Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

‘Too beholden’: Why the TikTok ban has marketers griping about their reliance on Facebook and Google

This Future of Marketing Briefing covers the latest in marketing for Digiday+ members and is distributed over email every Friday at 10 a.m. ET. More from the series →

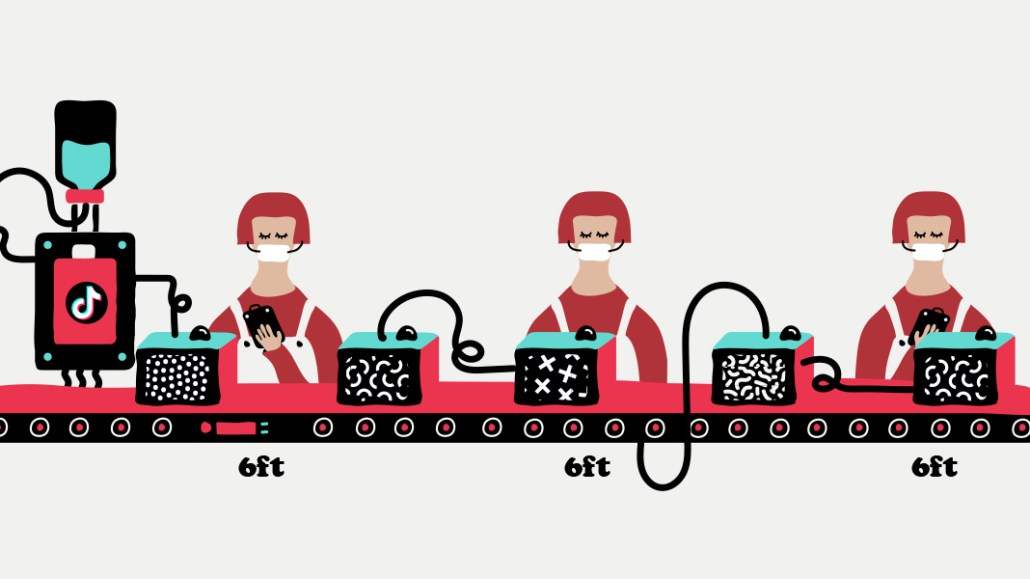

Marketers are once again grumbling about their dependence on Facebook and Google.

In recent months, it’s been tough to remember that problems predating the recession and the pandemic existed, but the power of the duopoly and marketers’ unbalanced reliance on it has long been an issue. And over the last week or so that issue has bubbled up once again due to the potential TikTok ban in the U.S.

If you ask marketers why the looming threat of a TikTok ban has brought up an old gripe, you’ll hear about how they’ve been trying to diversify their media channels away from just Facebook and Google and that TikTok was a viable option. It’s one that many had newly tested. During the Facebook boycott last month, many marketers tried out advertising on TikTok — it’s unclear how much media budget was redirected to the platform at the time — which just last month opened up its self-service advertising platform to marketers globally.

That’s certainly been the case for Hero Cosmetics. “From a growth perspective, we rely really heavily on Google and Facebook,” said Hero Cosmetics co-founder and CEO Ju Rhyu. “We recently started using TikTok for media and saw strong ROAs. We thought TikTok would be our third platform. We were like, this is great because it helps us diversify away from only Google and Facebook. But now there’s the possibility of the ban.”

Of course, TikTok is not the only other option for marketers, but it’s a newer channel with cheaper CPMs and a desirable demographic for many brands, especially ecommerce brands, that made the upstart platform more attractive. And recently, amid the Facebook boycott, many marketers had started to truly test the waters with TikTok and found promising results. But now, faced with the possibility that once again they’ll have to continue to rely on the duoply, there’s a collective sigh of annoyance from the marketing community.

“It almost feels like we had a lot of great momentum going and now it might get killed altogether,” said Savannah Sanchez, freelance media buyer and founder of The Social Savannah, adding for smaller brands that reliance on Facebook in particular during the fourth quarter can be problematic as Black Friday and other holiday sales drive up CPM costs.

CPMs aren’t the only reason brands need to diversify. Younger audiences, especially Gen-Z, are less likely to be on Facebook and TikTok has been a great way to reach those consumers, according to media buyers. Should TikTok be banned, buyers say that they’ll likely move those media dollars back to Facebook and Google because those are proven channels but that they worry about losing out on the burgeoning Gen-Z audience. The service also has 800 million active users globally, so messaging scale is a factor as well.

Working with the platform’s influencers — many of whom haven’t had profiles on competing apps like Triller or Instagram — has also helped buoy brands in need of Gen-Z’s attention. Marketers say the content created by those influencers using TikTok’s creator tools has generally been more successful than professionally created ads on the platform.

No matter what happens with TikTok, marketers don’t want to be so dependent on the duopoly anymore.

“The more that a real advertising threat enters the mix it helps advertisers gain more leverage against Google or Facebook,” said Rhyu. “It’s not a great thing to be too beholden or dependent on them.”

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.