Secure your place at the Digiday Publishing Summit in Vail, March 23-25

The rise of Amazon Advertising is news to no one in the industry’s $777 billion sector, but what needs more detail is just how it intends to sustain its challenge to the duopoly of Facebook and Google, especially in the wake of a 14,000 reduction in force (RIF).

The company’s recent Q3 earnings report showed Amazon Advertising revenues grew 24% year-over-year to $17.7 billion, with recent product launches expected to play a key part in furthering this growth.

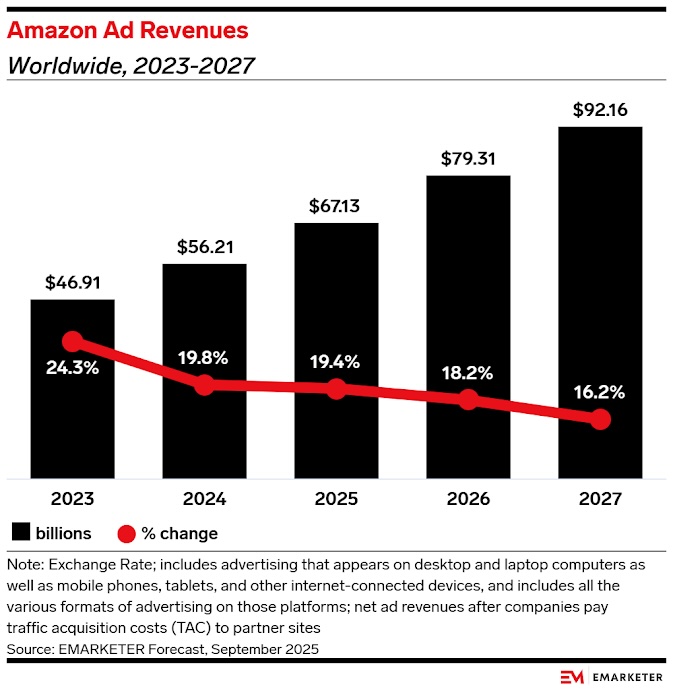

Recently revised eMarketer figures suggest the e-commerce giant’s advertising division will generate $67 billion in 2025, up almost a fifth from the previous year, and is projected to top $90 billion within two years, with services such as Amazon Marketing Cloud and its demand-side platform key to this growth.

According to the same estimates, Amazon Advertising’s progress will see it close out the year with an 8.6% global market share of media dollars, and the company is widely regarded as the third-largest player in the market behind the “duopoly” of Google and Meta.

Digiday was unable to ascertain how eMarketer assesses Amazon Advertising’s market share compared to the duopoly, although it is acknowledged as one of the fastest-growing entities on the market.

That said, there’s a significant gap to close if Amazon Advertising is to disrupt this order, as Q3 financial filings show Meta’s media spend was more than $50 billion. Google-parent Alphabet generated more than $74 billion in ad spend during the same period.

Amazon’s ambition, unboxed

In briefings ahead of its flagship unBoxed conference, Amazon Ads executives previewed their upcoming launches and acknowledged what advertisers have long complained of: the Amazon DSP user experience just wasn’t good enough. Forthcoming launches from Amazon Advertising, such as Campaign Manager, which essentially offers a single user interface for all Amazon Ads customers, are designed to shift these perceptions.

Speaking ahead of the Nov. 11 announcement, Meredith Goldman, director, DSP, Amazon Ads, said, “We heard that [the DSP’s UI required a redesign] non-stop… We’ve really spent the end of ’24 and ’25 getting through all these paper cuts. How do we make it easier for traders and customers to use the UI.”

For years, advertisers have tolerated Amazon’s cumbersome tools because of one thing: its purchase data made the user experience a challenge worth tolerating. Goldman conceded that the friction of using the platform often detracted from that advantage.

Sources told Digiday the earlier setup meant advertisers using both Sponsored Ads and its DSP had to have separate log-ins and use two different consoles. Such feedback directly shaped Campaign Manager, a unified command center that combines Sponsored Ads and Amazon DSP into a single, simplified interface. “It was quite hard to traverse [between platforms],” Goldman said, explaining some of the challenges that were fed back to the team.

For example, feedback noted how it was difficult for customers using both Sponsored Ads and Amazon DSP to understand overall budget allocation, planning, and activation across the separate seats. “So we really wanted to provide a much more simplified workflow for any of the customers who do want to traverse across Sponsored Ads and [conduct] a multimedia campaign approach,” she added.

Through the pending platform updates, which are being rolled out in the coming weeks, Amazon Ads wants to make its offering feel like a single, integrated ecosystem — a “front door” for advertisers managing retail media, streaming video, and third-party display buys. According to Amazon, its current overhaul efforts aren’t just a cosmetic UI update; they represent a fundamental rebuild of the underlying tech stack to reduce latency and improve reporting speed with further automation.

From slowness to ‘smart mode’

That automation is being powered by AI, which Amazon says can assist advertisers in everything from bid adjustments to creative generation. Goldman described a new “smart mode” that uses conversational inputs to control campaigns. “You might say, ‘Show me all my campaigns pacing over 75% delivery,’ and then, ‘Increase my bids by 20%.’ It’s just an easier way to fulfill your planning and activation in a simplified form,” she explained. Users can toggle between “smart mode” and “expert mode,” with the latter giving seasoned buyers full manual control.

The platform will enter general availability in December 2025, with a gradual migration through 2026. Goldman stressed that advertisers won’t face a disruptive “cold start,” saying, “We’ll go through an enormous amount of roadshows and education to really guide our customers through this transition.”

Lowering the barrier to entry

A recurring perception in the market is that Amazon Ads mainly serves endemic advertisers, i.e., brands that sell on its retail platform. However, Goldman noted how Campaign Manager sought to counter that idea, stating that the renewed platform was designed “for all businesses of all sizes.”

SMB advertisers were “historically more indexed towards Sponsored Ads,” she explained, stating that this profile of advertiser experienced a “barrier to entry and using a DSP”, with Campaign Manager positioned as a consolidated entrance point for all tiers of the market. Goldman added, “This lowers that barrier… For agencies and large advertisers, this simplifies their internal workflows, because they already operate across both DSP and Sponsored Ads.”

Amazon Ads has also accelerated its use of the Amazon Partners program in recent months to lower minimum spend requirements that have historically excluded some from spending on the platform. An Amazon spokesperson declined to comment on such claims when approached. However, one source told Digiday the company was increasingly working with partners such as Pacvue and SKai to help unlock lower DSP fees and better commercial terms than most advertisers couldn’t otherwise obtain on their own.

Asked how the overhaul brings Amazon DSP closer to parity with The Trade Desk or Google’s DV360 — the two leading DSPs on the market, with platforms widely regarded as the most refined — Goldman deflected slightly but acknowledged the ambition. “We’re always focusing on being customer-obsessed,” she said. “I wouldn’t necessarily focus on the parity [with other DSPs] as much as how we simplify our customers’ jobs and the time it takes for them to execute.”

Job cuts

All of this comes against the backdrop of Amazon leadership electing to “stay nimble” by investing in AI, and reducing overall headcount by 14,000, one of the largest RIFs in the company’s history, with separate sources, all of whom requested anonymity due to the sensitivity of the developments, telling Digiday the cuts impacted its AMC and DSP teams, among others. And while there is no clear consensus on how the latest RIF impacted Amazon Advertising’s workforce, separate sources with knowledge of the restructuring estimated the RIF at approximately 20%. In contrast, others said it was in the single-digit range. Amazon Advertising’s press team did not provide an on-record comment by press time when approached with these estimates.

While Amazon isn’t disclosing the dollar value of the rebuild, industry watchers see the Campaign Manager as Amazon’s clearest attempt yet to modernize its DSP and compete for premium programmatic budgets that have long flowed to independent or agency-preferred platforms, with the initiative underscoring just how central advertising has become to the retailer’s overall growth strategy. As Goldman summed up, “We’re bringing customers along for the wave [of evolution]. You can’t be too ahead of it, and you can’t be too behind. You want to make sure you’re meeting them where they are today.”

More in Media Buying

The agency holdcos have an AI story, but not an AI business model

The holdco platforms need to deliver on the promises made — and so far, clients aren’t seeing it.

Media Buying Briefing: The Big Three’s pieces are in place – let’s see who wins

With WPP’s strategic transformation announced last week, the battle for holding company supremacy could turn out differently than it’s been the last five years.

Bold Call: AI compute costs are the future of the upfront… and principal media

Agencies have a compute probable. As AI takes over more of their day-to-day work, its introducing a new and deeply unpredictable cost center.