Secure your place at the Digiday Publishing Summit in Vail, March 23-25

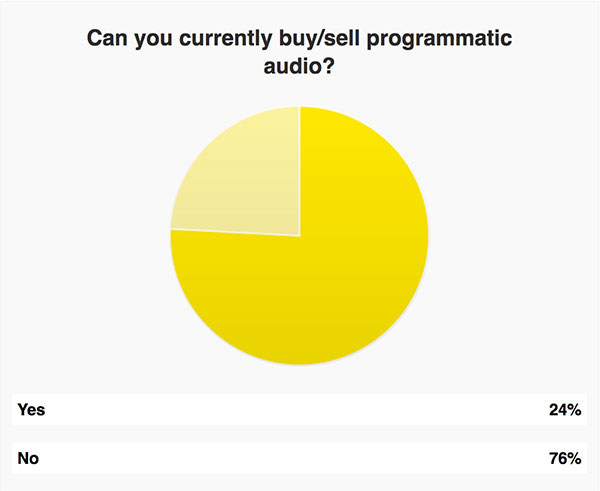

Digiday Research: 24 percent of marketers can now buy or sell programmatic audio

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

Digiday’s “Research in brief” is our newest research installment designed to give you quick, easy and digestible facts to make better decisions and win arguments around the office. They are based on Digiday’s proprietary surveys of industry leaders, executives and doers. See our earlier research on the publisher pivot to video here.

A comprehensive report on 2016 U.S. advertising spend by the Interactive Advertising Bureau and PwC earlier this year found that digital audio produced $1.1 billion in ad revenue — the first time digital audio generated enough revenue to warrant its own reporting line. This accounted for roughly 2 percent of the $72.5 billion spent on digital advertising. Although seemingly small in comparison to display or video ads, digital audio ads have seen strong growth in recent years.

Fueled by programmatic, this growth should continue, according to Digiday’s recent poll of advertising executives at the Digiday Programmatic Summit Europe. Twenty-four percent of people claimed they could buy or sell programmatic audio.

Programmatic audio is becoming a bigger part of the audio and digital advertising market. Both SoundCloud and Spotify have expanded their programmatic audio offerings. Podcasting has steadily grown in popularity, bringing with it new advertising opportunities. A record 67 million Americans listen to podcasts every month, according to a 2017 study by Edison Research in collaboration with Triton Digital. Digiday’s Jessica Davies recently noted that legacy media players, including News UK, Bauer and Global Radio, have also ventured into programmatic audio.

Marketers like digital audio because of its high completion rates and low risk of ad fraud and brand-safety issues. Proponents of programmatic audio have further cause for optimism after a recent eMarketer study found that U.S. adults spend more time on mobile devices listening to digital audio than doing anything else. Devices like Amazon’s Alexa and Google Home will boost both streaming time and advertising, but there have been hiccups.

More in Media

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.

Why more brands are rethinking influencer marketing with gamified micro-creator programs

Brands like Urban Outfitters and American Eagle are embracing a new, micro-creator-focused approach to influencer marketing. Why now?

WTF is pay per ‘demonstrated’ value in AI content licensing?

Publishers and tech companies are developing a “pay by demonstrated value” model in AI content licensing that ties compensation to usage.