Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Digiday Research: GDPR has reduced programmatic revenues for a third of European publishers

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

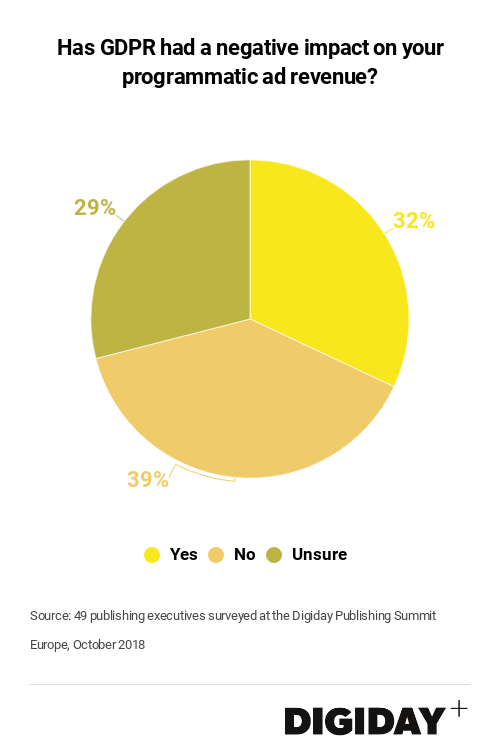

The E.U.’s General Data Protection Regulation hasn’t derailed programmatic online advertising as some had feared, but 32 percent of European publishers surveyed by at the Digiday Publishing Summit in Barcelona this October said that it’s had a negative impact on their programmatic revenues.

In the same survey, 39 percent of publishers said GDPR has not negatively impacted their revenues, while 29 percent said they’re unsure what it’s impact has been if any.

Given the initial fear that surrounded GDPR, it’s understandable that some publishers have seen programmatic revenue hits. After GDPR came into effect in May, programmatic ad buying activity fell of a cliff as advertisers withheld spending due to concerns that programmatic purchases would violate GDPR. One of the publishing executives surveyed by Digiday said the most significant impact of GDPR has been the increased “caution by advertisers.”

Though programmatic spending started to recover one month later, advertisers were still spending around 20 to 30 percent less on inventory from programmatic exchanges according to agency ad buyers.

Since then, evidence suggests prices for programmatic inventory have actually increased for some publishers. However, that doesn’t mean all publishers are seeing increases in overall yield or revenues. Most of the increases in programmatic pricing, according to ad-tech vendor Sovrn, have been limited to inventory that comes attached with consent strings. And that is far from all ad impressions; the majority of European publishers have yet to adopt a Consent Management Platform, which helps publishers attach consent strings to their inventory.

Consent strings help identify which users have consented to share their data to be served targeted ads, meaning advertisers, looking to avoid violating GDPR, are willing to pay a premium to target those consumers.

Some DSPs allow advertisers to bid only on inventory that comes with consent strings. But publishers who have adopted consent strings say that DSP’s can’t identify which ads come with consent strings or not. A lack of standardization in consent frameworks means that, depending on what frameworks a DSP has adopted, it might be unable to correctly identify whether or not a piece of inventory comes attached with a consent string. The resulting effect for the publisher is that often times their most valuable inventory isn’t getting bid on.

If publishers haven’t adopted consent strings — like many have chosen not to do in Germany — or if consent strings are being ignored, that could explain why some publishers are seeing a decrease in programmatic revenues due to GDPR.

Another possible reason GDPR has negatively impacted publishers programmatic revenues is that publishers are collecting less data and sharing less data about their audiences. Advertisers may be willing to pay less for inventory with limited access to data.

One result of GDPR is publishers looking to do more programmatic guaranteed deals with advertisers and to sell more ads based on contextual targeting rather than audience-based targeting.

Ryan Skeggs, general manager of GiveMeSports told Digiday that a large number of high-profile sporting events post-GDPR has allowed GiveMeSports to sell ads based on “contextual relevance which we have seen an increase [in demand] for.”

Ultimately, it can be difficult for a publisher that has seen programmatic revenues rise since GPDR to attribute what is a result of GDPR and what isn’t.

Skeggs, added that both display and video yields and revenues have increased for GiveMeSports in the past 5 months since GDPR, but he says, “I don’t feel the positive results are directly a consequence of GDPR.”

Due to the complicated nature of GDPR and programmatic advertising, it’s not particularly surprising that 29 percent of respondents would be unsure whether GDPR has hurt their programmatic revenues.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.