Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Future of TV Briefing: TV ad buyers and sellers expect a ‘slow, long upfront’ — for now

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing looks at ad buyers’ and sellers’ early expectations for this year’s upfront market.

- The early upfront outlook

- Super Bowl outshines TV watch time slide in February

- TikTok’s search-related creator payments, ESPN’s Jimmy Pitaro era and more

The early upfront outlook

The TV and streaming advertising upfront marketplace doesn’t kick off in earnest for another couple months. And, while plenty could change between now and then, ad buyers and sellers are already getting the sense that this year’s upfront will feel somewhat slow and a bit muted — which may not be so bad given the recent softness of the TV ad market.

“Usually, we say end of first quarter, beginning of second quarter informs what’s going to happen [in the upfront], and barring any changes, we just don’t see any change in the marketplace,” said one ad buyer.

“We don’t anticipate a significantly different marketplace than a year ago, unfortunately,” said one TV network executive.

The unfortunate part is that the TV ad market has weakened. In the fourth quarter of 2023, TV ad spending was 7% lower than the Q4 2022 mark, according to market intelligence firm Guideline, based on invoice data from agencies, including all major agency holding companies.

Despite the decline, ad buyers and sellers are adopting a relatively optimistic outlook for this year’s upfront. Again, they’re not expecting a blockbuster marketplace echoing 2021 and 2022 (before advertisers cut back their upfront commitments made in 2022). But they are feeling the cold TV ad market may be on the verge of a thaw.

“I don’t think anyone’s really expecting huge growth. Maybe [an increase in overall spending commitments of] 3% to 4%, maybe 5% in the upfront season,” said a second ad buyer. “I think so far people are optimistic. But I think people also know that there are some economic factors that may change ad spend.”

A second TV network executive described themselves as “cautiously pessimistic” heading into this year’s upfront, but they nonetheless cited some areas giving them cause for optimism: live sports and multicultural audiences.

“When you combine the demand for African-American audiences and the overwhelming demand for sports, I think that puts us in a pretty decent place compared to the competition, and we’re going to certainly make that known in the marketplace,” said this executive.

There’s certainly cause for optimism with respect to live sports. In Q4 2023, ad spending against live sports increased by 3% year over year, per Guideline, and live sports is typically the first inventory tranche to sell out each year in the upfront market. Meanwhile, part of what prolonged last year’s upfront was that some advertisers and agencies sought to make sure they allocated some of their upfront budgets for multicultural audiences before wrapping up their overall commitments.

But again, there’s still plenty of time for economic conditions to shift ahead of this year’s upfront, for better or worse. Which isn’t all that dissimilar from this time last year when TV ad buyers and sellers were hoping for the economy to improve and were willing to wait out the market in case it did.

“We haven’t seen a huge uptick in spend, but we sort of, kind of think — maybe not a huge uptick in spend — but we sort of, kind of think maybe some uptick is coming. All indications point to a slow, long upfront for that reason,” said the first ad buyer.

What we’ve heard

“I think VideoAmp will win the advanced audiences game, while Nielsen retains the crown for age/demo.”

— Agency executive on measurement currency expectations heading into this year’s upfront market

Super Bowl outshines TV watch time slide in February

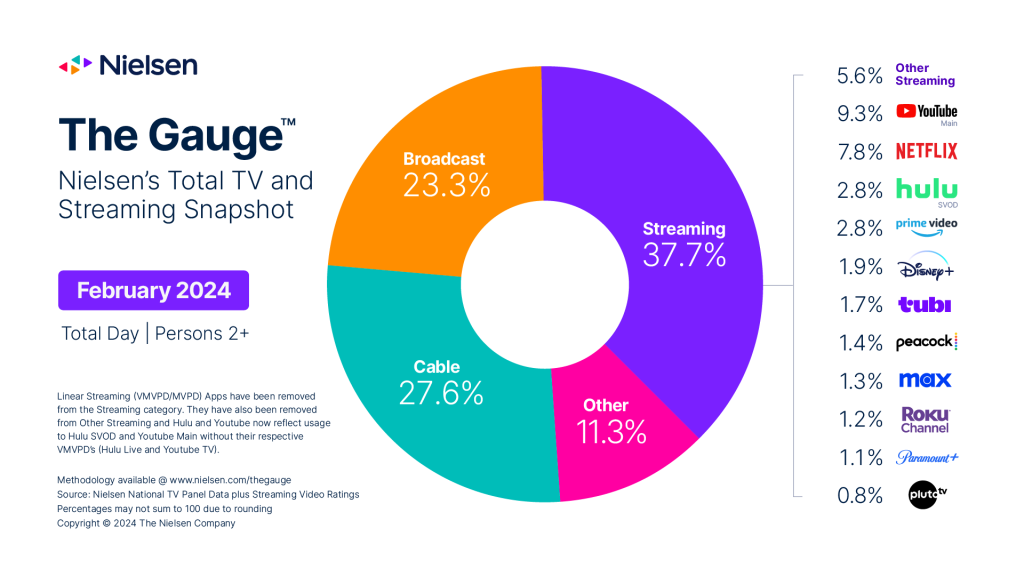

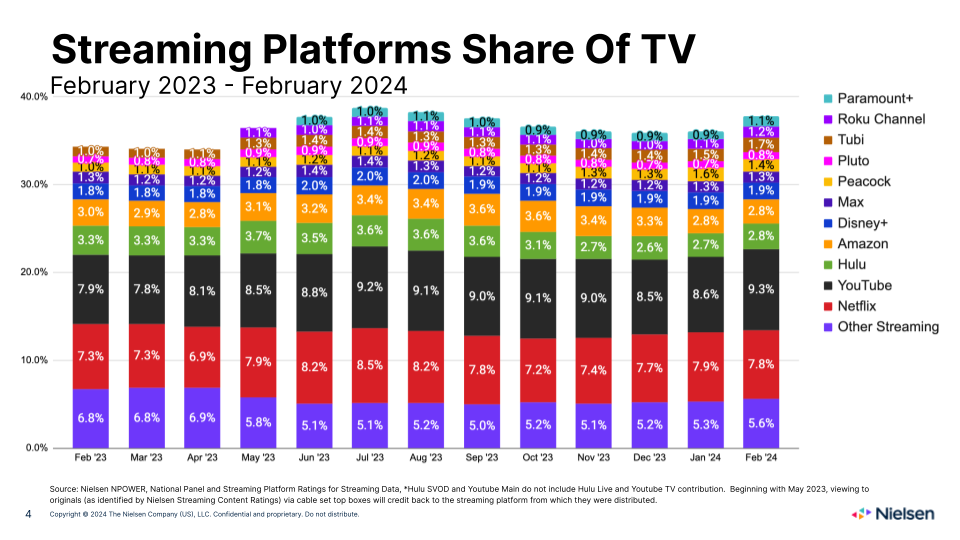

This year’s Super Bowl corresponded with the day that people spent the most time watching their TV screens since at least May 2021. Otherwise, the month of February was a bit of a downer, according to Nielsen’s latest The Gauge viewership report.

Watch time decreased across the board in February compared to January, and traditional TV’s share slipped to 50.9%, as streaming watch time dipped by 1.9% month over month compared to 10% for broadcast TV. Despite the month-to-month decline, overall TV watch time was actually higher in February 2024 compared to February 2023 and February 2022, per Nielsen.

As for the streaming side of the screen, YouTube notched the biggest increase in watch time share to extend its lead over runner-up Netflix. The rest of the category largely held steady, including Paramount’s Pluto TV remaining under the 1% threshold despite sibling streamer Paramount+ climbing past that mark.

Numbers to know

$16 billion: How much revenue TikTok generated in the U.S. in 2023.

4: Disney executives that are in the running to succeed Bob Iger as CEO.

8.6%: Average percentage of subscribers who cancel their subscriptions to a streaming service within the first year after signing up.

39%: Percentage share of streaming subscribers who said they signed up for a service because of a specific show.

What we’ve covered

While advertisers are playing it cool, they’re hesitant to unleash their budgets on TikTok:

- Some advertisers are preparing to stop advertising on TikTok amid a U.S. bill calling for its sale or ban.

- Some agencies are advising clients to take a wait-and-see approach.

Read more about TikTok here.

Frequency management is capping CTV ad spend:

- Enforcing frequency caps across streaming services continues to be a challenge for advertisers.

- Streaming services don’t always provide the data needed to manage ad exposures across services.

Read more about CTV’s frequency management issue here.

Influencer agencies prep worst-case scenarios if TikTok gets banned:

- Socially Powerful has influencers use at least three platforms to minimize risk.

- Brands are likely to redirect sponsorship dollars to YouTube Shorts and Instagram Reels.

Read more about influencer agencies here.

With UTA, Michael Kassan skirmish, why do Hollywood and Madison Avenue make for strange bedfellows?:

- Some industry observers don’t think the entertainment and marketing industries mix well.

- Celebrities like Ryan Reynolds have tried to combine entertainment and marketing within singular companies.

Read more about the entertainment and marketing industries’ dynamic here.

Advertisers don’t see new, immediate value in Snapchat’s ad offerings despite its brand marketing campaign:

- Last month, Snapchat debuted a new brand campaign to promote the platform.

- The campaign has yet to coincide with a new sales pitch from Snapchat to advertisers.

Read more about Snapchat here.

What we’re reading

TikTok’s search-related creator payments:

TikTok will now take into account what it considers “search value” when determining how much money to pay creators for videos’ performance, according to The Verge.

Hollywood’s executive unemployment issue:

The entertainment industry’s austerity era has resulted in executive-level employees — especially those in legal, marketing and development roles — being laid off with limited job prospects, according to Deadline.

Among the candidates to succeed Bob Iger as Disney CEO, Pitaro has had to navigate how to build up a streaming bulwark against ESPN’s weakening traditional TV business without irreparably upsetting sports leagues like the NFL, according to The Wall Street Journal.

Google’s updated in-stream vs. out-stream video policy:

Starting next month, Google’s ad exchange will adhere to IAB Tech Lab’s updated guidelines for delineating between in-stream and out-stream video ad placements (which you can learn more about here), according to AdExchanger.

Want to discuss this with our editors and members? Join here, or log in if you're already a member.

More in Future of TV

Future of TV Briefing: CTV identity matches are usually wrong

This week’s Future of TV Briefing looks at a Truthset study showing the error rate for matches between IP and deterministic IDs like email addresses can exceed 84%.

Future of TV Briefing: How AI agents prime TV advertising for ‘premium automation’

This week’s Future of TV Briefing looks at how agentic AI can enable TV networks to automate the sales of complex linear TV ad packages.

Inside NBCUniversal’s test to use AI agents to sell ads against a live NFL game

NBCUniversal’s Ryan McConville joined the Digiday Podcast to break down the mechanics of the company’s first-of-its-kind agentic AI ad sales test.