Secure your place at the Digiday Publishing Summit in Vail, March 23-25

It’s a difficult time for print media.

Analytics firm Enders predicts £1 billion ($1.3 billion) of revenue will disappear from the U.K. newspaper industry between 2011 and 2019. Last year was a particularly bad one for the U.K.’s print newspapers: The closure of Trinity Mirror’s New Day after two months, plus the Independent’s shuttering of its print edition are just two examples of mounting pressures facing the print industry.

Here’s a look at the state of print and online advertising in the U.K.

Display ads can’t plug the gap from falling print revenue

The narrative is a familiar one: Although digital display ad revenue is growing, it’s simply not enough to make up the losses from falling print ad revenue, mostly because print ad revenue is a larger piece of the pie.

A report from Enders Analysis (via Business Insider) from February predicts print ad turnover will fall from £1.5 billion ($1.9 billion) in 2011 to £533 million ($689 million) by 2019. Online revenue stood at £117 million ($151 million) in 2011 and is only forecasted to grow to £227 million ($293 million) in the next two years.

The report also states that print circulation has fallen, with tabloids The Sun and the Daily Mirror being hit the hardest. Trinity Mirror, publisher of the Daily Mirror, has reported print advertising is down 19 percent in the first four months this year, while digital is up 6 percent.

Source: Enders Analysis

But print decline is slowing

According to the quarterly Advertising Association and Warc Expenditure Report, released at the beginning of May, ad spend across all media in 2016 came to £21.4 billion ($27.7 billion). Nearly half of this, £10.3 billion ($13.3 billion), came from digital formats. Over 95 percent of all the new money entering the market came from digital formats.

Combined ad revenue in 2016 was £1.1 billion ($1.4 billion) for national news brands, just over £1 billion ($1.3 billion) for regional news brands and just shy of £880 million ($1.1 billion) for magazine brands.

Print advertising and the overall trend is downward, but the rate of decline is slowing. Between 2015 and 2016, combined ad revenue from national news brands fell by 10 percent; however, that was £25 million ($32.3 million) less than the loss recorded in 2015. The rate of decline in combined ad revenue for regional news brands is also expected to soften.

Source: Advertising Association and Warc Expenditure Report

Print consumption is flat

The decline in print ad revenue has been more drastic than the decline in print consumption habits. In 2011, people in the U.K. spent 18.3 minutes a day on average with newspapers (and 88 minutes on the internet), according to Zenith’s Media Consumption Forecast, which was published last week. For 2017, the estimate for time spent with newspapers fell to just under 18 minutes a day, but estimated time spent on the internet jumped to 224 minutes a day on average.

Source: IPA Touchpoints, Zenith

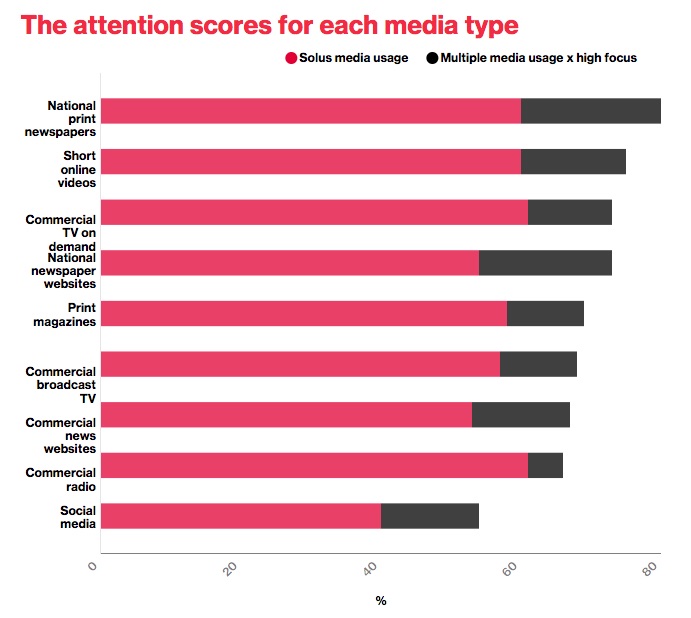

Not all media are created equal in capturing attention

While time spent with a medium is a factor for where the money flows, Newsworks, the newspaper trade body, argues that the quality of time spent with media should be factored in, too. As Newsworks notes, time spent with a newspaper is likely to be more engaged than, say, having the radio on in the background; therefore, ad recall would likely be higher.

In a Newsworks survey with PricewaterhouseCoopers of 2,600 U.K. citizens and how attentive they are to 15 types of media, print newspapers came out on top as a medium people regularly put time aside for. People feel a personal connection with titles and trust the content, and print newspapers give readers something to talk about.

The chart below shows that when reading a national print newspaper, 80 percent of the time a reader’s attention will be focused just on that media — what Newsworks calls “solus” media usage. The reader focuses on multiple media in the remaining 20 percent of time spent with a national print newspaper. More information on the methodology can be found here.

Source: Newsworks and PwC

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.