Unlike many publishers that take a scattershot approach to platform distribution, Metro remains dedicated to apps.

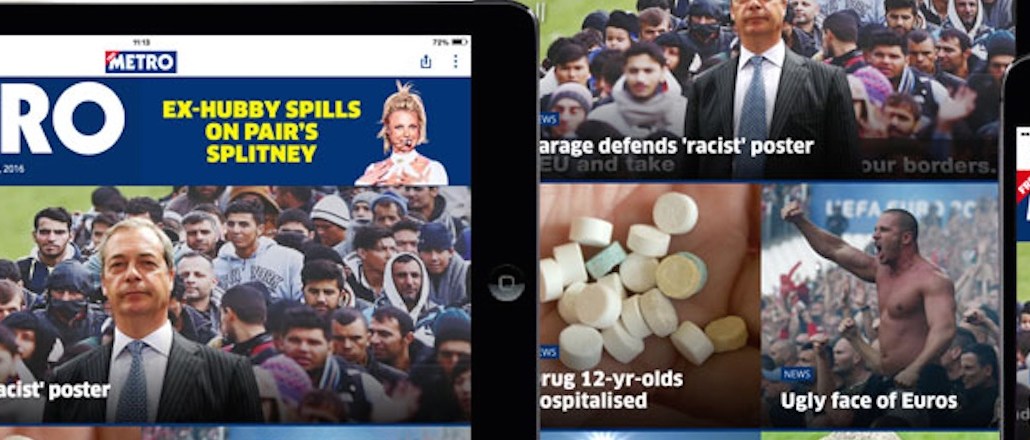

Last week, the news brand combined its main edition tablet and smartphone app and rolled out some new features, and in the next two months, it will take the wrapper off two more apps focusing on specific content verticals.

“The focus is not on people who will read one piece of Metro content once in a blue moon,” said Martin Ashplant, Metro’s digital director. “It’s on those who feel part of the experience. We take the view that loyal audiences are of more value to publishers and advertisers than non-engaged, passive users.”

Previously, Metro’s separate tablet and smartphone app looked like digital editions of the newspaper. The apps are an entirely separate entity to Metro.co.uk, which is managed by parent group Daily Mail and General Trust’s flagship title MailOnline, and populated by different editorial teams. While Metro found its audience of 40,000 daily app users was split roughly half on the smartphone and half on the tablet, 90 percent of the work went into repurposing content for the tablet edition, which had a shrinking audience.

Despite this disproportion, the changes in reader behavior weren’t that stark. On average, people spent 20 minutes within the tablet app, reading 60 pages, compared to 14 minutes in the smartphone app, reading 40 pages. It nearly matches print reading time, said Ashplant. “We say the paper’s a 25-minute read.”

Previously, the design of the tablet edition wasn’t suited to a world of sharing content; the tablet edition mimicked the style of the newspaper. Now, each article has its own page and a corresponding url, so it can be shared with people who don’t have the app and open up as a web reader. In the last two days, Ashplant said that there have been 15,000 views of Metro content in the web reader.

“We’re still in the migrational phase,” he said. “Eighty percent of people have moved over, then we will look at which acquisition areas result in more app downloads and loyal readers — is it Facebook, email, WhatsApp — and then focus where the value is for us.”

The app now also has an evening edition at 5 p.m., as well as its 6 a.m. morning edition, and a 60-second video of the day’s highlights, which is pushed to Twitter and YouTube (but not Facebook, where Metro.co.uk content is separate from Metro’s app content).

Reducing load times is an ongoing battle for publishers on mobile, and Metro is no different. The paper, and so the digital edition, varies in page numbers depending on the news cycle. While this upgrade has reduced the size of the tablet edition by two-thirds, making sure that the app remains light for smartphone users is a challenge, and it has to keep a check on compressing images without losing the quality.

While many publishers want to create attractive owned properties for readers to habitually return to, Metro’s focus on apps is also a response to dwindling desktop display dominance. “For the most part, websites see far lower levels of engagement and can find it hard to attract such loyal users. They can also suffer from banner blindness and ad blocking.”

Ad blocking on mobile is a growing concern. The IAB’s most recent study found that 10 percent of U.K.’s smartphone users block ads. Metro is selling ad packages across print and digital editions, previously different creative was designed for each, which led to higher quantities of print and tablet advertisers, and fewer on smartphone. Now, Metro will convert print ad creative to an interactive in-app ad, free of charge. It sells ads at a set price per edition. Sponsored content, created by Story, which is part of Metro’s commercial arm, is now sold across devices too.

“The adverts we have in these editions are an integral part of the experience; they can’t be blocked” said Ashplant. “They make the most of a digital environment while benefiting from a consumer’s full attention.”

More in Media

In Graphic Detail: The scale of the challenge facing publishers, politicians eager to damage Google’s adland dominance

Last year was a blowout ad revenue year for Google, despite challenges from several quarters.

Why Walmart is basically a tech company now

The retail giant joined the Nasdaq exchange, also home to technology companies like Amazon, in December.

The Athletic invests in live blogs, video to insulate sports coverage from AI scraping

As the Super Bowl and Winter Olympics collide, The Athletic is leaning into live blogs and video to keeps fans locked in, and AI bots at bay.