Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Future of TV Briefing: Streaming ad sellers need supplementary inventory sources

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing looks at the supply-and-demand dynamics in the streaming ad market.

- Video in demand

- WTF is the YouTube Shorts revenue-sharing model?

- Major streamers continue to separate in TV viewership share

- Netflix’s new co-CEOs, TikTok’s viewcount booster, Instagram’s video overload and more

Video in demand

The key hits:

- To satisfy streaming advertisers’ ongoing reach demands, streaming ad sellers need to amass more supply.

- Disney is unifying the ad tech stack behind its streamers, including Disney+ and Hulu.

- Meanwhile, Warner Bros. Discovery, YouTube and Netflix are weighing free, ad-supported streaming TV entries.

Streaming has entered the rebundling era on the subscription side. And the same situation may be bubbling up in streaming’s ad market.

Despite the lineup of major ad-supported streamers being as full as it’s ever been with Netflix and Disney+ entering the fray late last year, there remains a streaming ad supply shortage, at least among the top-tier services. Advertisers are following audiences from traditional TV to streaming, but when they get there, they’re finding there aren’t enough ad slots to go around.

“The thing that we spend a lot of time on, that’s big for our clients, is rebuilding reach and achieving reach in premium video environments,” said an agency executive.

Size has always mattered in the advertising business. So it’s not like size necessarily matters any more at the moment to streaming ad buyers than it did a year ago. But streaming ad sellers seem to be ramping up their efforts to satisfy advertisers’ scale demands by seeking out options to supplement their inventory sources.

Disney is unifying the ad tech stack behind Disney+ and Hulu to give it more flexibility with juggling advertiser demand between the two streaming ad supply pools. Meanwhile, Warner Bros. Discovery, YouTube and Netflix are, to varying degrees, weighing entries into the free, ad-supported streaming TV business, which could drum up additional inventory.

“We are keeping an eye on that segment for sure,” said Netflix co-CEO Ted Sarandos, when asked during the company’s quarterly earnings call on Jan. 19 whether Netflix would consider offering a free, ad-supported streaming TV service.

As non-committal as Sarandos was in his answer, Netflix may want to move quickly into the FAST space in order to speed up the development of its advertising business.

Netflix’s ad-supported under-delivery issue has abated so far this year, according to two agency executives. “The past few weeks, it has been okay,” said a second agency exec. But the company could have avoided that initial situation altogether if it had had supplementary inventory to offer advertisers to make up for the viewership shortfalls immediately rather than needing to allow advertisers to take their money back in order to achieve their year-end reach goals.

“They couldn’t say, ‘Hey, if you can’t spend it here, take it off Disney+ and put it on Hulu,'” said the second agency executive.

As that statement implies — despite having launched its ad-supported tier a month after Netflix’s and during the holiday shopping season when advertisers can be impatient about reaching enough potential customers — Disney+ hasn’t run into under-delivery issues, according to agency executives and Disney Advertising president Rita Ferro in an interview last week for a separate story.

“The unique thing that I think is different for Disney than Netflix in this particular situation is we have a whole streaming ecosystem beyond Disney+, so we’re able to manage that much more holistically,” Ferro said. She went on, “So when advertisers have to run in a particular time period of the year, in particular windows, we’re able to manage that. So if that were the case, we would be able to make them whole.”

Basically, Disney doesn’t necessarily run the risk of under-delivering for Disney+ advertisers because it can reroute their campaigns to Hulu or ESPN+ or any of the House of Mouse’s other digital or TV properties. And Disney seems to be taking advantage of this by discussing with some advertisers the option of moving their campaigns off Disney+ to make room for other advertisers. If Disney didn’t have other inventory sources available, then its only options to make room for advertisers would be either to give some advertisers their money back or shift their spending to future quarters, a.k.a. what Netflix did.

The situation was the same for NBCUniversal’s Peacock a few years ago. Ad buyers were comfortable placing bets on the streamer ahead of its launch because, if Peacock didn’t attract enough viewers for advertisers, NBCUniversal could make up the difference with its traditional TV networks and digital properties. As one agency executive told me at the time, “What they are relying on is their ability, as a portfolio media company, to have their own safety net.”

Netflix, by contrast, doesn’t have a safety net at the moment. And although the streamer’s ad delivery dilemma has cleared for now, it’s not necessarily in the clear.

Said the second agency executive, “As far as pacing goes, we’re okay. And I think it’ll improve. It’s just I think it’s going to be slow.”

Unless maybe Netflix goes FAST.

What we’ve heard

“I don’t know if this is throwing too strong of a dagger, but I think the [free, ad-supported streaming TV] services are only resonating with a certain amount of generations in our population. If you were to look at Gen Z behaviors, none of them are turning on Pluto [TV] to watch old reruns of ‘Gilligan’s Island’ or whatever it may be.”

— Prophet partner Eunice Shin on the Digiday Podcast

WTF is the YouTube Shorts revenue-sharing model?

Next week, YouTube will officially start sharing ad revenue with Shorts creators. But how exactly YouTube will calculate the cut going to creators and publishers is way more complicated than YouTube’s traditional revenue-sharing program or even TikTok’s revenue-sharing program Pulse. So I did my best to do the math on YouTube’s math in this video.

Numbers to know

5.4: Average number of streaming services that U.S. households used in the fourth quarter of 2022.

$16.8 billion: How much money Netflix spent on TV shows and movies in 2022, a 5% dip year over year.

-77,000: Number of streaming pay-TV subscribers that Dish Network’s Sling TV lost in Q4 2022.

$74.99: Starting monthly subscription price for streaming pay-TV service DirecTV Stream.

0.7%: Percentage increase in number of film, TV and commercial shooting days in Los Angeles in 2022 compared to 2019.

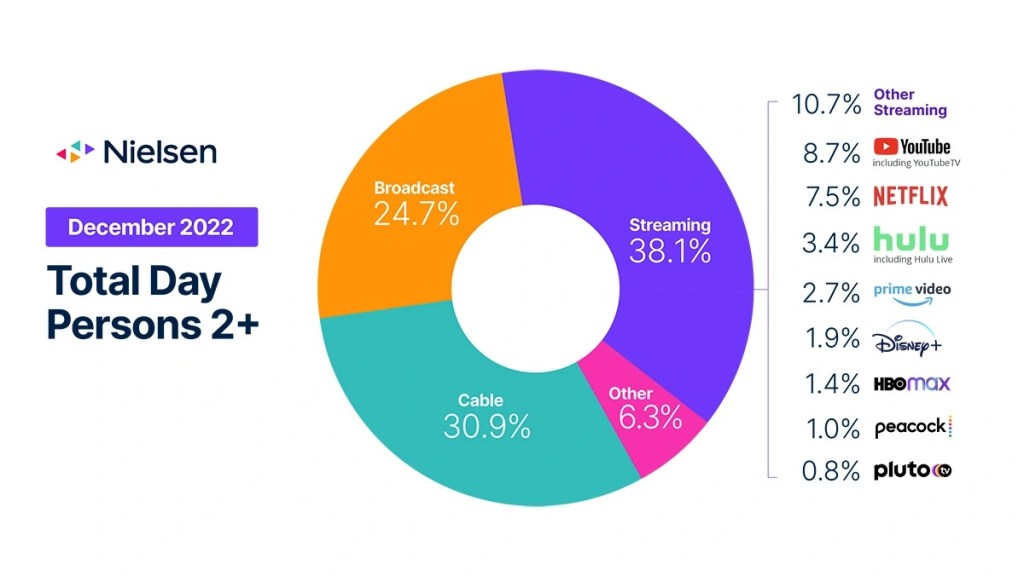

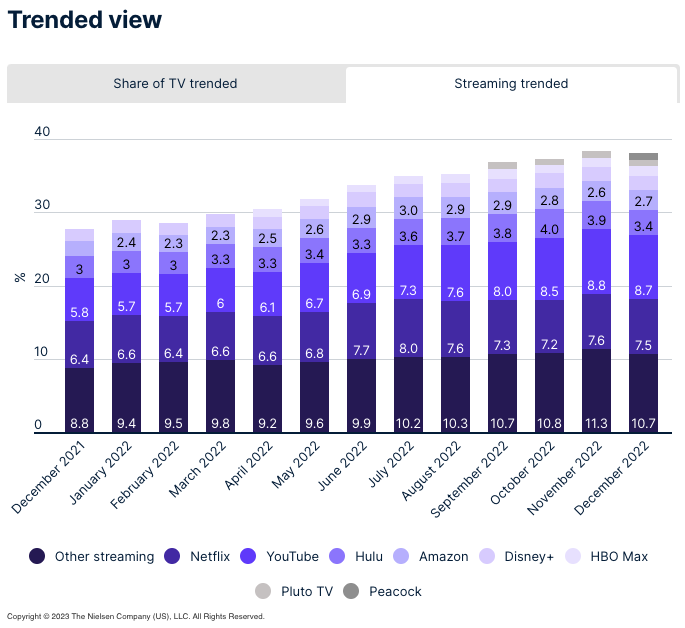

Major streamers continue to separate in TV viewership share

Now that streaming seems to have solidified its grip on TV audiences’ attentions in terms of time spent, we can turn our attentions to how streaming watch time breaks down among the various services. And Nielsen’s The Gauge viewership report for December 2022 indicates that major streamers are breaking away from the broader mix, with Peacock being the latest to secure at least 1% share of total TV watch time.

When Nielsen published its first The Gauge report in June 2021, the only streamers listed individually were Netflix, YouTube, Hulu, Amazon Prime Video and Disney+. That’s probably the expected who’s who of streaming services. But then in April 2022, HBO Max crossed the 1% watch time threshold to make the list, followed by Pluto TV in September. And now Peacock has made its mark.

By implication, there are some major streamers that have yet to break out of the “other streaming” category: Paramount’s Paramount+, Apple’s Apple TV+, Roku’s The Roku Channel and Fox’s Tubi, most notably.

Given that Disney+, HBO Max and Pluto TV are each within 1 percentage point of a 1% watch time share — and that Pluto TV is actually under that threshold at 0.8% — it’s hard to make much of Paramount+, Apple TV+, The Roku Channel, Tubi and their ilk not yet making the cut. Especially since the “other streaming” has grown its watch time share over the past year, despite the streamers that have graduated to their standalone entries.

So it’s less what Peacock’s pop says about the streaming wars at the moment and more what the “other streaming” category will indicate throughout this year when more services break out on their own and which those services are — or if none do.

What we’ve covered

Why entertainment expert Eunice Shin is watching streamers’ subscriber churn rates:

- Subscriber churn rates will indicate how well streamers are coping with competition and economic conditions.

- In a Digiday Podcast interview, the partner at consulting firm Prophet also discussed the investments companies have made into their streaming businesses.

Listen to the latest Digiday Podcast episode here.

Disney plans to extend Hulu’s ad targeting options to Disney+’s ad tier:

- Hulu’s full suite of targeting options will become available for Disney+ advertisers in July.

- The move will be the latest sign of how Disney is putting its unified ad tech stack to work.

Read more about Disney+’s ad tier here.

News publishers are flocking to TikTok as they continue to search for new audiences:

- Most of Comscore’s top 50 news publishers created a TikTok account in the last two years.

- Publishers vary in how they have staffed teams to handle their TikTok accounts.

Read more about news publishers’ TikTok strategies here.

What we’re reading

Bloomberg interviewed Netflix’s new CEO duo Ted Sarandos and Greg Peters, who said they aim to release a “Squid Game”-level hit each week and to have advertising generate “mid-single digit billions of dollars in three years.”

TikTok has a practice of employees cherry-picking videos for its hallowed algorithm to push to people’s feeds, and these boosted videos typically account for 1% to 2% of total daily views, according to Forbes.

Instagram head Adam Mosseri admitted the Meta-owned platform overdid it in pushing videos into people’s feeds last year and has been trying to recalibrate the balance between videos and photos, according to The Verge.

The smart TV maker is weighing whether to strike up deals with hardware rivals to carry its free, ad-supported streaming TV service Samsung TV Plus on their TVs, according to Janko Roettgers’ Lowpass newsletter.

The U.S. JIC’s buyer outreach:

The TV ad industry group seeking to standardize measurement — the U.S. Joint Industry Committee — has sent letters to agency holding companies inviting them to join the group, according to Broadcasting + Cable.

Bonus

As a thanks for reading all the way through this week’s briefing, here’s a skit I made on Netflix’s Q4 2022 earnings report:

More in Future of TV

Future of TV Briefing: CTV identity matches are usually wrong

This week’s Future of TV Briefing looks at a Truthset study showing the error rate for matches between IP and deterministic IDs like email addresses can exceed 84%.

Future of TV Briefing: How AI agents prime TV advertising for ‘premium automation’

This week’s Future of TV Briefing looks at how agentic AI can enable TV networks to automate the sales of complex linear TV ad packages.

Inside NBCUniversal’s test to use AI agents to sell ads against a live NFL game

NBCUniversal’s Ryan McConville joined the Digiday Podcast to break down the mechanics of the company’s first-of-its-kind agentic AI ad sales test.