Secure your place at the Digiday Publishing Summit in Vail, March 23-25

How Well+Good is using its newsroom’s knowledge to steer its commerce business

Wellness and self care became two top categories for online shopping in 2020 — perhaps second only to online grocery and toilet paper — thanks to people managing stress levels and tending to personal care from their homes, rather than seeking out those services elsewhere.

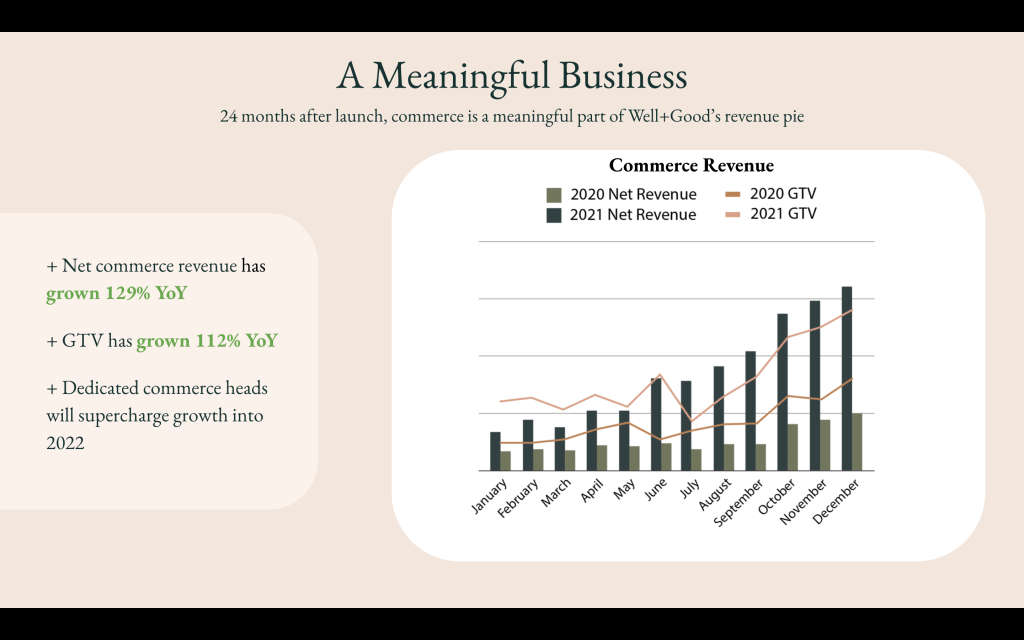

For Leaf Group’s digital wellness brand Well+Good, that surge in interest was a boon to its e-commerce business, something it’s been honing for the past four years. Year-to-date, commerce revenue has increased by 129% and gross transaction value has increased by 112% from 2020 to 2021.

But the brand has been trying to move away from its reliance on traditional affiliate commerce content and launched its own online wellness marketplace last year that gave its readers a one-stop shop for editorially vetted and recommended products. The idea is that shoppers will remain on the Well+Good website and buy a variety of products from different brands all at one location.

“There are so many retailers out there doing e-commerce incredibly [well] and have whole teams dedicated to making those experiences incredible for audiences. For publishers to be successful with marketplaces, they have to really have to be solving a need that hasn’t been solved yet by a big retailer,” said Kate Spies, svp and general manager at Well+Good.

The problem that Well+Good is solving with its marketplace, she said, is firstly consolidating a lot of fragmented brands who aren’t sold at existing marketplaces like Sephora or Ulta, for example, and secondly, leading into the editorial curation and testing.

“The wellness industry is honestly really rife with misinformation. There are bad players out there, there is snake oil out there. And what we have always aimed to do at Well+Good is decode and demystify that space. The same concept is applied to commerce,” said Spies.

In this episode of the Digiday Podcast, Spies shares how she and her team transformed Well+Good’s e-commerce business during her four-year-long tenure by focusing on honing the edit teams’ industry expertise and knowledge of its audience. A portion of this conversation includes a recording from the Digiday Publishing Summit, where Spies gets into the granular details of how her team launched and iterated on the marketplace.

Here are a few highlights from the conversation, which have been edited for length and clarity.

The first version isn’t the final version

When we first launched our marketplace, I was very keen to make sure that we were looking at the best of e-commerce across the internet, and trying to glean as many learnings from them. However, we are not a Sephora, we’re not a Nordstrom, we’re not a Walgreens, we are a content-first brand who is really good at pairing information and education with conversion. A huge learning of mine is why would you ever separate that. It’s moving away from our first iteration, which really was index pages of products that many other people operating on the internet can do better than us, [and] we’re now moving towards this hybrid model that really reflects our strategy.

Your reader is your customer

We’re only recommending products that are worth people’s time and money and that are really efficacious. And we also want to make sure that we stay true to that mission of being an accessible entry point into wellbeing. Goop does an incredible job of curating [this] space at a very high level and they have beautiful products in their marketplace, but most of them are pretty expensive. We want to make sure that we are really providing an accessible option for people who want to purchase things to enhance their well being and don’t want to spend a fortune every time.

I really believe that to move people down that conversion funnel, you have to have authenticity at the core. We’ve found that our best performing content, as it pertains to conversion, is from the point of view of our editors or our experts. It’s people that our audience trusts and they trust them because they know that they’re not being BS’d. We could have possibly scaled this business more speedily if we had really chased an incredibly high AOV [average order value], but actually we found that operating sub $50 on average is a comfy spot for us.

Driving new customers from all over the web

Right now, I would say 90% [of our customers consist of] our existing Well+Good audience because they are the people that are going to convert because they’ve known us for a long time. However, the goal is absolutely to expand that footprint. We’re looking, particularly for 2022, to start doing audience extension into audiences that may not know Well+Good but are looking for these wellness products and we’re going to use tools and tactics that have been used by e-commerce retailers for a long time but not necessarily have been employed by publishers.

Newsletters are the place we see the most opportunity because conversion rates are best there. AOV is best there. CTR [click-through rate] on anything commerce related is best there. The large audiences that we have on Apple News and Flipboard are used to coming to us to get information and then also maybe read about a product or see a product reviewed. And so we have seen, honestly with no extra effort, that by optimizing that content, the way that we do for every platform, we’ve seen some nice conversions there. And on Apple News, in particular, we’ve had some really runaway hits, we’ve had big traffic spikes to stories that do have commerce in turn on Apple news.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.