Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

After two decades of publishers giving their content away for free, many are coming around to the idea that they should charge for it. The question is: How much?

Digital consumer revenue is expected to become a bigger share of news publishers’ revenue over the next few years, but many publishers are still charging more than a lot of people are willing to pay. Here are five charts that show how — and why — news publishers are pricing their digital content.

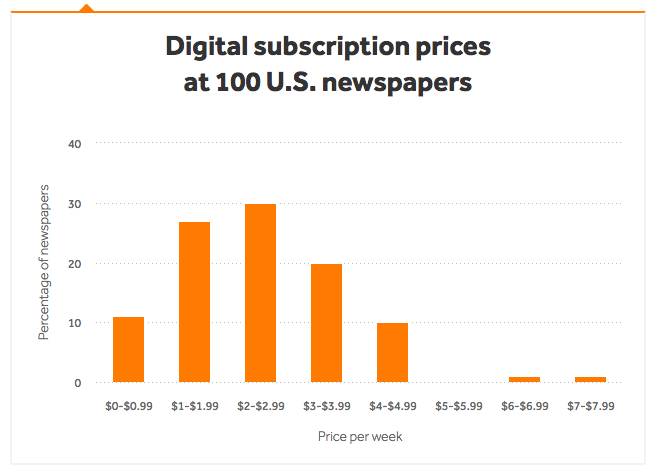

Less than a latte …

In 2012, the Reynolds Journalism Institute concluded that the optimal price for a digital news subscription was about $1.25 per week. Data compiled by the American Press Institute finds that the median price of digital news subscriptions in 2017 was nearly twice that, at $2.31.

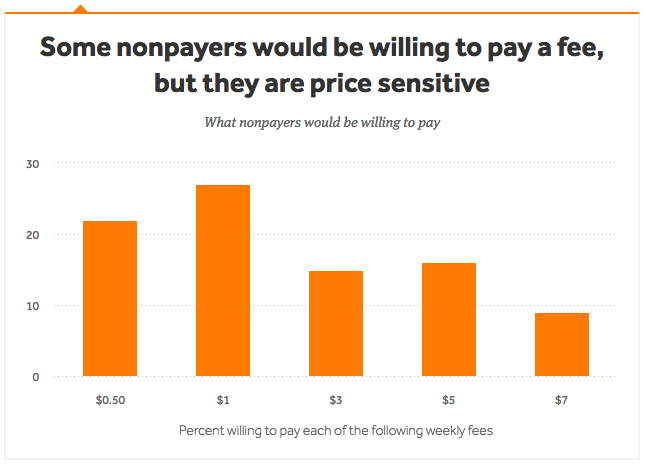

… but more than many people are willing to spend

People who pay for news think differently from those who don’t. Research published last spring by the Media Insight Project found that nearly half — 49 percent — of survey respondents said they’d be willing to spend $1 or less per week for digital news.

Undervalued?

Those paying for a subscription, however, appear to be happy with the value they get for their money. More than four-fifths of respondents to the same Media Insight Project survey said they thought their news subscriptions delivered “fair” or “good” value for the price, and fewer than one-fifth thought their subscriptions were somewhat overpriced.

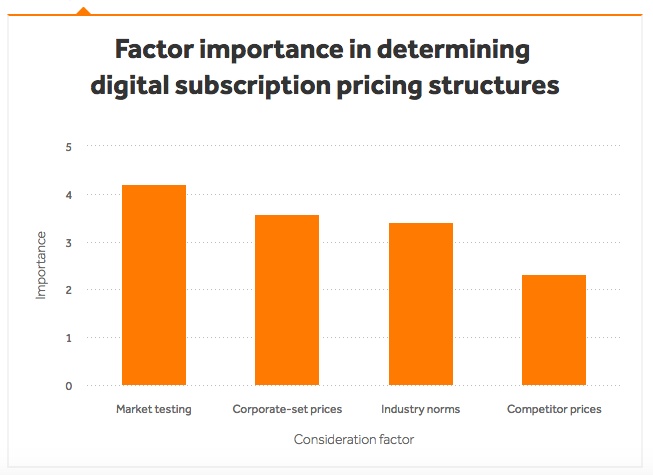

What the market will bear

The same American Press Institute survey found that newspaper publishers put more importance on market testing than on competitors’ prices when determining the price of their digital subscriptions.

Measuring up

The median price of a digital newspaper subscription is around $10 per month. That’s the same or slightly cheaper than leading audio content subscriptions, including Spotify and Audible, but it is more expensive than the asking price for many subscription video content products, including both mass-market offerings such as Netflix and specialty products such as Crunchyroll.

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.