Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Digiday Research: European marketers buy more inventory from PMP’s than U.S. marketers

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

Key takeaways:

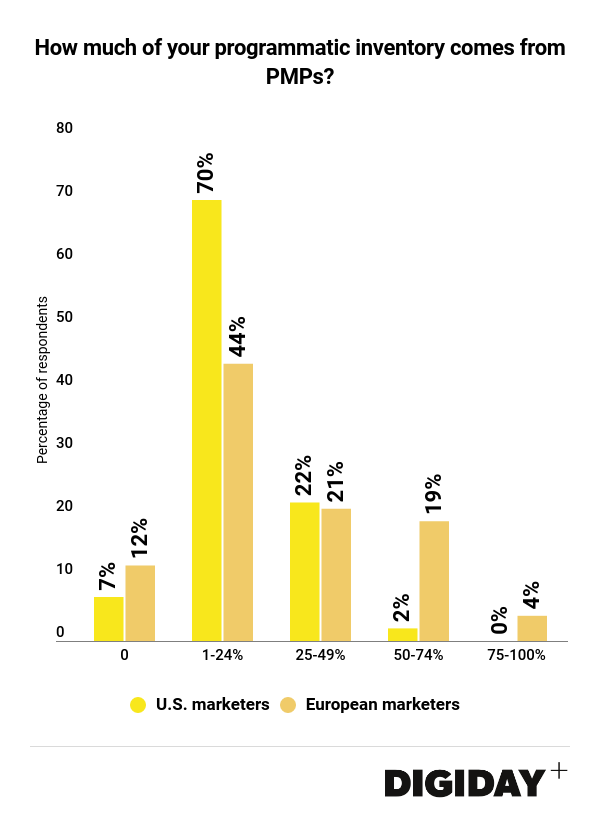

- More than 20 percent of European marketers purchase half of their programmatic ads from a PMP.

- Ninety-three percent of U.S. marketers purchase programmatic inventory from a PMP.

- Eighty-eight percent of European marketers purchase programmatic inventory from a PMP.

Deals through private marketplaces or “PMPs” were once a niche part of marketers’ media budgets, but are becoming increasingly critical to marketers’ media strategies. With rises in programmatic spending in both the U.S. and Europe, we asked 98 brand and agency marketers at the Digiday Programmatic Marketing Summit in New Orleans and in Estoril, Portugal what percentage of the digital ad inventory they purchase now comes from a PMP.

According to the results of the Digiday survey, more marketers in the U.S. purchased inventory through a PMP than their European counterparts. Ninety-three percent of U.S. marketers did so compared to 88 percent of European marketers. However, European marketers buy a higher proportion of their inventory from PMP’s than their U.S. counterparts. Twenty-three percent of European marketers said at least 50 percent of their programmatic inventory comes from PMPs, whereas just two percent of U.S. could say the same.

PMP spending in the U.S. is growing. Ninety-seven percent of U.S. publishers in a previous Digiday survey said they plan on increasing the amount of deals transacted through a PMP in the coming year. Meanwhile eMarketer estimates that PMPs will account for $8.99 billion of the $39.1 billion spent on digital display spending in 2018, a 37.3 percent year-over-year increase.

However, Europe has traditionally seen higher PMP usage than in the U.S., especially in markets such as the Netherlands and Germany where PMPs are responsible for almost all programmatic transactions. France is also experiencing an increase in PMP spending.

GDPR could also accelerate PMP usage in Europe. Because the GDPR set strict limits on how information can be collected from consumers and the use of third-party data in advertising, the use of third-party data in programmatic exchanges has predictably lessened. That means the value of open inventory on exchanges could decrease without third-party data to prop it up. As marketers search for sources of first-party data to buy inventory with, publishers will serve as a primary source because of their close relationship with users. Given the declining value of programmatic inventory in open exchanges marketers could be convinced to pay a higher price in PMPs for premium first-party data informed inventory.

More in Marketing

Thrive Market’s Amina Pasha believes brands that focus on trust will win in an AI-first world

Amina Pasha, CMO at Thrive Market, believes building trust can help brands differentiate themselves.

Despite flight to fame, celeb talent isn’t as sure a bet as CMOs think

Brands are leaning more heavily on celebrity talent in advertising. Marketers see guaranteed wins in working with big names, but there are hidden risks.

With AI backlash building, marketers reconsider their approach

With AI hype giving way to skepticism, advertisers are reassessing how the technology fits into their workflows and brand positioning.