Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Remedies vs reality: Publishers weigh what Google’s ad tech break up could really deliver

Google could be forced to shed AdX and hand publishers long-awaited settlements. Still, many fear it won’t matter: AI Overviews is hollowing out traffic so quickly that remedies may land after the industry has already bled out.

That frustration reflects the squeeze they’re under.

Google’s AI Overviews is the latest blow to referral traffic and ad revenues, intensifying just as the Department of Justice’s ad-tech antitrust trial inches toward remedies. Publishers are watching the outcome of the remedies phase with a mix of bitter curiosity and grim resignation. Content to see some form of recompense, but cynical that any remedy will occur in time to repair the damage currently being done by declining referral traffic.

Many publishers believe the fix — even if it goes their way — is seven years too late: seven years past the peak of digital display advertising.

“Publishers have already gotten choked out,” said Bill Morrow, publishing consultant and former NBC Universal vp of digital monetization and planning. “I’m not as worried about the heyday of display advertising and that someone was taking too much of a share from me and not letting me manage my own business properly. Now, they’re [publishers] in panic mode almost, because of AI, and they’ve lost a bunch of search traffic, and have lost a bunch of social traffic over the years as well.”

After years of treading carefully to preserve relations with Google, they’re now openly embittered: squeezed dry by the platform, and fearful that by the time any remedies land, the agentic web will have reshaped traffic flows so profoundly that any outcome will be rendered moot.

And yet, amid the frustration, there’s a sense that the tide, however sluggish, may be turning. Legal action, once avoided for fear of retaliation, now feels like one of the few rolls of the dice left to apply pressure.

In 2021, The Daily Mail filed an antitrust lawsuit alleging Google used its control over search and display advertising to squeeze digital publishers out of revenue. In 2023, Gannett filed a lawsuit accusing Google of monopolizing ad tech markets and depressing publisher revenues. And on Sept.8, Business Insider filed a lawsuit against Google for alleged anti-competitive ad practices.

Meanwhile, earlier this month, Rolling Stone owner Penske became the latest publisher to sue Google directly for the alleged damage the tech company’s AI summaries are doing to its referral traffic and to its journalism for alleged content scraping.

“Right now, publishers are reeling off losing 30-40 percent of their search traffic and, in turn, inventory after the rollout of the AI summaries,” said an executive at a global news organization, who requested anonymity to speak freely. “Remedies must enable more innovation that results in media owners having more options to sell their media space at higher yields. More direct integration with demand without such a powerful middleman would mean money in the pot for media owners and more media spend from the demand side reaching audiences.”

And yet, even the best remedy outcome from the antitrust ad tech case will “make absolutely no difference at all,” given the current decline of referral traffic, said another publishing exec at a news organization, who also requested anonymity. “We’re not going to put right the last decade or more. Will we find a way to put back the money into publishers’ hands that they’ve lost due to self-preferencing and gaming of auction mechanics, withholding of data, and all that publishers have witnessed? I don’t know how we’d ever put that right. It would mean some serious payouts,” they said.

Publishers don’t want plug pulled on GAM if AdX divested

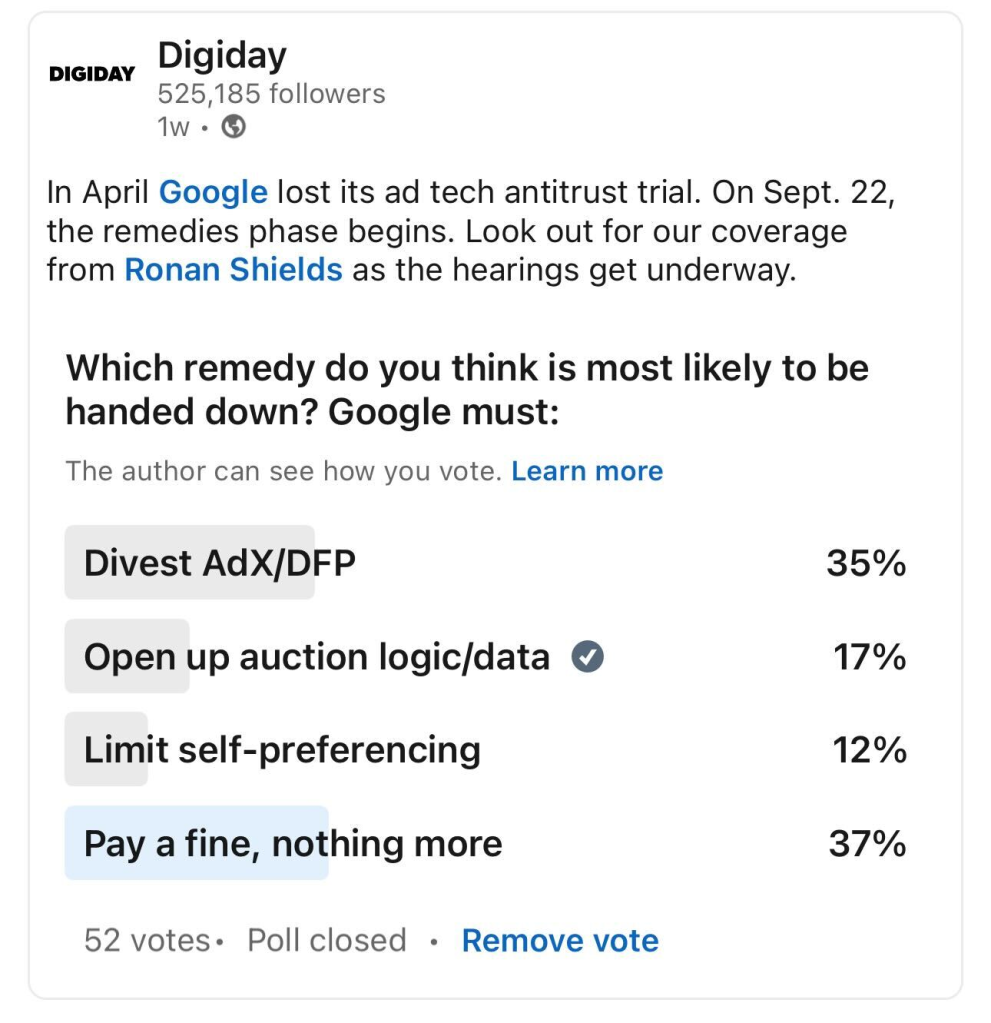

Last week, Digiday conducted a LinkedIn poll asking followers which remedy they think is most likely to be handed down. Most agreed (35 percent) among 52 replies that Google would be forced to divest AdX/DoubleClick for Publishers – now called Google Ad Manager (GAM); while 17 percent said it would have to open its auction logic data. Only 12% said that Google would have to limit self-preferencing, and the largest number (37%) expect it to have to pay a fine, or for nothing to happen at all.

For publishers, divesting AdX is a no-brainer. It’s been the heart of the wrongdoing, as officially deemed so by the DOJ’s ruling. As for who publishers’ preferred new owner might be, they’re not overly picky – just someone who doesn’t own media, they say. Some suggested perhaps a consortium of publishers, or a private equity company. They’re even open to another ad tech company. Just as long as they can’t game the system in favor of their own media. Otherwise, “the next owner might be another wolf in sheep’s clothing,” said Morrow. “That’s the biggest challenge in this space right now, publishers do not have a fiduciary. A brand has an agency always looking out for their best interests; publishers don’t. They need a fiduciary,” he added.

When it comes to the future of Google’s ad server, publisher responses are nuanced, with views diverging on whether divestiture, escrow, or other remedies would deliver meaningful change. Most agree that they don’t want the remedies to backfire and leave publishers shouldering the disruption as collateral damage.

Although much of the DOJ’s attention is on AdX, publishers are watching closely what happens to Google’s ad server (GAM). Judge Brinkiema found Google guilty of exercising a monopoly over two ad tech categories: the open web display ad exchange market and the open web display publisher ad server. While not necessarily likely, a remedy could force Google to spin off the ad server. And in turn cause major logistical headaches for those publishers who would subsequently weigh up moving ad servers.

Publishers loathe switching ad servers because it’s like rewiring the engine mid-flight. The process is costly, time-consuming, and risks disrupting both revenue streams and advertiser relationships. “The ad tech team [within publishers] have a whole list of stuff they’re trying to get done, current quarter, next quarter, next year, to say now we have to do an ad server migration, it would blow up their whole strategy for probably a year,” said Morrow.

That said, no one wants Google to be allowed to ditch GAM entirely if it’s forced to divest AdX.

Their argument: Google should be obliged to solve the mess it has created, and that means maintaining GAM. “What is GAM without AdX and the auction logic attached to it? It’s really just a workflow tool. And does that workflow tool hold any value in the current direction of the agentic buying ecosystem?” said a publishing exec at a media group.

If Google is allowed to walk away from GAM it will “become a relic of the past open internet quite quickly,” they said. “With AdX and the auction logic under new management, a necessary make-good is Google maintaining what’s left of GAM so you’re not pulling the plug on publishers who rely on this tool for the foreseeable future. Otherwise, it’s like [they’d be saying] ‘I’ve used this, I’ve flogged it to death, now you pick up the mess as it fades into obscurity.”

Settlements settlements settlements

One of the DOJ’s proposals is that Google would be required to place 50 percent of net revenues from AdX and GAM into an escrow account while it splits off those businesses.

Jason Kint, CEO of publisher trade association Digital Content Next, believes this settlement is one of the most critical remedies for publishers. “Having to change your ad server and have the market change, where there is already this pressure on publishers, is worrisome, and so that escrow is what should give them relief during that period of change, and allow publishers and the industry to not lose sight of the fact that the status quo is broken,” he said.

Google Network revenues, which include AdX and GAM, totaled $30.4 billion in 2024, according to Alphabet’s filings. “Whatever that [current network revenue] number is, it’s in the billions and if 50% goes into an escrow that’s for publishers until they’ve completed the divestitures, I’d interpret that as potential to be used as assistance with ad server migration,” said Kint.

Naturally, publishers aren’t alone in wanting payouts. SSPs Pubmatic, Magnite and OpenX are suing Google for monopolistic behavior. Two publishers Digiday spoke to for this article said they have no issue with ad tech vendors fighting their own causes, but they don’t expect any potential settlements there to fall into publisher pockets.

For publishers that rely on GAM, the spotlight is on the proposed 50 percent escrow. Morrow believes this promise of payout is vital for publishers, no matter when it may come. Not for ad server migration, which he believes is unnecessary if AdX is divested and even if GAM were to be divested. But to invest in unique content and journalism, now so critical to survive AI summaries’ reduction of click-through rates.

“I believe it should be used at the publishers’ discretion. That revenue was unfairly funnelled away from the publisher. That publisher would have been able to do what they want with it – they could have paid salaries with it,” said Morrow.

There are no details yet on just how this 50 percent escrow would work, who would determine which publishers get what, how or when, if the DOJ is successful in pushing for it.

No one has the luxury of snubbing a potential cash windfall. And yet, if it sounds too good to be true, it often is. There may be caveats for unlocking the escrow, like requiring publishers to switch ad servers to get their share, Morrow said. Others dismiss the escrow entirely as “[court] theater – more showmanship than reality,” as one publishing exec put it.

Even the toughest remedies may only buy time. And yet, the remedies debate isn’t about preserving the open web as it exists today, but about confronting the structural conflicts that helped break it in the first place.

“As much as Google may try to argue, don’t break the status quo or do anything too aggressive here and cause an acceleration of the decline of the open web – to use their words – the current world is broken and the solution is breaking the conflict of interest but making Google carry the burden to fix it,” said Kint.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.