Connect with execs from The New York Times, TIME, Dotdash Meredith and many more

‘It’s a crutch’: South China Morning Post is the latest publisher to swear off third-party data

South China Morning Post is the latest news publisher to build its own first-party data platform, which it’s calling Lighthouse. The goal is to increase the addressability of its global audience, girding it for when third-party cookies are null and void for targeting and ultimately improving the effectiveness of ad campaigns.

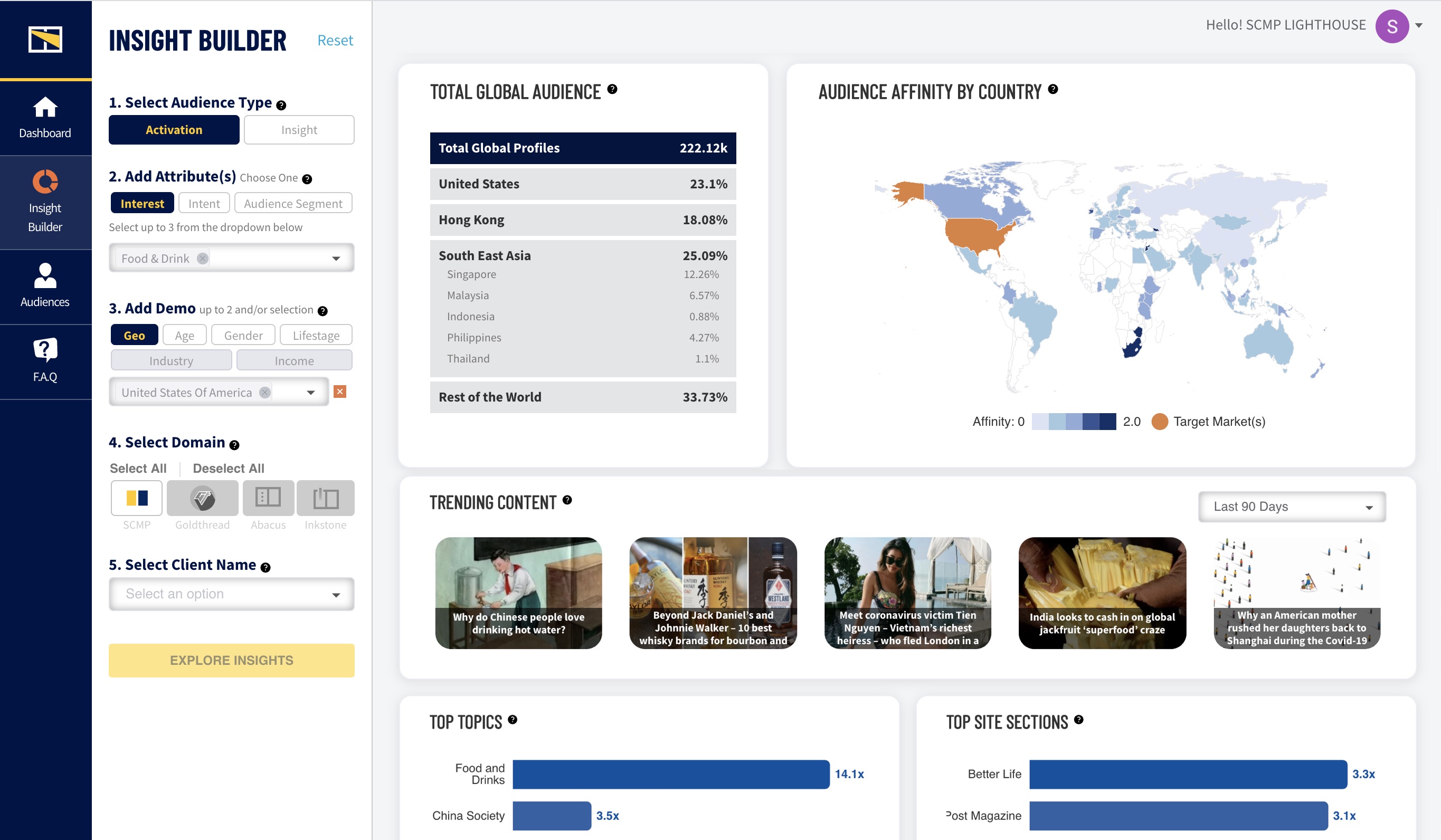

Ad clients can access Lighthouse via a dashboard and build their own bespoke audience segments based on their preferences, campaign targets, distribution channel and content trends. But, Alibaba-Group owned and Hong Kong based SCMP has also collated 25 pre-built audience segments such as luxury lifestyle, business travel and health fans that marketers can pick off the shelf based on historical usage of 50 million monthly average users, 37% from the U.S., according to internal figures. Comscore finds it has 22.2 million global unique monthly users.

Six months in the making, Lighthouse follows efforts from Vox, The Washington Post and The New York Times who are reducing reliance on third-party data ahead of browsers and regulators cracking down.

“Third-party data is a crutch, it allows you to say ‘we kind of understand that,'” said Ian Hocking, vp of digital at SCMP. “When you take it out it makes you focus on what is important to understand [about] how you can service clients. Publishers are well-positioned to capitalize on that if they are motivated in the right way.”

That motivation, for all publishers, is to understand more about its audience and turn that into useful information for its sales, editorial, commercial content and marketing teams. Last week was a busy one for marketing and identity issues, kicked off by Apple announcing IDFA is opt-in. That was followed by Facebook revealing that Facebook Audience Network publishers see 50% less revenue when no ID is present. Publisher’s first-party data strategies are only going to get more crucial as the lights go out on third-party cookies.

SCMP said Lighthouse gathers more than 1.2 million data points a day, which it collects through declared data from polls, surveys and quizzes, plus observed data from elements like onsite behavior, ad logs, CMS, content analytics, sentiment, readability and contextual data.

The publisher has a registration wall but wouldn’t say how many people have signed up. Increasing this pool plays a growing role, having logged-in users lets it create persistent identifiers, making attribution much more efficient. Beyond simple data like geography and demographics, the publisher can infer the value readers see in its content: A user looking in the parent section could be expecting triplets or already have a toddler, they could be feeling nervous or excited.

SCMP — which is mostly ad funded — has worked with customer data platform 1PlusX. With 1PlusX, SCMP syncs various IDs under one first-party user ID with all the known attributes about them and assigns an arbitrary name. It then applies the vendor’s audience expansion machine learning to create targetable audiences.

“We see more [companies] making the move from a DMP to a CDP,” said Alexis Faulkner, head of FAST UK, Mindshare’s integrated performance business unit. “It means you stop relying on segment data and move to individual user profiles that can build audience understanding. It’s a move any company that has information from different sources on their customer may want to consider [in order to] unify their approach across the different data assets they have.”

But it’s a developing space and publishers have only had a couple of years to build out capabilities with CDPs. And it can get murky when data is aggregated, causing no shortage of confusion. SCMP has an internal cross-department team of 14 from data, tech, product commercial which built and now manage the platform.

Over the last month, it’s tested Lighthouse with its core 25 pre-built segments to test the performance of adding data versus the cohort run of site average. Using Lighthouse improved click-through rates by 40%, the company said, it applied a business segment to an education campaign looking for MBA candidates saw an increase in CTR from 0.12% to 0.3%

Beyond the 25 pre-built segments, Hocking hopes marketers will get under the hood and build bespoke audiences and apply new targeting criteria on the fly.

“When reporting campaigns back to clients, you typically send back CTR or viewability and not much else,” said Hocking. “There’s little differentiation between you and a third party vendor in the programmatic marketplace.”

Hocking notes this won’t generate millions of dollars in revenue immediately — SCMP has signed three big partnerships, although he wouldn’t say with whom, based on the ability to offer these insights — but instead it signifies the importance of building deeper, ongoing relationships with publishers to understand incremental audiences.

“Publishers haven’t so far had much response to the decline in third-party data,” said Hocking. “They haven’t had a unique position, but the data is value-adding and worth the time investigating.”

More in Media

IAB Tech Lab pitches plan to help publishers gain control of LLM scraping

The IAB Tech Lab wants to unite all compute edge companies and publishers to create a technical standard for LLM crawler monetization, before pitching to the AI companies.

Three publishers’ workforce diversity reports show DEI efforts remain sluggish

Overall, staff diversity at The New York Times, Hearst and Condé Nast has either marginally improved or stalled in 2024, according to their annual workforce diversity data this year.

Retail media meets publishing: News UK, Future and Ocado tap clean room tech for smarter data targeting

News UK, The Independent, Immediate Media and Future are teaming up with retail media network Ocado to test clean room-powered data matching.