A few years after publishers fell in and out of love with games, they are toying around with them again.

In the past couple months, Hearst Digital has begun producing branded puzzle games and quizzes for MSN; both Mic and the Washington Post have begun experimenting with non-branded game bots on platforms like Kik and Facebook Messenger, respectively; The Outline, Josh Topolsky’s venture-backed “New Yorker for millennials,” rolled out a game within a week of going live, called “Musk Lander”; meanwhile, in print media, the New York Times announced it would publish a special Puzzles section in the Dec. 18 edition of its newspaper.

These steps haven’t produced any smash hits for publishers yet, or if they have, they’re keeping it to themselves: Hearst did not respond to requests for comment about its games, and both WaPo and Mic declined to share numbers. But with more publishers looking for ways to foster loyalty among readers (and draw them to their owned and operated sites on a regular basis), publishers are giving games another go.

“Our hypothesis has been that interactive elements lead people down a path toward loyalty,” said Greg Barber, the Washington Post’s director of digital news products. “We’re still a ways out from being able to prove that, but that’s what we’re trying to get to.”

Games like crossword puzzles, word jumbles and sudokus have been fixtures in newspapers and magazines for decades. And plenty of publishers, particularly newspapers, continue to drive small, but meaningful chunks of digital revenue from them. The New York Times, for example, earned $2.4 million in the third quarter of 2016 from crossword app revenues. Other publishers, including USA Today and The Los Angeles Times, have come to depend on stable, healthy flows of ad revenue from readers who come by regularly to play everything from crosswords to matching games.

Arkadium, a company that provides games for all of the above publishers, among others, claims the average session on one of its partner sites lasts more than 15 minutes, and during that time they see more than three more ads than that site’s average visitor would.

“With most publishers, we’re sub-5 percent [of the total readership],” said Jessica Rovello Arkadium co-founder. “But we’re much more of an outsized revenue driver.”

But about five years ago, publishers began toying around with the idea of using games as a storytelling tool, too. Wired launched games designed to give people a sense of everything from pandemics to the economics of Somali pirates; The Huffington Post launched a Mortal Kombat-styled game oriented around the 2012 presidential debates.

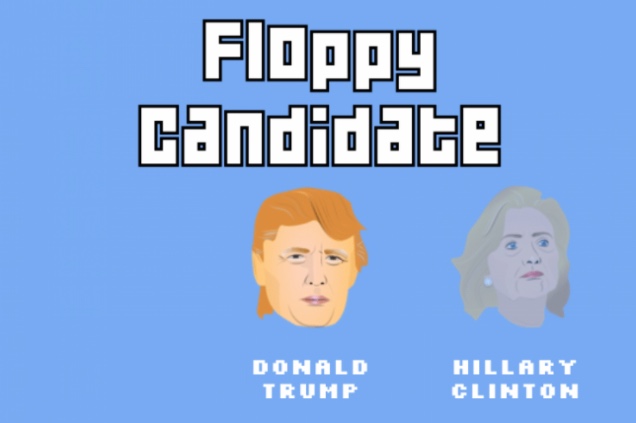

Indeed, the just-concluded election seemed to get publishers back into the gaming mood. The New York Times published an Everyday Arcade game called “The Voter Suppression Trail”; The Washington Post launched a mobile game called “Floppy Candidate”; Wonkette worked with the UK-based game developer Auroch Digital on “Elections of US America Election: The Card Game,” a turn-based card game it funded on Kickstarter.

These all grabbed headlines. But they never spurred publications to invest more meaningfully in them. “This stuff is made to be novel rather than to do journalism,” said Ian Bogost, a distinguished chair of media studies at Georgia Tech and the author of “Newsgames.” “[Those games] never rose to the level of becoming speech.”

They also didn’t do much in the way of making money. While BuzzFeed managed to turn quizzes into a moneymaker – they now account for 15 percent of that site’s branded posts, and that number’s going up, according to Summer Anne Burton, an executive creative director there – lots of publishers are reluctant to put substantial resources behind things that don’t make money.

“I don’t want to boil it down to, ‘People don’t like to take risks,’” said Peter Willington, a producer at Auroch Digital. “But I do think with media brands in general, there is a reluctance to try something new when the old is known to provide results.”

But with more and more publishers focused on getting people off of platforms like Facebook and Snapchat, games might be worth a go. The only way to find out, though, will involve committing to them.

“If you published a newspaper [only] once, it would be a curiosity,” Bogost said. “If you do it every day, it becomes an institution.”

More in Media

In Graphic Detail: The scale of the challenge facing publishers, politicians eager to damage Google’s adland dominance

Last year was a blowout ad revenue year for Google, despite challenges from several quarters.

Why Walmart is basically a tech company now

The retail giant joined the Nasdaq exchange, also home to technology companies like Amazon, in December.

The Athletic invests in live blogs, video to insulate sports coverage from AI scraping

As the Super Bowl and Winter Olympics collide, The Athletic is leaning into live blogs and video to keeps fans locked in, and AI bots at bay.