Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Media Briefing: Cheap reach inventory is the next target from the consultancy that spearheaded the MFA crackdown

This Media Briefing covers the latest in media trends for Digiday+ members and is distributed over email every Thursday at 10 a.m. ET. More from the series →

Up next: Cheap reach inventory

“Cheap reach inventory” is the next target from Jounce Media, the consultancy that helped to spearhead the MFA crackdown last year.

Defined by Chris Kane, founder of Jounce Media, as “chronically non-viewable” ad inventory, cheap reach is a growing classification of supply that comes from “websites or mobile apps that have reasonably high quality content and organic audience, [that are] not dependent on ad arbitrage, but create a low quality ad experience.”

This classification is meant to be considered separately from the MFA conversation, because even though the ad experience may be undesirable for the user and the advertiser alike, the sites selling these ads aren’t actually practicing ad arbitrage.

“When we find certain publishers who are reputable publishers and produce high-quality content and have organic visitors, but whose supply is presented to the [demand side platforms] as overwhelmingly really, really low quality… we’re going to guide buyers to avoid those portfolios,” Kane told Digiday.

Jounce categorizes cheap reach “at the supply path level. Basically, we classify each ads.txt entry in a publisher’s file,” Kane said. However, he called the current measurement process “incredibly simplistic” and a starting point for how his company will evaluate cheap reach inventory going forward. But right now, classification is based on the viewability rates of ad placements on a webpage. Kane did not disclose what the exact threshold is for “low viewability,” but said these ads often have viewability rates that are sub-15%.

Examples of ad inventory in the “cheap reach” category include below-the-fold ad spots in content recommendation widgets, comment sections, endless scroll pages and click-through slideshow stories, all of which are measured using viewability rates, according to a Supply Path Benchmarking report published by Jounce in January that was shared with Digiday by a recipient who requested to remain anonymous but expressed concerns about how a crackdown on cheap reach could impact their business. In the report, vendors like Outbrain, Taboola, Connatix, Disqus and OpenWeb were named as operators of cheap reach inventory.

Jounce used cheap reach as a filter for deciding which publishers to include in its 2024 bellwether list of publishers that the consultancy believes advertisers should consider must-buys.

Between the 2023 and 2024 bellwether lists, Jounce removed four publishers — Tribune Publishing, Weather.com, DMG Media and Fox — for having 20% or more of their bid requests lead to cheap reach ad products, per the report. While DMG Media was measured to have 22% of bid requests lead to cheap reach placements (primarily from dailymail.co.uk), Weather.com (formerly a part of the IBM portfolio) was upwards of 52%.

Buyers aren’t blocking cheap reach like they did MFAs

While Jounce has begun flagging cheap reach to its clients and in its research reports, media buyers aren’t necessarily taking action and removing this inventory from their clients’ media buys just yet – unlike the swift action taken during the MFA crackdown.

“When we talk about cheap reach, you have to understand that, to me, in the world of display, it’s all cheap reach. The way that buyers think about it now, TV is premium, to a certain extent click-to-play pre-roll is premium, and everything else is cheap reach,” said a media buyer who spoke on the condition of anonymity. “Display is so severely commoditized at this point that I would be reluctant to find anyone with a very sophisticated strategy in display beyond tonnage and some data targeting.”

A second media buyer who also spoke anonymously on this topic went as far as to say that “cheap reach is often viewed as a necessary evil because our campaigns must remain cost efficient.” With client cost bases being reset over and over in the past few years, “there is an expectation of cost efficiency” that media buyers have to meet to satisfy clients.

A third media buyer who also requested anonymity said that, while they’re aware of Jounce’s classification of cheap reach inventory and work with Jounce on MFA classification, they are still figuring out their tolerance levels for cheap reach.

“We wouldn’t have the same kind of hard-and-fast rules that we would around MFA flags,” the third buyer said. The reason for the different stances is largely because of the lack of parameters around what exactly cheap reach is at this point. “If there’s not a definition for MFA, there is definitely no industry definition for cheap reach at this point. So it’s very much down to the opinion of the buyer,” they said.

Identifying and avoiding cheap reach inventory isn’t an impossible task for buyers looking to avoid those placements, but it does require more attention to detail in the open market.

The third buyer said it was a frustrating task to identify and circumvent cheap reach placements in the open market because “buying against a single domain isn’t enough. You need to know exactly which units you’re buying within that … It takes very granular information and very granular targeting to be able to remove it.”

Kane said he hopes that buyers’ responses to cheap reach won’t be the same as the industry’s rise up against MFAs. “I very much hope that the cheap reach problem doesn’t get solved by blocking, but that it gets solved by rewarding publishers that have the highest quality products,” he said.

Publishers and vendors take pause

While buyers aren’t necessarily reallocating budgets away from cheap reach inventory as of now, publishers — particularly those that were formerly on the bellwether list — are wary of this classification and how it’s being measured.

Dave Olesnevich, head of data and advertising products for The Weather Company, said that his company didn’t work with Jounce prior to learning about cheap reach and this report, but is now in contact to learn about how weather.com is being evaluated.

“We were a little bit surprised by this. We don’t have the data that [Jounce is] looking at,” said Olesnevich. But ultimately, he said that “the buyer knows what they’re buying,” when it comes to Taboola or Connatix inventory and his team is not trying to trick anyone into buying “cheap reach” inventory.

While Olesnevich didn’t disclose what portion of their bid requests lead to Taboola inventory, he said that Connatix only represents 1% of weather.com’s ad inventory and the 52% figure felt inflated.

When asked about the response to being removed from Jounce’s bellwether list for having a high percentage of cheap reach inventory, a Fox News spokesperson said via email: “As a premium content publisher, we strive to work directly with brands through private marketplace partnerships and are currently evaluating our third-party business to ensure enhanced transparency across our programmatic inventory.”

DMG Media and Tribune Publishing did not respond to requests for comment. Meanwhile, vendors also expressed concern about the cheap reach classification coming into the conversation.

“OpenWeb takes seriously industry standards for viewability and other metrics for inventory quality… For that reason, we’re unable to account for our inclusion in this category. OpenWeb is not a simple below-the-fold comment system, but rather a holistic community engagement and audience activation solution,” said Max Weiss, OpenWeb’s chief strategy officer.

An Outbrain spokesperson said that the company is actively working with Jounce to “achieve clarity for the industry in regards to our inventory, its value, and what buyers can expect from it,” and added that the Outbrain business model “is designed to drive engagement, offering mutual value to both publishers and advertisers.”

Steven Stein, who is the resident and gm of Disqus, said that his company is not working with Jounce and his main concern “revolves more around how a free press can compete in this market.”

One exec from a vendor named in the report who spoke anonymously said that they’re working with Jounce and are in active conversations with their publisher and advertiser clients to make sure they understand the cheap reach designation and encourage them to lean in further to PMP and direct deals with buyers as a result.

Cheap reach is not MFA

One of the reasons for crafting the cheap reach classification was to make sure that publishers with genuine editorial intentions (and not solely created for ad arbitrage) weren’t grouped in the MFA classification, even if they have a poor ad experience.

This week, Integral Ad Science rolled out new classification tools that use machine learning to identify MFA sites as well as a secondary category called “ad clutter,” which was partially informed with Jounce’s cheap reach classification. This secondary category vastly decreased the number of publishers that previously were flagged as MFA during the alpha tests of the MFA identification tool before the ad clutter category was created, according to Scott Pierce, head of fraud protection at IAS.

“Our guidance to clients is to avoid MFA sites. When it comes to ad clutter sites, many of the sites that we will be flagging as ad clutter are well known sites… and so just because they have ad clutter or ad spammy environments, our guidance to clients is you don’t need to block or avoid them outright. Just closely monitor the performance of the sites and see if they’re actually delivering you meaningful outcomes and not just clicks and views,” said Pierce.

Cheap reach measurement is still in development, Kane said, adding that there are other types of low-quality ad spots that he wants to go after next, but the ability to measure that inventory doesn’t exist yet. For example, the tiny in-video ads that are docked to the bottom corner of a mobile website might get high viewability rates because they autoplay, but “any reasonable marketer would say that’s not a premium video product,” he said.

“There’s still a lot of supply that we probably should be calling ‘cheap reach’ … that we currently call premium,” said Kane.

What we’ve heard

“The U.S. market is super strong… Our Oscars event, [the Vanity Fair Oscar Party], that’s coming up is up 50% year over year [in ad revenue]. So we have a lot of really exciting cultural moments happening in the first half of this year which are driving our upside.”

– Pam Drucker Mann, global CRO of Condé Nast

Facebook link post referrals are still down

Some publishers and creators say that despite promises from Meta, Facebook referral traffic hasn’t picked up since Meta rolled out a new page experience on the platform in May that affected the visibility of link posts.

After the change last summer, publishing execs told Digiday that Meta had informed them the platform was aware of the issue and that publishers could expect referral traffic to return to normal in a few months. This week, two publishing execs – who requested anonymity – told Digiday that Meta had told them in early October that the platform was updated and that they could expect link post performance to improve in a few weeks’ to a few months’ time.

However, five months later, that hasn’t happened. One of those publishing execs said engagement and traffic for their larger Facebook pages (some of which have over 1 million followers) was about half of what it was before the platform change last summer. Smaller Facebook pages (those with 100,000-150,000 followers, for example) have had no improvement, they added.

It seems to be another example of the continuation of Facebook’s years-long deprioritization of publishers and a push to keep users on the platform. Meta declined to comment.

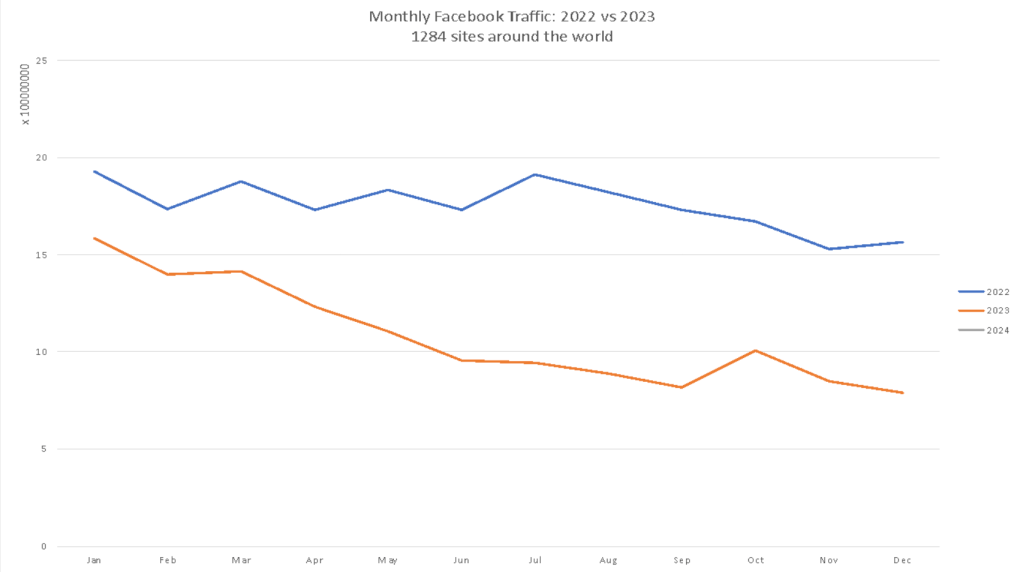

According to the referral traffic data of 1,300 global sites from Chartbeat, there was an uptick in October but traffic continued to decline since then, returning to the same trend as 2022. Monthly Facebook referral traffic in 2023 was down between 40-50% year over year, according to Chartbeat.

“I don’t think [link posts are] a focus area for Meta,” the second publishing exec said. “It doesn’t surprise me.”

However, they noted that a higher share of their overall social referral traffic came from Facebook in 2023 compared to 2022, which they believed was due to the publisher’s focus on short-form video like Reels.

A content creator with over 9 million Facebook followers said link posts were bringing in one-quarter to one-third of the traffic and engagement they drove before June 2023. The creator has taken to posting links to their site in the comments rather than in the main post itself – in some cases, resulting in “100-fold” traffic and engagement lift compared to their link posts.

Link posts “go to die on Facebook,” the creator said.

None of those interviewed for this piece said they had received specific guidance from Meta on link post performance. It remains unclear if Meta is working on getting publishers’ Facebook referral traffic back up. And it remains to be seen if link post performance will improve (or get worse) now that Meta is shutting down the Facebook News tab next month. – Sara Guaglione

Numbers to know

700: The number of applications Defector Media received for a staff writer open position.

400: The number of news publishers that LinkedIn works with in a professional capacity, which gives publishers access to the platform’s in-house development and editorial teams to enhance their posts, newsletters, podcasts or video.

What we’ve covered

An oral history of the murky made-for-advertising crusade:

- Recently, there have been calls from industry stakeholders to reclassify MFA to mean “made-for-arbitrage.”

- Here is the story of how the efforts to reduce the amount of ad dollars allocated to low quality ad inventory evolved into a witch hunt that ultimately impacted earnest publishers in an already troubled market.

Hear from industry execs the backstory on how MFA devolved beyond arbitrage here.

Vox Media, MilkPEP and Gale ink multi-million dollar media partnership to increase women’s representation in sports:

- Stagwell agency Gale, Vox Media and dairy brand MilkPEP this week inked a multi-million dollar media partnership focused on spotlighting female athletes.

- The contract is part of a larger campaign that includes editorial content, integrated media promotion and other programs on YouTube in collaboration with Popsugar Fitness, a Vox brand, and additional audio content on the Vox Media Podcast Network.

Learn more about the new deal here.

Why podcast companies are investing in AI-generated podcast translations despite questionable quality:

- In January, iHeartMedia announced plans to use generative AI tools to translate five to 10 existing shows into a number of different languages by the end of this quarter. But the company has pushed back that timeline.

- While podcast networks like iHeartMedia, Spotify and PodcastOne have publicly announced plans to debut AI-generated audio translations, few have gone live yet (Spotify has released a handful of test episodes).

See why some podcast networks have delayed their AI-generated launches here.

Newsguard debuts new automation tools for tracking election-related misinformation:

- NewsGuard, the news rating service, is adding more automation tools as it works to track misinformation efforts ahead of the 2024 elections.

- The tools will be used across websites, social media platforms and video channels to help track false or misleading claims about elections.

Read more about Newsguard’s new brand safety tools here.

Podcast companies see signs of an improved ad market in 2024:

- iHeartMedia, Spotify, SiriusXM and Acast reported year over year revenue growth in their podcast businesses during the fourth quarter of 2023.

- “We expect 2024 to be back in growth mode,” said Rich Bressler, president, COO and CFO of iHeartMedia, during the company’s earnings call.

See how podcast companies performed during the fourth quarter of 2023 here.

What we’re reading

Complex Networks + NTWRK = Complex NTWRK:

Following the $108 million acquisition of Complex last month, new owner NTWRK, an e-commerce platform, announced that it would be folding into the Complex brand as the anchor for the media company’s commerce business, Axios reported. Over the next six months, this transition will take place and the collective company will be called Complex NTWRK.

Vice Media’s virtual town hall hands abruptly ends after a flood of thumbs down emojis:

CNN’s Reliable Sources reported that during an all-hands town hall meeting last week, Vice Media’s COO Cory Haik was interrupted by a bombardment of thumbs down emoji reactions from laid-off staffers, leading chief executive Bruce Dixon to terminate the meeting early. The meeting was scheduled shortly after hundreds of staffers were laid off from the company, as well as the announcement that the company would cease publication on its dotcom.

The New York Times was accused of racial targeting by its union:

During the investigation of leaks from the Times’ newsroom around its coverage of the Hamas attacks in Israel on Oct. 7, the union representing the Times’ staffers said the media company was guilty of targeting employees of Middle Eastern or North African lineage, The Washington Post reported.

Google says it’s trying to be better about squashing AI spam in search results:

The Verge reported that Google is rolling out some changes to its search result ranking system with the intention of deprioritizing content that consists solely of summarizations of other uniquely reported content, which has increased in volume with the help of generative AI as of late.

News publishers won’t receive renewals for their deals with Meta:

The Wall Street Journal reported that Meta will not be renewing or signing new multi-year deals made with news publishers in Australia and the U.S., claiming that the number of users in those countries using the Facebook news tab has decreased over 80% in the past year.

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.