Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

It’s tough for any publisher to branch out into agency-like services, but local publishers face their own particular challenges.

Local broadcaster Nexstar grew its digital marketing and agency services revenue 38 percent to $62 million in the first quarter of 2018, representing more than 10 percent of the broadcaster’s quarterly revenue.

“I think there’s a lot of room to grow here,” said Anthony Katsur, svp of platforms at Nexstar. “We’re your one-stop shop for local, SEM [search engine marketing], social, and video.”

Nearly one-third of the publisher respondents to a survey by the Local Media Association said digital marketing services like SEO, website design, native ads and social media management were their top growth opportunity. Another 60 percent said those services were a top-three opportunity. Nearly two thirds said that side of their business was profitable.

Local publishers have less competition for small marketers’ business than do national publishers. But local publishers also have more service needs that they’ll hand off to third parties.

“The path to making great inroads with the Fortune 1000 is really tricky,” said Jed Williams, chief innovation officer of the Local Media Association.

Local advertisers also have a wide range of business needs, which requires sales team to keep up with a menu that changes frequently. Katsur said that Nexstar’s COO spent nearly one quarter of 2017 on the road, putting the broadcaster’s local sales teams through two-day trainings that included a final exam.

Some agencies like Excelerate Digital, a marketing agency owned by newspaper chain McClatchy, try to serve businesses of all sizes. UpCurve, a group of services businesses owned by GateHouse Media, caters to small businesses. Most recently, it acquired Closely, a SaaS product that helps small businesses track their social and mobile presences of their competitors; and Contact Management Systems, a CRM service. Nexstar, which expanded its digital services when it acquired Media General in 2017, aims at bigger businesses, often in support of its core broadcast television advertising business.

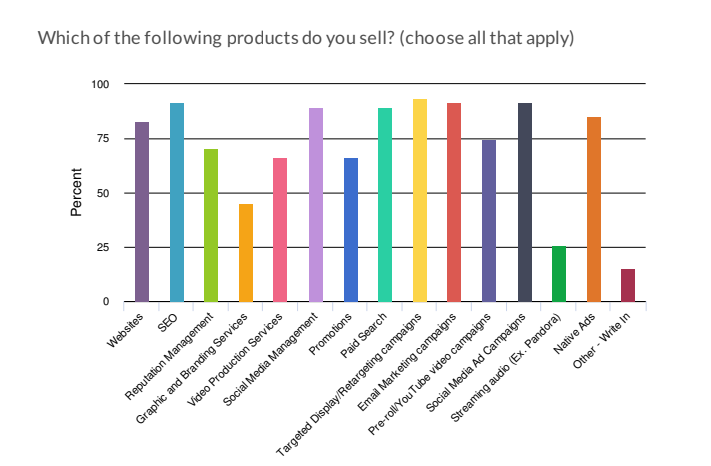

The Local Media Association survey also showed homogeneity creeping into publisher offerings and margin pressure from competition. Upwards of three quarters of respondents offered the same services. One third of the services were offered by more than 90 percent of respondents.

But agency services let publishers offer something different from Facebook and Google and give publishers a way to deepen existing business relationships.

“We said, ‘We’ve got these trusted brands, we’ve got a big local salesforce, we’ve got the ability to market, let’s take advantage,’” said Peter Newton, chief operating officer of GateHouse Media.

More in Media

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.

Overheard at the Digiday AI Marketing Strategies event

Marketers, brands, and tech companies chat in-person at Digiday’s AI Marketing Strategies event about internal friction, how best to use AI tools, and more.

Digiday+ Research: Dow Jones, Business Insider and other publishers on AI-driven search

This report explores how publishers are navigating search as AI reshapes how people access information and how publishers monetize content.