Secure your place at the Digiday Publishing Summit in Vail, March 23-25

U.S.-based publishers often have to retrofit their brands for overseas audiences when they expand internationally. That’s not the case with Quartz. It set out to be a global, mobile-first publication for the business set from the get-go when the Atlantic Media Company launched it in 2012. Today, 47 percent of its audience of 18 million comes from outside the U.S. (figures are from the publisher, citing Omniture; comScore doesn’t have non-U.S. figures for Quartz.)

U.S. publishers have found growing audience overseas easier than monetizing it. One reason is that ad buying is often done market by market, and marketers outside the U.S. lag in adopting the native-style advertising that many U.S. publishers have been pushing.

Quartz is different because its readership has been global from Day One, and its readers tend to be decision-makers and have above-average incomes. Quartz monetizes its audience proportionately, so 44 percent of its ad revenue was billed against non-U.S. inventory last year. Those advertisers tend to be global or foreign companies trying to reach upscale readers outside the U.S., like Credit Suisse, Cathay Pacific and Singapore Economic Development Board.

“From the beginning, the ad marketplace has seen us as having a lot of credibility as a global brand,” said Jay Lauf, president and publisher of Quartz.

Quartz has been careful to keep its journalistic voice global and uniform, regardless of where stories come from. Quartz editor Kevin Delaney required hires to speak at least two languages fluently, and Quartz notes as a point of pride that, today, a total of 35 languages are spoken across the staff.

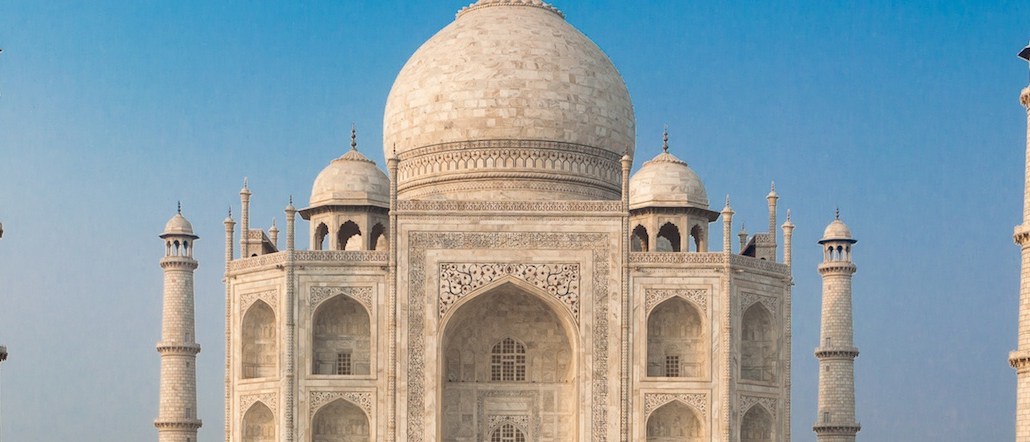

Another pillar of Quartz’s strategy is that it hasn’t struck traditional licensing deals in other countries as other publishers including The Huffington Post and Business Insider have to scale fast and inexpensively. For its push into India in 2014, its first non-English market, Quartz teamed up with a local publishing company, Scroll.in, that helps Quartz with infrastructure and some sales and with sourcing journalists — somewhere between a licensing arrangement but not totally controlled by Quartz, either. Quartz has seven staffers there who are technically employed by Scroll but report to its newsroom.

“We’re building a brand that’s distinct in tone, and if you cede control of that to other players in other markets, there’s a real danger of eroding the brand proposition,” Lauf said.

For its next launch, in Africa in 2015, Quartz hired its own staffers in a traditional owned-and-operated model, but has kept costs down by not opening a bureau; staffers work remotely, in Lagos, Nairobi, and Johannesburg. Quartz also has a 22-person office in London and eight journalists in Hong Kong through a legal subsidiary there. Quartz is also exploring ways to connect to Spanish-speaking audiences and readers but no specific plans are in the works.

As a publication that sells only custom ads, Quartz still has its work cut out for it in monetizing its site overseas where marketers are catching up to the U.S.

“Native is something we’re known for,” Lauf said. “It’s why our brand has grown so quickly. While it may be difficult to get a test campaign, I think that’s going to serve us well in the long haul. We don’t want to water down our brand, and we don’t want to water down our ad offering.”

More in Media

GEO hype busted: How it differs (and how it doesn’t) from SEO

GEO is flooding media execs’ inboxes. But SEO veterans say these AI visibility services may not be as revolutionary as they seem.

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.