Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

‘The future of their businesses is at stake’: European publishers are exploring alternatives to the duopoly

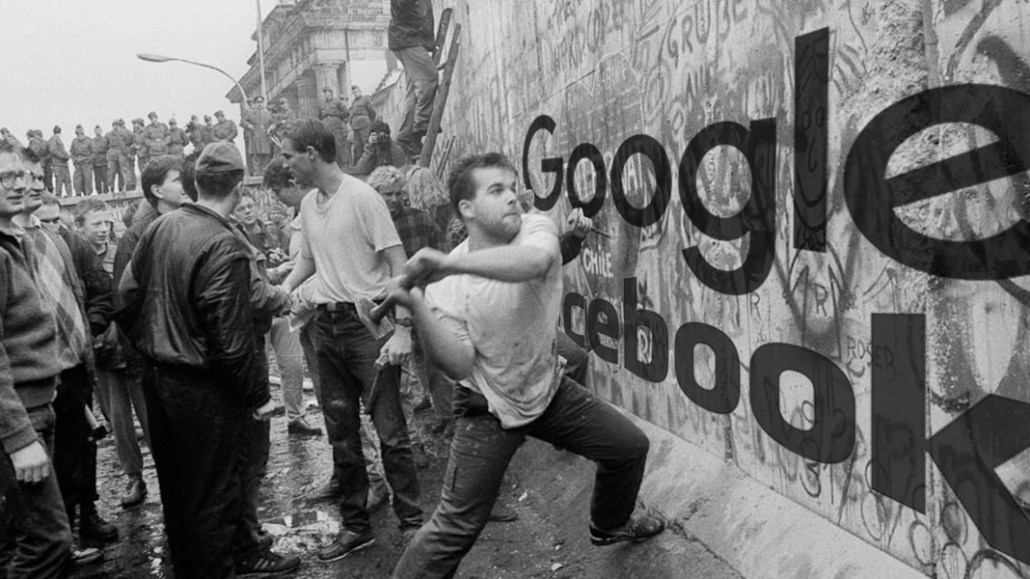

European publishers are taking a stand against the dominance of the Facebook-Google duopoly.

The moves take various forms, but they have a common theme: If there is a strategy that can reduce reliance on either Google or Facebook, take it.

This week, it was Germany’s turn (again). Axel Springer, Germany’s biggest digital publisher and owner of Business Insider, revealed plans to stop using Google’s ad server, DoubleClick for Publishers, and Smart, an ad server the publishing house previously owned, in favor of independent ad tech provider AppNexus.

Axel Springer titles Bild.de, Welt.de, Meinestadt.de, Finanzen.de, Bz-berlin.de, and Businessinsider.de will start migrating to the AppNexus ad server in 2018. And the roll-out likely won’t stop there, though the company didn’t share details. Given Axel Springer has a presence in 40 countries, the potential scope is big. (The publisher won’t stop using Google technologies completely and will continue to plug into Google’s ad exchange.)

“We are seeing great potential from a more intense collaboration between Axel Springer’s many digital offerings,” said Andreas Wiele, president of marketing and classified ad models for Axel Springer. “With AppNexus’ technology, we create the technological base for this, which will be particularly beneficial to our digital marketing.”

Axel Springer is known for not relying heavily on any one provider, especially ones that dominate the digital ad spend pie, like Google. But another factor is that AppNexus offers full transparency into bidding.

Together, Google and Facebook take home more than 70 percent of digital advertising revenue and a combined 20 percent of the entire media advertising pie. Publishers can’t afford to continue letting that happen. And in Europe, they’re particularly keen to explore alternatives to Google’s and Facebook’s platforms.

European publishers are at the vanguard of taking a stand against the duopoly, said Michael Rubenstein, president of AppNexus. “Publishers everywhere are looking for answers, but this is an area European publishers are leading. We are seeing more aggressive and ambitious moves and more dynamism from European publishers around this than we are in the U.S. They recognize what’s at stake is the future of their businesses.”

That’s not to say publishers don’t want good relationships with Google and Facebook — they just want it more on their terms. And Google has competed against AppNexus in several publisher pitches over the last few months, and lost.

Nordic media group Sanoma dropped DoubleClick for Publishers six weeks ago and hasn’t looked back. Like elsewhere in the world, the duopoly is sucking up ad spend in the Nordics: Last year, Facebook and Google accounted for 60 percent of digital ad spend in Sweden and 70 percent in Norway. Sanoma’s primary goal was to simplify its former ad tech stack by going from five ad servers, including Google’s, to one. AppNexus won the pitch. Although it was AppNexus’ product set that swayed the decision, the duopoly’s dominance also influenced Sanoma.

“We took into account the fact that Google and Facebook are also competitors. So whatever revenue we can steer away from them, we will,” said Stefan Havik, director of marketing and advertising for Sanoma. “There is a big need for consolidation in inventory supply. You are either the predator or the prey, and we prefer to be the predator.”

Using AppNexus as its single tech provider also gave Sanoma more control, Havik added. “We can consolidate our inventory via AppNexus. The market is too fragmented from a buying perspective. You have to consolidate against Facebook and Google or you will continue losing market share.”

In France, Le Figaro has also adopted AppNexus, though it was previously using a different ad server than Google’s. And yet, Google and AppNexus went toe-to-toe in the pitch process, and AppNexus emerged the winner.

Le Figaro is using AppNexus for display and mobile, while video inventory still runs via Google. The publisher will test AppNexus with its video inventory in the coming weeks. Although fear of the duopoly wasn’t the main motivator, the market imbalance is still a concern.

Google and Facebook together represent 92 percent of the mobile market, according to the Obs ePub SRI of January 2017 in the French market, where 50 percent of the ad impressions are delivered on mobile, which raises questions about the sustainability of the legacy media business model, said Alexis Marcombe, chief operating officer at Le Figaro.

Publishers are also putting traditional rivalries aside to explore alliances. In the U.K., CNN, The Guardian and others formed programmatic ad sales network Pangaea. And increasingly, data cooperatives are popping up. In Germany, eight of the biggest publishing groups including Axel Springer, Gruner + Jahr and RTL owner Bertelsmann pooled audience data through the Emetriq platform to create an ad-targeting product to compete with Facebook and Google.

This is also a technique adopted by publishers in Portugal, where Facebook and Google accounted for 68 percent of digital ad growth last year. Leading Portuguese media owners like Impresa and Global Media have agreed to make user logins mandatory. The plan is to use that combined data to make it easier for agencies to buy from a single point.

In Norway, Schibsted, a media group with 7,000 employees across 30 countries, is pulling intent data based on logged-in users, which it hopes will give it an edge against Google and Facebook. It stopped using DoubleClick for Publishers in 2015.

Daniel Neuhaus, CEO and founder of Emetriq, said data is fast becoming the new battleground for media. “An oligopoly situation like this leads to less competition, innovation and shrinking efficiency,” he said. “The big players are ahead by a few years in terms of quality and quantity of data. Closing this gap is impossible for single companies and even traditional enterprises. Therefore, it is important to create alternatives, which is only possible through cooperation. That is why we encourage publishers and advertisers to collaboratively share their data in order to stay competitive and independent.”

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.