Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Tired of hot takes on Elon Musk’s ownership of Twitter? Let’s talk numbers

Twitter and Elon Musk — you can’t read anything at the moment without the unfolding dramas appearing in headlines.

Since Musk initially floated the idea of buying Twitter, in what feels like many moons ago back on April 14, through to the completion of the deal on Oct. 27, Twitter has seen a fluctuation of ad spend, prices and users.

Here’s the rundown on how the capricious relationship between Twitter and its new owner Elon Musk has shaken out so far.

Ad dollars go wherever Musk isn’t

Back in April 2022, the mean average weekly spend in the U.S. for the top 10 advertisers was $608,000, according to Sensor Tower. This slipped in May to $573,600, and again (albeit slightly) in June to $572,000.

Sure, there are likely to be all manner of reasons as to why advertising on Twitter fluctuated like this, but it’s hard to discount Musk as one of them. If anything, the one thing connecting a lot of the dips in advertising on Twitter this year is that they have tended to happen more the closer Musk got to Twitter.

Back to the numbers: By July, mean average weekly advertising spend in the U.S. rose to $924,100 for the top 10 advertisers and again in August to $945,800, per Sensor Tower’s data. This was the period when Musk said he planned to terminate the agreement to buy Twitter, claiming the platform had breached its end of the bargain, by refusing to crack down on spambot accounts.

By September, Twitter saw a slight dip on the mean average weekly spend in the U.S. by the top 10 advertisers to $944,200. At this time, tensions were brewing further as Twitter’s deposition of Musk (part of the platform’s lawsuit that had been filed in the Delaware Court of Chancery back in July) was expected to take place between Sept. 26-27, with an extension to Sept. 28 if necessary. But despite the legal dramas, it looked as though the deal was going to be pushed through — it was just a matter of when.

On to October. Prior to the deal, the mean average weekly spend in the US for the top 10 advertisers decreased again to $877,200. Unsurprisingly, just one week after Musk’s Twitter takeover was finalized, mean average weekly spend fell to just $589,100.

Again, there are several factors that influence the flow of ad dollars in and out of any ads business. Even so, Musk has been and continues to be one of the predominant influences on advertising on Twitter.

A bleak future

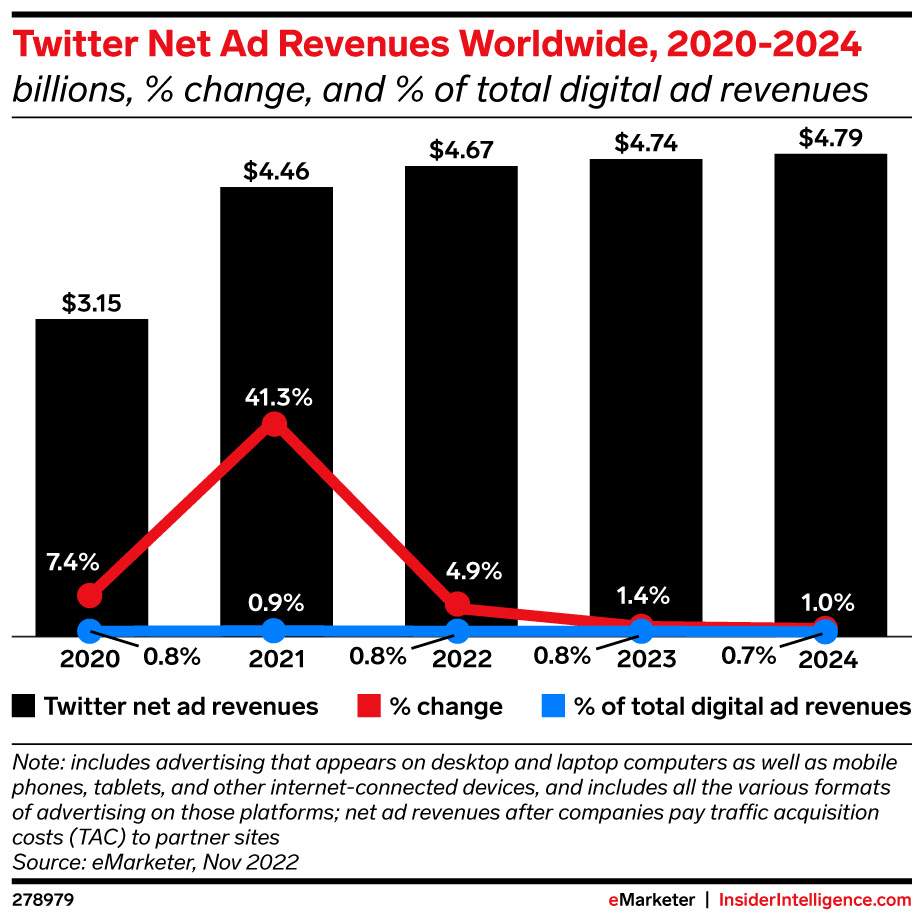

The advertising pause on Twitter could become a long goodbye, if the forecasters are to be believed. The platform’s ad forecast through to 2024 has been cut by more than a third (39.1%), according to Insider Intelligence. There is just too much uncertainty around the future of the platform these days for advertisers to be anything but wary of putting their dollars there. That’s not just a Musk issue, it’s also down to the economy, which is forcing ad dollars to contract into fewer areas. It turns out Twitter isn’t really one of those platforms — and it hasn’t been for a while.

The truth is these advertisers were cutting their Twitter ad spending well before the Musk takeover

While Musk has indeed brought Twitter to the forefront of the news cycle, the deal has only highlighted problems that were already bubbling away, waiting to explode. The main one being ad dollars — or rather, a lack of them.

Take CPG giant Mondelez, for instance. Since 2019, its ad spending on Twitter in the U.S. has slowed, per analytics firm Pathmatics. In 2019, it spent $13.5 million on ads, a year later that rose 55% to $21 million, and then in 2021 those dollars rose 43% to $30.1 million. For the first 10 months of this year, the advertiser’s spending rose 13% to $34.2 million.

It’s the same story at Kraft Heinz Company. Between 2019 and 2020, its ad spending on Twitter in the U.S. rose from $20.8 million to $28.4 million, a 37% increase. A year later ad spending hit $37.3 million, a 31% increase on the previous year. In 2022, the advertiser seems to have curbed spending even more dramatically as it dropped out of Pathmatics’ analysis of the top 15 advertisers altogether.

Users are mainly here for the gossip

Between Oct. 15 to Oct. 26, Sensor Tower estimated there were around 6.3 million worldwide installs of Twitter from the App Store and Google Play. Once Musk closed the deal on Oct. 27, installs of the app rose to 7.6 million through to Nov. 7.

Musk’s own following on the app saw a similar bump. The controversial billionaire amassed 5.2 million followers on Twitter last month, almost half of which he accumulated between Oct. 24 and Oct. 30 — i.e. a few days on either side of the deal completion, according to marketing analytics business Emplifi. And the surge didn’t stop there. Following the brutal cull of Twitter staff last week, Musk acquired a further 2.4 million followers.

All of this is to say people love a dumpster fire, and the Twitter debacle is one of the biggest around right now.

More in Marketing

‘Nobody’s asking the question’: WPP’s biggest restructure in years means nothing until CMOs say it does

WPP declared itself transformed. CMOs will decide if that’s true.

Why a Gen Alpha–focused skin-care brand is giving equity to teen creators

Brands are looking for new ways to build relationships that last, and go deeper than a hashtag-sponsored post.

Pitch deck: How ChatGPT ads are being sold to Criteo advertisers

OpenAI has the ad inventory. Criteo has relationships with advertisers. Here’s how they’re using them.