertisers are reassessing how the technology fits into their workflows and brand positioning.