Last chance to save on Digiday Publishing Summit passes is February 9

With ad-supported digital media companies in choppy waters, more publishers are trying paid subscription models. On Tuesday, Chartbeat founder Tony Haile revealed more specifics about Scroll, a startup he launched quietly at the beginning of 2017, using a $3.1 million seed round he raised from a number of publishers, including The New York Times. Scroll will offer readers unlimited access to ad-free versions of sites belonging to brand-name news publishers.

Scroll is the third foray into news subscriptions that the Times has participated in this year, and it’s not alone. In May, the document-hosting startup Scribd, which also offers e-books to subscribers for $8.99 per month, announced it would add news to its offering; earlier in September, Medium announced it would add curated articles from publishers including the Times, The Economist and others to the paid tier it unveiled this past summer.

Here is a look at the state of bundled news subscriptions, in five charts.

A tough sell

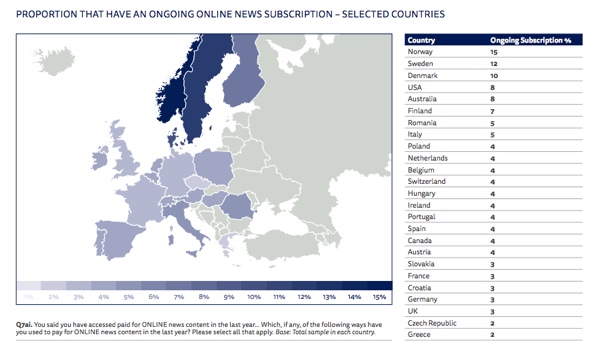

Historically, this is an idea that has not gained a lot of traction. While the share of people willing to pay for news varies by country, in most of the world, a majority of people are disinclined to pay for news. The picture gets even bleaker when examining subscriptions. In the United States, 8 percent of readers pay for some kind of recurring digital news subscription, a number that puts the U.S. in the upper echelons among select Western countries monitored by Reuters.

But things may be looking up

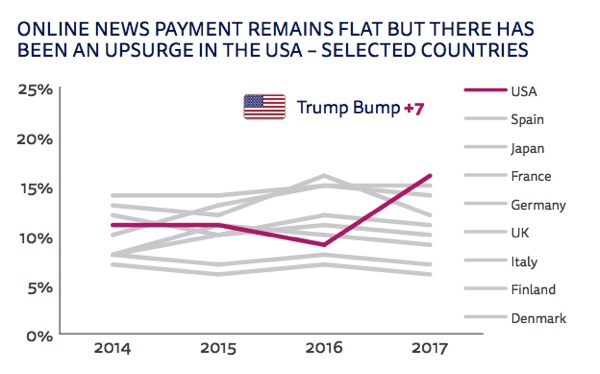

In the past 10 months, there was a sharp uptick in digital payments for news in the U.S. following Donald Trump’s election. It’s worth noting, however, that a lot of the activity that fueled this surge came in the form of one-off payments and donations; the overall subscription rate for the U.S. remained steady, at 8 percent, also per Reuters.

Little traction yet

The bundled products that many of these startups aspire to, Netflix and Spotify, routinely rank among the most popular apps in Apple’s App Store and in Google Play. But so far, many of these products are having trouble gaining traction, even in the news category, according to App Annie data.

The price is right?

With little traction in the space, a wide array of price points are being tested in the market. Inkl, an Australian startup that said it intends to become “Spotify for news,” charges 15 Australian dollars ($12) per month, while Scroll, which its founder said obsessed over the price, charges $4.99 per month.

Money to burn

That said, some startups selling bundled news subscriptions have plenty of cash on hand. Investments from major investors including KKR have filled the coffers of startups like Texture, which offers a subscription bundle of magazines, and Medium, which has pivoted from being a publishing platform into a membership-driven service.

More in Media

Brands invest in creators for reach as celebs fill the Big Game spots

The Super Bowl is no longer just about day-of posts or prime-time commercials, but the expanding creator ecosystem surrounding it.

WTF is the IAB’s AI Accountability for Publishers Act (and what happens next)?

The IAB introduced a draft bill to make AI companies pay for scraping publishers’ content. Here’s how it’ll differ from copyright law, and what comes next.

Media Briefing: A solid Q4 gives publishers breathing room as they build revenue beyond search

Q4 gave publishers a win — but as ad dollars return, AI-driven discovery shifts mean growth in 2026 will hinge on relevance, not reach.