Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Now that ads.txt is gaining traction, it is inevitably running into kerfuffles.

Publishers say that third-party sellers like Thrive+, Ludius Media and SelectMedia asked to be listed on their ads.txt files, even though the publishers did not have direct relationships with these companies. These vendors say they were merely trying to approach new business partners or form direct relationships with publishers whose inventory they were already reselling. In response to reporting on this subject, the politics publisher Salon removed Thrive+’s name from its ads.txt file, SpotX and LKQD terminated their relationship with the reseller, and OpenX sent an email out to its publisher clients that called the whole thing a “scam.”

Launched by the Interactive Advertising Bureau Tech Lab in May, ads.txt is a text file that publishers put on their web servers to list their authorized inventory sellers. The point of ads.txt is to reduce unauthorized reselling and domain spoofing, which are persistent problems in programmatic advertising.

The hubbub began last week when a publisher source announced on Reddit that he was receiving unsolicited requests from vendors to get on the publisher’s ads.txt file, which prompted an AdExchanger article on the topic. One of the vendors, Thrive+, was listed on 65 ads.txt files as of last week, according to Pixalate. Salon and Dingit.tv were the largest publishers on the list.

Salon declined an interview request for this story, but as seen in these archived links, it removed Thrive+’s name from its ads.txt file after Digiday asked the publisher about its connection to the vendor. Dingit.tv said it uses Thrive+ to sell its inventory, but it didn’t answer other questions that Digiday posed. Thrive+ said it has relationships with both publishers.

What’s made this particularly confusing is that in a phone conversation, Thrive+ referred to itself as a programmatic agency and a buyer of inventory. But ads.txt is for listing sellers of inventory, not buyers, which is a point ad tech people are passionate about.

“It’s definitely a reseller trying to not just game but cheat the system,” said Dan de Sybel, CTO of programmatic agency Infectious Media. “They want to pass themselves off as a legitimate source for selling this inventory. Buyers do not need to be added to ads.txt, only sellers.”

Bob Regular, managing partner of Delivering Yield, which invests in Thrive+, vehemently disputed that Thrive+ is engaging in shady arbitrage.

He said the ad tech industry’s response to the Reddit thread is a “mass bullying campaign that is working to destroy the company.” At one point, he said accusations against Thrive+ were “defamation.”

Regular said there is a nomenclature misunderstanding and that Thrive+ is helping publishers by reselling their inventory. Essentially, Thrive+ works as a supply-side platform reseller. In order to resell inventory, it must first buy it.

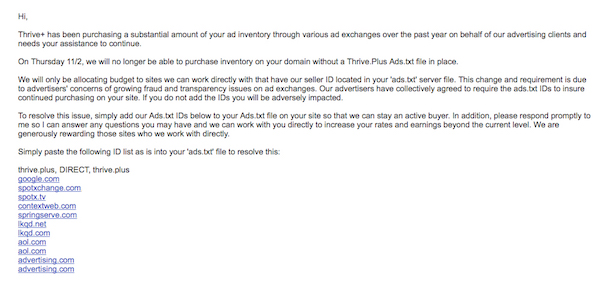

Since Google’s demand-side platform is beginning to use ads.txt to filter unauthorized resellers, the point of Thrive+’s emails to publishers was to let them know that Thrive+ buys inventory from them and that Thrive+ would like to work directly with them, Regular said. The full email it sent to publishers appears below. The ID numbers for each company have been scrubbed.

There are a few peculiarities with the ads.txt requests in the email. For one, Thrive+ is a reseller, but it is asking to be listed as direct. It also lists unnecessary vendors in their request. For instance, Thrive+ asked publishers to list ad server SpringServe as a direct authorized seller of inventory. Thrive+ uses SpringServe as an ad server, but since ad servers don’t sell inventory, they don’t need to be listed in ads.txt files, said Edward Shannon, CRO of SpringServe.

Publisher sources requesting anonymity said the SSP SelectMedia and ad net Ludius Media also asked to get listed on their ads.txt files even though these sellers didn’t have direct connections to the publishers. SelectMedia did not respond to a message for this story. Ludius Media was not available for an interview, but said that it reaches out to new publishers to establish a relationship with them in an transparent way. It sent the following statement that said in part: “Ever since we learned about the Ads.txt initiative several months ago, this point has been added to our existing sales process, as Ludius Media operates as a network and relies on SSP based demand alongside with our direct advertisers demand, as was specified in communications with the publishers we approached.”

One thing that is worth emphasizing is that resellers are accepted in ads.txt. Despite all the crap that publishers talk about resellers, many premium publishers still rely on them because resellers can help drive up the price of their inventory. The Wall Street Journal has three resellers listed on its ads.txt file, Cosmopolitan has seven, CNN has 15 and ESPN has 204. Some publishers desperate for high CPMs may not know, or care, where their ads get sold down the line. And with the fourth quarter upon us, ad buyers and their tech vendors are going to come out of the woodwork to try to make deals to reach annual goals before it’s too late.

However, if a reseller is authorized, which are the companies that get listed on ads.txt files, a publisher is going to be aware that the reseller is selling their inventory, said John Murphy, vp of marketplace quality at OpenX. Expecting a blind intro email to result in getting listed on an ads.txt file is a bit like expecting a first date to lead to marriage. If a publisher is unaware of the reseller asking to get listed, then that illustrates the byzantine nature of the ad-supply chain, which is what ads.txt is supposed to help clean up.

Then again, “spray and pray” emails pay off as long as someone bites every once in a while. It is up to the publisher to determine whether or not a company should make it onto the file.

“I think absolutely there will be more and more buy-side companies doing this, and inevitably, quite a few publishers doing what they ask,” said Matt O’Neill, gm of ad verification company The Media Trust.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.