Secure your place at the Digiday Publishing Summit in Vail, March 23-25

As TikTok teeters, YouTube, Meta, Snapchat and more race to claim its ad dollars with incentives, discounts

With TikTok’s fate in the U.S. dangling between the Supreme Court and President-elect Donald Trump, competitors are moving in to try and claim its ad dollars.

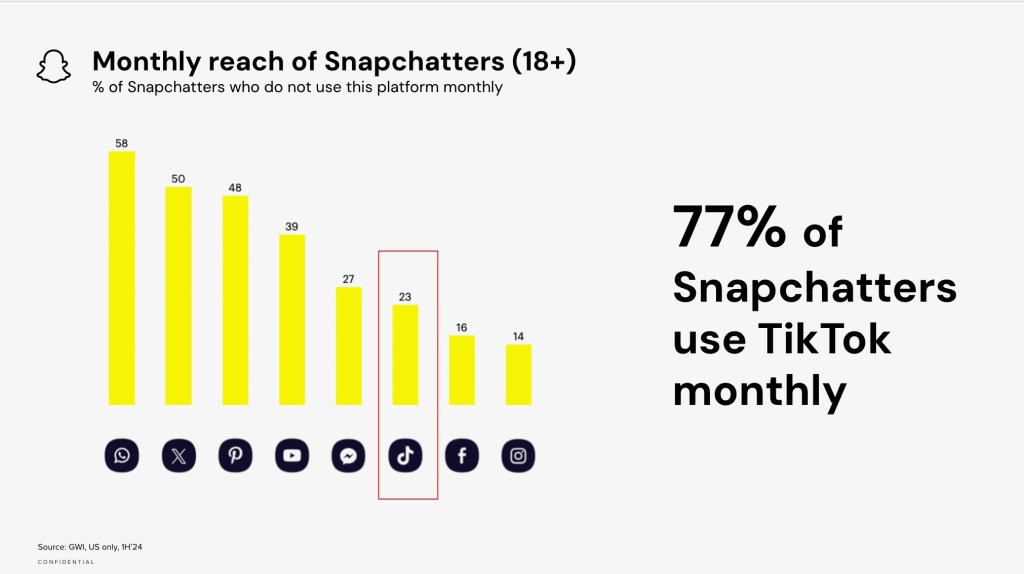

Snapchat, for example, isn’t holding back. In recent pitches to marketers, the app’s ad sales team has highlighted the notable audience overlap between Snapchat and TikTok in the U.S., both on a daily and monthly basis, according to two slides shared with Digiday.

The first slide shows Snapchat’s claim that 60% of U.S. users over the age of 18 also use TikTok daily, while the second slide highlights that 77% of Snapchat’s U.S. users aged 18 or over use TikTok monthly. Both slides strongly indicate that anyone seeking a possible replacement could at least find a majority of their TikTok users over on Snapchat.

The parallels between Snapchat’s and TikTok’s platforms are well known, and audience crossover at this scale is almost expected. As Colleen Fielder, vp of social and partner of marketing solutions at Basis Technologies, explained after reviewing the slides shared with Digiday: “It doesn’t surprise me if it explicitly calls out that data point in sales pitches.”

Platform users (per earnings and/or internal figures):

- TikTok: more than 1 billion users

- YouTube: 2.49 billion monthly active users (MAUs)

- Meta: 3.29 billion daily active people across its family of apps

- Snapchat: 850 million MAUs, 443 million DAUs

- Pinterest: 537 million MAUs

- Reddit: 97.2 million daily active uniques (users)

- WeAre8: 2 million verified unique users

- Substack: More than 4 million paid subscriptions, tens of millions of total active subscribers across the network

What’s more notable is Snapchat’s timing. That Snapchat is actively counting TikTok’s advertisers underscores just how much the short-form video app has disrupted its rival. TikTok hasn’t just competed with Snapchat for ad dollars in recent years — it leveraged Snapchat to grow its own user base. In fact, TikTok was Snapchat’s largest advertiser in 2020, a twist that adds another layer to the growing tension between the two platforms.

And it’s not just Snapchat getting aggressive.

YouTube’s sweeteners

According to two ad execs, YouTube has been offering sweeteners in recent weeks to encourage advertisers to spend more of their ad dollars with them. Think “spend X amount and the platform will give you X amount in ad credits.”

“YouTube is generous if you negotiate correctly, generous in how you can apply the credits,” said one of those U.S. ad execs, who shared details with Digiday in exchange for anonymity.

For YouTube, TikTok’s meteoric rise was more than a financial threat — it redefined the online video landscape by shifting the battle for attention to short-form content driven by viral trends, fleeting moments, and the quirky, ephemeral magic of a well-timed dance. If TikTok were to vanish, it would leave a significant gap in media plans, one YouTube is eager — and uniquely positioned — to fill.

Not to be outdone, Pinterest is also making a move.

It offered a percentage match for advertisers increasing their investment by a certain minimum amount, starting on or before Jan. 22, Fielder said, following her correspondence with the platform.

On those plans, Pinterest’s vp of global agency sales, Soniya Monga told Digiday: “We have existing bonus media incentives tied to incremental paid spend. With the changes happening across the industry, now is a great time for our partners to take advantage. As a place where people find inspiration, advertisers can benefit from Pinterest’s positive environment, and research shows that positivity pays off at every stage of the purchase funnel.”

Meta’s moves

Like Pinterest, Meta has also offered a percentage match for incremental spend against Reels ads or for incremental budget — with no specific product or measurement solution required — during the month of January 2025, Fielder continued.

Another U.S. ad exec, who spoke on condition of anonymity, also confirmed to have seen Meta offer advertisers in January a 3:1 or 5:1 match for incremental investment.

Reddit’s gambit

Reddit, too, is in the mix, reminding advertisers of its 70 million daily users in the U.S., and matching $1,000 in ad spend, with credits, since the start of the year.

“We’ve definitely seen ad credit opportunities across channels — Pinterest, in particular, has been pushing our team quite hard on these offers lately,” said Tucker Matheson, co-founder and co-CEO of Markacy.

Though he did also note that it’s not uncommon for ad credits to be more readily available at the start of the year when advertisers are finalizing their yearly budgets.

“There might be some synergy with the timing [around the TikTok ban],” Matheson added.

While it’s too soon to crown a winner, YouTube appears to have the upper hand in a straight head-to-head with Meta. The challenge for Meta lies in performance — Reels doesn’t measure up to YouTube or TikTok, according to ad execs interviewed for this article.

“The TikTokification of social media will outlast the potential TikTok ban,” said Jasmine Enberg, vp and principal analyst, social and creator economy at eMarketer. “TikTok popularized short videos, and now nearly every social platform, including LinkedIn, is a short video app. That’s a testament to TikTok’s lasting effect on the social landscape.”

The tussle for creator talent

These platforms aren’t just vying for ad dollars, they’re after TikTok creators — a flywheel of content, engagement and revenue. They know creators bring users, who bring more creators, turning one-time visitors into daily scrollers.

WeAre8 is one platform that has been explicitly hoping to poach TikTok creators.

“We have been active this week targeting creators and bringing more over to WeAre8 as the uncertainty around TikTok mounts in the USA,” a spokesperson for WeAre8 told Digiday. As a result of ongoing outreach, more than 2000 creators have joined WeAre8, they added.

The marketing team has been distributing a piece of comms titled, “Why WeAre8 is the TikTok replacement you’ve been waiting for,” as well as what they describe as a “tactical creative” — a vertical video (below) akin to TikTok’s short-form format, which suggests that WeAre8 should be part of a creator’s “TikTok ban survival kit”. Both the comms and video have been circulated organically across all WeAre8 owned and operated channels in social media, plus via direct engagement with creators, while additional ATL (advertising strategy) plans are in discussion, they added.

Substack isn’t sitting on the sidelines either

The platform is trying to create more buzz around its live video function, which is available to all publishers. But more importantly, Substack execs posted a piece explicitly stating that in this limbo period of waiting for the Supreme Court to give its verdict on the TikTok ban, Substack is “making it easy for more creators to join Substack, preserve their audience, and build a loyal community.” And that includes offering a $25,000 prize for TikTok creators who “creatively inspire others to join Substack and spark a trend.”

The TikTokification of social media

Make goods, incentives, discounts — it’s all part of the playbook platforms use to keep advertisers (and creators) engaged, particularly during turbulent times. With the flurry of recent deals from YouTube, Snapchat and others, it’s clear they’re dusting off those tactics again, positioning themselves to catch any loose TikTok ad dollars that may come their way. The game is on, and no one is sitting this one out.

“TikTok’s impact stretches beyond short video,” Enberg added. “Its powerful algorithm has been the envy of every other social platform, and has pushed its rivals to tweak their own technology to better match what TikTok offers. While no platform has been able to replicate TikTok’s algorithm, they’re likely to keep trying, with or without TikTok to compete with.”

Meta and YouTube did not immediately respond to Digiday’s request for comment. Reddit declined to comment. Snapchat declined to comment specifically on this article, but instead pointed to the platform’s latest creator-driven “Find Your Favorites on Snapchat” campaign.

Editor’s note: A Reddit spokesperson has disputed the U.S. daily active user (DAU) figure previously reported by Digiday, which was attributed to a Reddit sales representative and shared by an ad exec. The spokesperson clarified: “As reported in Reddit’s 2024 Q3 earnings, US DAUq was 48.2 million.”

More in Marketing

‘Nobody’s asking the question’: WPP’s biggest restructure in years means nothing until CMOs say it does

WPP declared itself transformed. CMOs will decide if that’s true.

Why a Gen Alpha–focused skin-care brand is giving equity to teen creators

Brands are looking for new ways to build relationships that last, and go deeper than a hashtag-sponsored post.

Pitch deck: How ChatGPT ads are being sold to Criteo advertisers

OpenAI has the ad inventory. Criteo has relationships with advertisers. Here’s how they’re using them.