Secure your place at the Digiday Publishing Summit in Vail, March 23-25

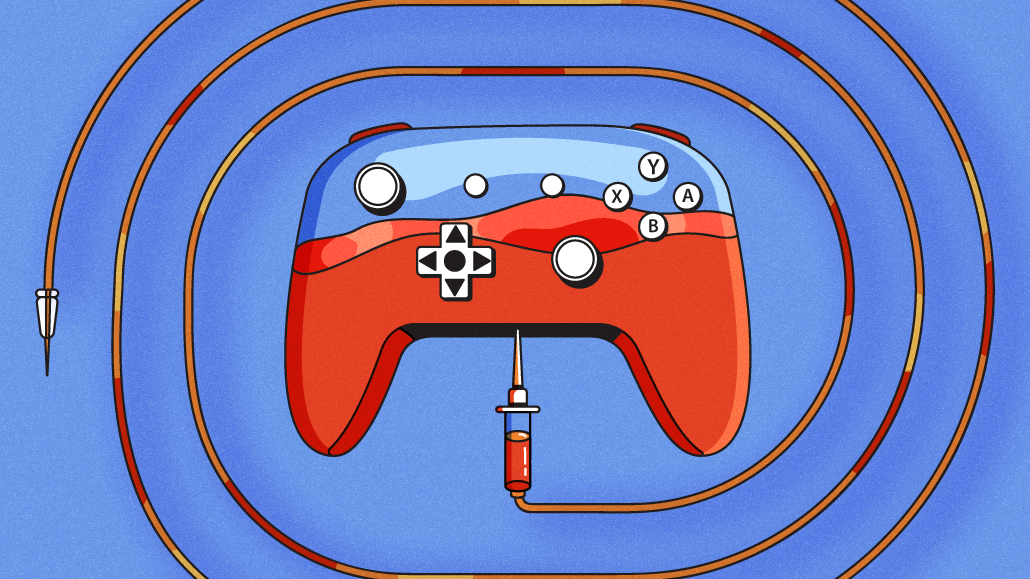

After years of trial and error, the esports industry appears to have finally found a path to profitability: Saudi Arabian money.

Over the past two decades, esports companies have thrown a wide variety of spaghetti at the metaphorical wall of profitability, with most of it failing to stick.

First came esports team streaming payments and esports league media rights deals with Twitch, which dried up a few years ago. Then came esports companies’ flirtation with crypto and gambling money, a source of investment that cratered during the crypto winter of 2022 and 2023.

At the same time, some esports organizations’ attempts to go public crashed and burned, dampening the interest of once-enthusiastic institutional investors from the worlds of venture capital and private equity. And while brands and their marketing budgets have been a relatively consistent revenue source for esports companies, this aspect of the business has not grown as quickly as many anticipated, particularly as non-endemic advertisers fled the space in 2023.

In 2024, one of the few institutions still funding esports is Saudi Arabia’s Public Investment Fund, which is currently throwing money into the industry from all directions. There’s ESL/FACEIT Group (EFG), an esports league operator that Saudi Arabia acquired for $1.5 billion in 2022. There’s the upcoming Esports World Cup, which started out last year as the Saudi Arabian tournament Gamers8. And then there’s the gaming and esports section of the planned Saudi Arabian city Qiddiya, among other investments. (Editor’s Note: ESL/FACEIT Group paid for this reporter’s travel and lodging at the EFG-owned event DreamHack Dallas on June 2.)

“What we tried to do in the last few years, and specifically in the last year, is to make sure the world knows that the kingdom, and Riyadh and Saudi Arabia, is very serious about esports,” said Ralf Reichert, the CEO of the Esports World Cup Foundation, a non-profit organization founded by the Saudi government. “It has a proven record with EFG — an acquisition which went well and has continued to stay the course on its original mission — and Gamers8, as a precursor of what the Esports World Cup will become.”

Thus far, it seems like just about every stakeholder in the esports industry has gotten the message. For publishers, tournament operators, and esports teams alike, securing a slice of the Saudi Arabian pie has become a clear — and, according to some observers, necessary — move to remain afloat following the challenges of last year’s esports winter.

“I think it is necessary whether we like it or not, in terms of where the esports industry is. It wasn’t exactly amazing before esports winter either; financially, some teams were struggling to show clear, profitable scale, and it led to the situation right now, where investors are pulling out, people are having to downsize, et cetera,” said Grant Rousseau, the global director of esports and operations for leading Saudi Arabian esports org Team Falcons. “Something like this very much reinvigorates the industry.”

Saudi Arabia is not the only country to invest heavily in esports in recent years. The tournament operator Blast, for example, achieved profitability this year after being kept afloat in 2023 by a € 12.7 million investment round led by Denmark’s Export and Investment Fund. U.S. state governments such as that of North Carolina have also opened esports industry grant funds in recent years.

“If you compare it to any other sports, all of them are heavily funded by governments across the world, from grassroots to pro sports, and people underestimate the involvement of government funding,” Reichert said. “And this is probably the first time that this has happened in esports on that scale, so it’s a good thing, actually — it’s not a bad thing whatsoever.”

But of the nations currently putting money into competitive gaming, Saudi Arabia’s commitment to the space is the largest by far. Savvy Games Group, the Saudi umbrella company that comprises EFG and other Saudi Arabian gaming holdings, has reportedly earmarked $38 billion to build the nation’s presence within gaming and esports.

Saudi Arabia’s outsized investment in esports presents some challenges for the esports companies that have signed on so far. As more money and attention from esports goes toward Saudi Arabia, it has raised natural questions among esports fans about just how much their favorite teams and leagues are aware of or support the human rights abuses that have taken place in the country. (Check back later this week for a dedicated report on this topic.)

To some extent, the same concerns have cast a shadow over traditional sports, too. As Saudi Arabia expanded into golf, for example, prominent athletes in the sport acknowledged the ethical sticking points that came with the encroachment, including Phil Mickelson, who referred to the Saudi government as “scary motherfuckers” in 2022. But money talks. Prior to making that statement, Mickelson had already signed onto LIV Golf, Saudi Arabia’s competitor to the PGA Tour, for a reported $200 million contract.

While the leaders of many prominent esports orgs and leagues are concerned over the ethical issues, these concerns are dwarfed by their broader existential fears following the difficulties of 2022 and 2023. After years of fits and starts powered by investors from other areas, they are finally being handed a blank check by Saudi Arabia, and they are running with it.

To beleaguered esports companies, the choice is not whether or not to take Saudi Arabian money, but increasingly whether to take Saudi Arabian money or stop existing entirely. With this in mind, it’s no surprise that some executives in the space have bought into the vision with enthusiasm.

“I love the kingdom, and I love where we’re headed as a kingdom,” said Qiddiya City Gaming and Esports Advisory Board chairman Mike Milanov. “So I just want to get the word out there in the right way.”

More in Marketing

‘Nobody’s asking the question’: WPP’s biggest restructure in years means nothing until CMOs say it does

WPP declared itself transformed. CMOs will decide if that’s true.

Why a Gen Alpha–focused skin-care brand is giving equity to teen creators

Brands are looking for new ways to build relationships that last, and go deeper than a hashtag-sponsored post.

Pitch deck: How ChatGPT ads are being sold to Criteo advertisers

OpenAI has the ad inventory. Criteo has relationships with advertisers. Here’s how they’re using them.