Secure your place at the Digiday Publishing Summit in Vail, March 23-25

This is a developing story and will be updated throughout the day.

Google has been found guilty of antitrust violations in two of the three alleged markets, following a long-awaited ruling in its ad tech antitrust battle with the Justice Department.

Judge Leonie Brinkema partially sided with DOJ lawyers ruling Google guilty of violating U.S. antitrust laws by monopolizing the markets for publisher ad servers and ad exchanges, and by illegally tying its ad server to its ad exchange. However, Google was not found guilty of monopolizing the advertiser ad network market.

So, with liability established, the case now enters the remedies phase, with DOJ lawyers pushing for a sell-off of its ad tech case.

“The Court finds that Plaintiffs have failed to prove that there is a relevant market for open-web display advertiser ad networks, but have proven that Google has violated Section 2 of the Sherman Act by willfully acquiring and maintaining monopoly power in the open-web display publisher ad server market and the open-web display ad exchange market,” reads the precise wording of the ruling.

It goes on to state, “[Google] has unlawfully tied its publisher ad server (DFP) and ad exchange (AdX) in violation of Sections 1 and 2 of the Sherman Act.”

The trial, which heard prosecution and defense arguments in September of last year, before a months-long recess for closing remarks and then the current judgment, revealed the measures Google was prepared to take to remain at the summit of online display advertising, including the erosion of evidence.

For example, multiple internal communications from former Google employees hinted at an internal cognizance that publishers were trapped by the feedback loop created by policy decisions following the Federal Trade Commission’s approval of the $3.1 billion purchase of DoubleClick in 2008.

DOJ attorneys want a court-mandated break-up of the online ad giant’s sell-side ad tech, a.k.a. Google Ad Manager. Still, sources consulted by Digiday liken the prospect of such a seismic move to the opening of Pandora’s Box.

So, what now?

The Court has not yet imposed specific remedies, but it issued an order requiring the parties to jointly propose a schedule for submitting briefs and holding hearings on what remedies should be imposed to address Google’s antitrust violations.

Some believe drastic measures like breaking up Google’s ad tech empire remain unlikely and that more realistic outcomes include stricter transparency requirements or partial divestitures.

Remedies could involve separating Google’s ad server from its ad exchange to prevent closed-loop dominance, though implementing these changes will take years due to Google’s deeply integrated ecosystem.

Meanwhile, experts like Gray Matter’s Megan Gray and Arete Research’s Richard Kramer suggest spinning off Google’s ad tech assets, such as “Google Network,” into a transparent, capped-profit entity. Advocates of this approach claim it would alleviate regulatory concerns while minimizing disruptions to publishers reliant on Google.

Google may even welcome this move, given “Google Network’s” low margins and high regulatory liabilities. Such a resolution could appease Wall Street investors, allowing Alphabet to focus on AI advancements.

However, success depends on regulators’ deep understanding of Google’s systems to ensure meaningful transparency and equity.

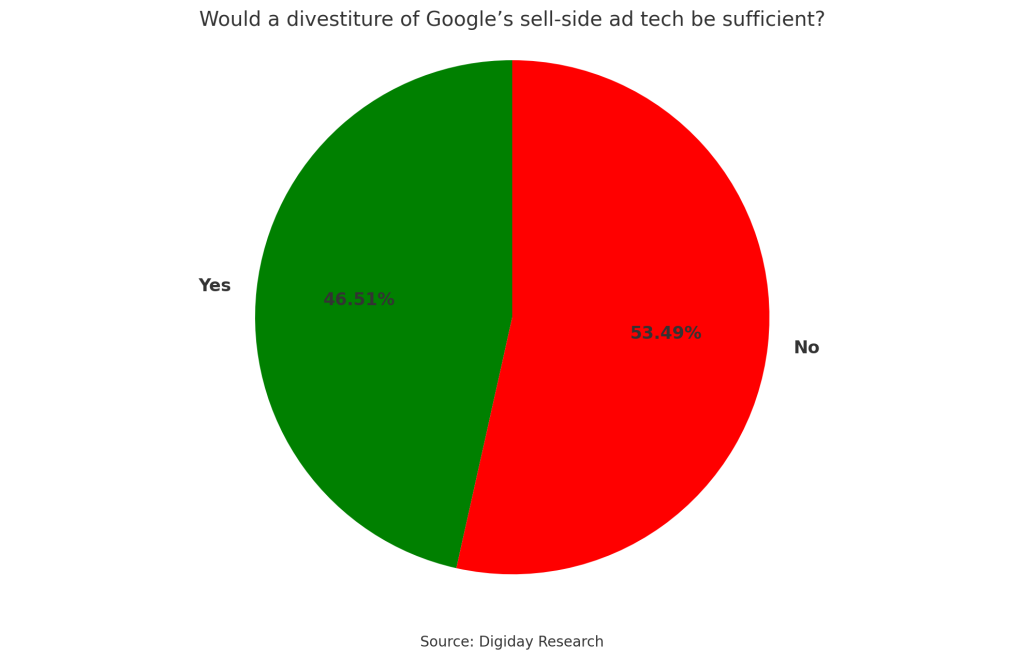

For example, in a study conducted as the trial kicked off in September this year, survey respondents indicated a broad range of preferences as to the ideal outcome of the trial to the Digiday Research team, with approximately half asserting that additional measures on top of divestiture would be required in order to remedy some of the sector’s ills.

This is because the potential fragmentation of such a foundational industry cornerstone could harm publishers’ programmatic revenues; such is the extent of their reliance on the advertiser demand facilitated by the tightly woven relationship between Google’s ad server and its ad exchange.

“Google doesn’t need to stop Google Ad Manager (GAM), but they should stop buying from publishers within GAM,” noted one anonymous survey respondent in September, adding that it should also be compelled to participate in header bidding auctions like other companies such as Magnite, OpenX, AppNexus, etc.

The respondent went on to ad, “Currently, Google seems to be leveraging its dominant position to buy priority inventory without truly participating in header bidding. They claim they are, but that’s not the reality. If they truly wanted to participate, they could create their own prebid adapter for header bidding.

“However, they prefer to buy more valuable impressions within GAM without competing in the header bidding auction with others. Why would you? You are controlling publisher placement and buying it when you want faster than any other demand partner of a publisher. Solution? Well, they have to be equal with everyone so they need to stop buying in GAM directly and become a bidder in prebid auction.”

More in Media

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.

Why more brands are rethinking influencer marketing with gamified micro-creator programs

Brands like Urban Outfitters and American Eagle are embracing a new, micro-creator-focused approach to influencer marketing. Why now?

WTF is pay per ‘demonstrated’ value in AI content licensing?

Publishers and tech companies are developing a “pay by demonstrated value” model in AI content licensing that ties compensation to usage.