This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

Publishers are placing their bets on both traditional and alternative revenue streams in 2024 — even after a tumultuous 2023, when publishers’ revenues turned out to be less lucrative than expected and the media industry saw a seemingly endless cycle of layoffs.

Despite those challenges, direct-sold display ads remained a top revenue driver for publishers throughout 2023 and, in actuality, direct-sold ads have been publishers’ top revenue stream since 2020. This is according to Digiday+ Research surveys of publisher professionals conducted over the past four years. Programmatic ads have consistently come in second place among publishers’ revenue sources, followed by branded content and video advertising, according to Digiday’s surveys.

However, with publishers facing declining referral traffic from search and social platforms, steeper competition for scale-focused campaign budgets, and a myriad of other woes impacting ad revenue, some publishers are growing their focus on events in 2024, while others are placing a renewed focus on subscriptions.

For the publishers with a growing focus on subscriptions, their motivation is likely tied to two components: subscriptions’ capacity for providing a recurring revenue stream and publishers’ need to collect more first-party data through subscriptions as deprecation of the third-party cookie becomes a reality. Many publishers automatically renew consumers’ subscription and loyalty program memberships, making them a fairly reliable revenue source, as long as subscribers don’t opt out. By maintaining their subscriber numbers, publishers have more access to their audiences’ first-party data — a promising alternative amid third-party data’s prolonged exit.

Some publishers are also planning to build their events businesses this year. Events took a hit during the height of the pandemic when stay-at-home orders eliminated publishers’ ability to host large, in-person gatherings. However, in the first quarter of 2024, slightly more than half of publisher respondents (52%) told Digiday they would focus at least a little on growing their events business in the next six months.

“Pre-pandemic we had a massive events business,” said The Atlantic’s CEO Nicholas Thompson. “Obviously, we reduced that, to bring it back up again. It’s unlikely in the next five years, we will be the size that we were prior to the pandemic, but we’re expanding the number of events … and the amount of revenue we bring in is expanding. So, it is an important part of our strategy, both for brand awareness and our business model.”

Bearing in mind publishers’ recent economic realities, in this first annual report on publishers’ revenues Digiday+ Research examines the current and future state of publishers’ revenue streams, from traditional ad revenue to events and subscriptions. The second installment of this report, publishing later this month, will take a close look at affiliate commerce and content licensing

Following 2023’s economic turmoil and ad revenue declines, many publishers are looking to 2024 with caution. Josh Stinchcomb, global CRO of Dow Jones and The Wall Street Journal, said he’s hesitant about what to expect in 2024.

“Based off the data that I have, things like AI and things that we’ve done at our company to create new opportunities around energy and risk, I would have no reason but to be totally optimistic if not for the fact that when I have conversations with CMOs. They’re a little uncertain,” Stinchcomb said. “There’s a sense of cautiousness and uncertainty … I’m taking them at their word and I’m tempering my enthusiasm.”

While ad revenue has diminished in the last year, it still makes up the largest portion of publishers’ revenue streams and remains a major focus. Direct-sold, programmatic, branded content and video ads all accounted for the top revenue streams for survey respondents over the last four years. Still, publishers’ ad strategies are changing.

When Digiday asked publishers what ad strategies they employ, respondents gave slightly different answers in 2024 than in 2023. In 2023, publishers’ top four responses were data and analytics, audience-based campaigns, ad placement and native advertising. However, the most notable changes in 2024 were that high-quality content took the top spot among ad strategies, while data and analytics fell to fourth place and native advertising fell out of the top four.

The shift here indicates several trends in the advertising space. As ad competition increases and AI solutions proliferate, producing high-quality content becomes a main competitive advantage for publishers. High-quality content here indicates the quality of the editorial content that surrounds the ads or the ad environment — in this case, on a publisher’s own website. This is in contrast to made-for-advertising sites (MFAs) that allow for scale, but are overcrowded with ads and low-quality, often AI-generated content.

Nicholas Thompson, CEO at The Atlantic, noted the importance of editorial staff being in the driver’s seat, specifically when it comes to the publication’s newsletters. “Our strategy is editorial decides what newsletter we write, and we sell that,” Thompson said. “You can imagine a world where it’s the other way around, but it doesn’t work that way at The Atlantic. … For example, editorial has an AI newsletter [Atlantic Intelligence] and a planet newsletter [Weekly Planet] which are easy to sell. Advertisers like it, and it’s a direct way to reach consumers.”

Craig Kostelic, chief business officer of global commercial revenue at Condé Nast, emphasized the impact a publisher’s branding can have on ad revenue. “When somebody sees our brand associated with something, what is the incremental action that they’re taking?” he asked, rhetorically. “The messenger is just as important as the message. And we’ve really lost sight of that because of all the creative optimization and email headline optimization, and the A/B testing that we have done. We haven’t actually thought about the variable — the messenger in the communication,” Kostelic added. “That’s what we’re [Condé Nast] trying to move forward within the industry and really own.”

As high-quality editorial content becomes a more important ad strategy this year, it will also give a lift to branded content. Branded content is designed to resemble editorial content, but with the biggest difference being that branded content is sponsored by advertisers. Publishers’ branded content must be of a similar quality to their editorial content in order for it to match the surrounding environment.

While branded content can make up a large portion of publishers’ ad revenue, publishers tend to focus on it as an extended, rather than short-term, ad strategy. “Branded content is much longer term,” said The Atlantic’s Thompson. “You can run the campaigns for a long period. We can create a piece of content that you’ll still be using a year from now, or even longer. So, you put a lot more effort into creating it, making sure it’s good, making sure it can last.”

It’s important to note that branded content should not be confused with native ads, which also resemble editorial content. However, clicking on native ads directs readers to advertising destinations, like brands’ landing pages or product pages, while clicking on branded content directs readers to sponsored content in the form of an article, report, video or something else that usually exists on the publisher’s own site, or on a social media platform.

Sherry Phillips, CRO at Forbes, said she’s seen branded content ad revenue ebb and flow over the last year, in part because of its longer timeline. “Last year, branded content was down. Coming into the start of Q1, it’s actually up over last year,” Phillips said. “Branded content is a piece of business that is longer-tail. So, it’s a longer tail for approvals and it can have higher premiums.”

“What we were seeing in 2023, and even into the start of Q1 [2024], is quicker campaigns, and branded content does not fit in that strategy,” Phillips added. “We were seeing an uptick for Q1 and then a nice order flow for it in Q2, but other businesses are outpacing it on direct digital and live events.”

Another notable trend revealed by Digiday’s survey results is the drop in importance of data and analytics as a revenue-driving ad strategy for publishers in 2024, as seen in the previous charts. This could indicate that publishers are focusing less on data as a competitive advantage or selling point for their ads. This decrease in importance is particularly noteworthy with the deprecation of the third-party cookie looming on the horizon. Third-party cookie deprecation should ostensibly make publishers’ data more valuable, but it doesn’t seem to have played out that way. Nonetheless, data and analytics took the fourth-place spot among publishers’ ad strategies in Q1 2024.

To dig further into the trend, Digiday+ Research asked respondents about the type of data that plays the most significant role in generating positive ad revenue outcomes for their companies. In both 2023 and 2024, respondents said that first-party data has the most impact. This focus on first-party data indicates that publishers see their first-party data as an alternative selling point following the death of the third-party cookie.

Subscriptions are a large source of first-party data for publishers and, as previously mentioned, some publishers are increasing their focus on subscriptions as a revenue stream this year. Taha Ahmed, chief growth officer at Forbes, said that first-party data and subscriptions are closely linked for the publisher. “It is a very connected strategy for Forbes,” Ahmed said. “First-party data, building a proprietary database on the audiences that we have, and building our models around it is so critical. We use that as the center from which multiple revenue streams get enabled.”

“First-party data supports our advertising business, but it also fuels nicely into the subscription business and being able to show the right people the right offers,” he added. “We also use it to build top and middle funnel, to bring in better audiences, and we use it to drive newsletter users who then subscribe. … We want to continue to provide as much value to the user at every stage and build our first-party data, which then will enable newer revenue opportunities.”

Similar to their survey responses about 2024, when publishers were asked about their predictions for which data type will play an important role in their ad strategies in 2025, publishers predicted an increase in the importance of first-party data.

Publishers also predicted that the percentage of ad impressions served by first-party data will increase in 2024 and 2025.

While data and analytics may have decreased in overall importance as a competitive ad strategy for publishers this year, it’s clear that first-party data is a priority for them in the face of the deprecation of the third-party cookie. As a result of the interconnectedness between subscriptions and first-party data, it’s possible that publishers could place more emphasis on subscriptions to gather first-party data and to support their ad strategies and other revenue streams in 2024.

For some of the bigger publishers, digital subscriptions have been on the rise since 2022. The New York Times, for example, added 210,000 net new digital-only subscribers and increased that revenue stream by 16% year over year to $282 million between Q3 2022 and Q3 2023. Dow Jones also saw the total number of its digital subscriptions grow, increasing by 12% year over year to 4.6 million digital subscribers in the same period. While these increases are significant, some of their competitors did not see the same results.

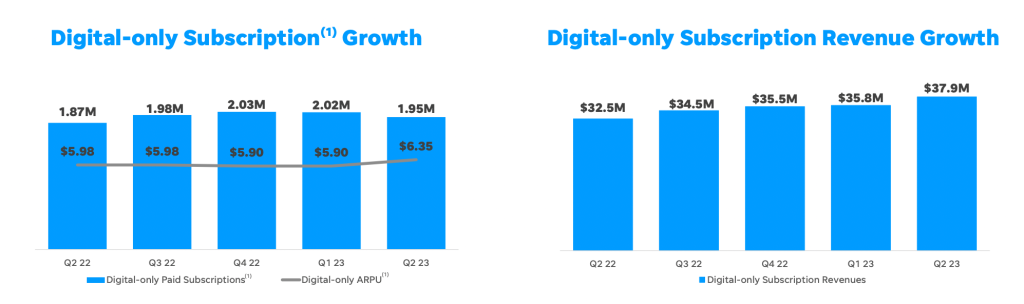

Earlier in 2023, Gannett’s number of digital-only subscriptions fell. However, the publisher still managed to grow its revenue from digital-only subscriptions by increasing the revenue per subscriber. Gannett’s CEO Mike Reed said that this area of the business was a boon during Q2 2023. Total revenue for Gannett’s digital-only subscriptions business was $37.9 million, marking an increase of 17.3% year over year and 5.9% from Q1 2023 to Q2 2023. It may seem odd for a company’s digital-only subscription revenues to increase despite the total number of digital-only subscribers falling, but Reed said that the company’s recent prioritization of increasing the average revenue per user has been working to improve the overall profitability of the business. As the publisher doubled down on this revenue stream, Gannett saw success in the following quarter.

The publishers Digiday spoke with for this report said they are taking a variety of approaches to increase subscriptions in the coming year. Forbes’ Ahmed said the publisher is focusing on using newsletters to create audience loyalty first. “An important piece of the loyalty strategy is newsletters,” Ahmed said. “It allows us to capture the right marketing opt-ins. [Newsletters] allow us to build a database of people and serve them content that they want to read, when they want to read. That has done really well for us. Businesses like the ‘Forbes Daily’ is over a million subscribers.”

Ahmed explained that building audience loyalty directly through newsletters results in new subscriptions. “We see that people who read newsletters and read them for a certain amount of time, end up converting at a higher rate,” he said. “It is significantly higher than the traditional ‘hit the paywall’ and pay for more content. That’s why we’re using it as an important level of our subscription strategy.”

Forbes’ newsletter model allows the publisher to gain reader insights and understand what content readers want and for what they’re willing to pay.

While Ahmed noted that newsletters outperform the typical paywall strategy for Forbes, other publishers have found the paywall model to be lucrative. The Atlantic’s Thompson said offering readers memorable content encourages them to subscribe after hitting that paywall. “Our subscription policy is very much attached to our journalism policy, and our journalism strategy is to publish a number of high impact and iconic stories,” Thompson said. “So, our subscription strategy is to have a pretty tight meter [number of free articles]. … If we had a different editorial strategy and published more stories, but fewer iconic stories, we would have a looser meter. We engineer our meter strategy around, or backward from, the journalism strategy.”

While The Atlantic’s paywall strategy focuses on teasing impactful stories to encourage readers to subscribe, for many publishers the paywall strategy is not limited to editorial stories. Digiday+ Research’s Subscription Index found that placing non-editorial content behind a paywall can also be an effective strategy. For example, Outside magazine gives subscribers the ability to enroll in free member-exclusive training programs, which lean heavily on digital media like instructional videos for specific outdoor activities including rock climbing, biking and backpacking. In the same vein, the publication also hosts activity and sports professionals, such as Olympians, to speak at online events to further create enthusiasm among subscribers.

At the end of the day, publishers must navigate a balance between ads and subscriptions. Andy Morley, CRO at The Independent, said the publication has recently placed a greater emphasis on subscriptions to work in tandem with its existing ad strategy. “We’ve been in the subscription game for many years now, but the truth is short-term revenue goals have superseded consistent strategy on subscriptions in the past,” Morley said. “But now, the value of driving first-party data has us really investing hard behind our subscription business. Fundamentally, we’re an ad-funded business, and we continue to believe that that is our future for growth. What we’ve done in the last 18 months, that we haven’t done before, is invested in subscriptions to a point where there’s a real value exchange that delivers a tremendous product at a fair price to our subscribers.”

Morley added that The Independent has been specific about choosing what content requires a paid subscription. “We’ve got to be selective about what we put behind the paywall and what we show for free,” he said. “We made a decision to put all of our comments section behind the paywall, because that is a longer read, with deeper analysis. Fundamentally, because it’s generally news related, most advertisers would define the Independent’s Voices section as being largely brand unsafe — it’s high value for our audience, much lower value for our advertisers. Actually, we haven’t lost a great deal in terms of advertising dollars, but we’ve improved our offer for subscriptions significantly as a consequence of making that change.”

An increased focus on subscriptions often means placing more content behind paywalls, which can also lower traffic. For publishers like The Independent who rely on ad revenue, but who also want to build up their subscriptions business, finding content that entices subscribers without negatively impacting their relationships with advertisers will be key to the balancing act.

Publishers’ focus on events to generate revenue has been an up and down roller coaster ride over the past several years. Events ground to a halt during the height of Covid-19 pandemic, stalling the revenue stream, and publishers were initially hesitant to invest a lot in events as the world opened back up post-pandemic. However, over the last two years more publishers have looked to events as a re-emerging revenue stream in which to invest.

The events business is still on rough terrain in early 2024, however. The percentage of publishers who make money from events decreased this year compared to last year. Just under half of publishers (47%) said in the first quarter of 2024 that they get at least a little revenue from events, compared with well over half of publishers (57%) who said the same a year prior. And slightly more than half of publishers (52%) said in the first quarter of 2024 that they would focus at least a little on growing their events business in the next six months, compared with two-thirds of publishers (67%) who said the same in the first quarter of last year.

Publishers focused on this revenue stream make money from events in a variety of ways, ranging from paid sponsorships to consumer product purchases made either on-site or through affiliate links. Publishers who have established keystone events can use them as a springboard to generate revenue from multiple revenue streams. Mass media company Condé Nast has a widespread global events business with events ranging from the renowned Met Gala, to the Pitchfork Music Festival, to Glamour’s Women of the Year awards. Condé Nast chief business officer Craig Kostelic said the company approaches its events from a holistic perspective, viewing them as an opportunity to reach not only in-person attendees, but also millions of consumers who are watching or reading about them elsewhere, especially on social media platforms.

“Events should obviously entertain the people who are there and, if brands are sponsoring the events, we should get products into the hands of those people,” Kostelic said. “But then there’s this huge benefit that it’s essentially a creative production shoot for social, to drive significant awareness and conversions and acquisitions. Ten years ago events used to be a siloed business in which you hosted events and integrated brands. Now, events are a fully integrated offering.”

Kostelic also said he sees events as an opportunity to extend Condé Nast’s branded content revenue stream. He said, for example, the publication’s “Vogue World,” a one-night event that features fashion shows, celebrities and performances and is set in a new city each year, takes on the tone of the city in which it is held. “And then our branded content also takes that [tone],” Kostelic said. “We’re not treating branded content as its own siloed separate area, but actually as a container within a bigger editorial moment that takes all the sensibilities and the aesthetic of what we’re doing editorially and feeds that to our partners, so that the consumption around that tentpole [event], whether it’s branded content or editorial content to a consumer, the nuance is smaller.”

Kostelic added that because of the reach of social media, Condé Nast is closing the gap between its U.S. and non-U.S. events businesses. “Usually, if you hosted an event in London, you’d only talk to local U.K. media investment leads,” Kostelic said. “Now, because of that connectivity between social and events, when we do a Vogue World London, the majority of budgets were coming from U.S. buyers because the majority of consumption was happening with the U.S. audience. That’s a really new trend in the marketplace.”

Forbes is another publisher with an established events business. The company produces around 100 events per year, according to CRO Sherry Phillips, with its “Forbes Under 30” list event top among them. The 12-year-old list of 30 business leaders under 30 years of age has had a corresponding event for 10 years. Phillips said that list and its event provided a natural pathway for Forbes to establish its 2-year-old “Top Creators” list and corresponding event. “We’re always testing and learning in this space,” Phillips said. “[We’re] working really closely on live events and loyalty. A great combination of building loyalty is inviting our users or participants into more events, whether they’re virtual or in person. … And a lot of it ties back to the core themes communities are interested in.”

For The Guardian and The Independent, both based in the U.K., their aim is to build out events businesses featuring keystone events. “The ultimate goal is to have a flagship event that we are still working our way up to,” said Nataki Williams, senior vp of finance at The Guardian US. “Events are not a main advertising strategy for us at the moment. They’re a cherry on top.” For example, The Guardian capped off a multi-part editorial series with an in-person event to attract advertisers and provide The Guardian’s readership with an opportunity to interact with content in a live setting, according to Williams.

The Independent, on the other hand, is building out events as an extension of its advertiser partnerships, but also with an editorial focus, according to CRO Andy Morley. A 2023 event sponsored by chocolate brand Galaxy was focused on women’s empowerment, for example. The publisher also hosts events strictly for its subscriber base. “The truth of it is, if you’re building an event business, you’re probably not going to make any money for the first year, and maybe not the second year,” Morley said. “But in the fifth year, you might have an asset that you can sell that is hugely valuable. So, it’s a long game.”

Despite the financial challenges that can come along with establishing an events business, many publishers are finding success. Axios, for example, entered 2023 with the goal of earning $10 million in event sponsorship revenue by the end of the year. The company exceeded that goal in the third quarter of the year, with the added bonus of an expected 60% year-over-year increase in events revenue by the end of the fourth quarter of 2023. Meanwhile, Bloomberg Media reported that its 2023 events revenue was up 48% year over year as of the third quarter.

News publisher Semafor, which holds events anchored to its editorial content, has hosted more than 50 global events and expanded its events team by more than half since launching the business in October 2022, according to CRO Rachel Oppenheim. Half of the company’s total revenue — in the eight-figure range, which is a threshold it surpassed as of May 2023, according to The New York Times — comes from events. And events were central to the company’s achievement of doubling its total client base, according to an earlier interview with Oppenheim. “We’ve seen remarkable momentum and expansion in our events initiatives both editorially and commercially via sponsorships and bespoke activations,” Oppenheim said in March.

Time announced the newly created role of chief events officer late last year. Time also increased the number of events it hosted in 2023 to 27, up from 10 in 2022. This is noteworthy for a publisher that hasn’t traditionally focused on events.

According to Time CEO Jessica Sibley, the media company experienced a 70% year-over-year increase in U.S. events revenue in 2023 and a 14% increase year over year in international events revenue. She declined to share hard revenue figures, but a company spokesperson said that Time’s events business represented eight figures in revenue in 2023.

Sibley said she sees the current industry appetite for events exceeding pre-covid levels. “We are going to continue to drive our event opportunities because that’s where the demands and the client asks are. They want to be part of our tentpole events,” she said.

Ad strategies

- High-quality content is publishers’ top ad strategy and main competitive edge in 2024. High-quality content here indicates the quality of the editorial content that surrounds the ads or the ad environment, in this case, on a publisher’s own website. Publishers are placing an increasing focus on maintaining and enhancing the quality of their editorial content this year in order to continue distinguishing their sites from made-for-advertising sites (MFAs), and to drive more visitors and advertisers to their sites as well.

Data strategies

- Digiday’s survey results showed a drop in importance of data and analytics as a revenue-driving ad strategy for publishers in 2024. Nonetheless, data and analytics took the fourth-place spot among publishers’ ad strategies, marking its overall importance in 2024.

- When asked about the type of data that plays the most significant role in generating positive ad revenue outcomes for their companies, in both 2023 and 2024, first-party data rose to the top. Publishers plan to use their first-party data libraries as an alternative selling point once the third-party cookie goes away.

Subscription strategies

- Publishers that are starting to to build a loyal audience base and convert that base to paid subscribers would do well to follow Forbes’ newsletter model, which allows publishers to gain reader insights about what content readers want and for what they’re willing to pay.

- Another subscription strategy is focusing on high-impact content behind paywalls. Notable examples include The Atlantic’s high-impact, editorially-led content and Outside magazine’s member-exclusive training programs.

Event strategies

- Publishers who have established keystone events can use them as a springboard to generate revenue from multiple revenue streams. Publishers like Condé Nast, with its keystone Met Gala, Pitchfork Music Festival and Glamour’s Women of the Year awards events, and Forbes, with its 30 Under 30 list and corresponding event, are examples of this.

- Publishers just starting to build their events businesses should look to establish keystone events. Time announced the newly created role of chief events officer late last year and increased the number of events it hosted in 2023 to 27, up from 10 in 2022.