Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Streaming TV ad rates are falling and Amazon’s the anchor

Amazon’s influence is pulling streaming ad costs downward.

Right now, ad buyers are paying around $40 to reach a thousand viewers on Prime Video, about the same as on Netflix. Whether that holds for the rest of the year is anyone’s guess, but Amazon’s impact on ad pricing is already undeniable.

“Regarding video CPMs, the average for 2024 was close to $40 on Amazon Prime,” said Robert Kurtz, group vp of search media solutions at Basis Technologies. “This is comparable to Netflix, but Disney+ was a significant percentage higher than Amazon Prime.”

The same holds true for advertisers at digital ad agency Markacy. They’re seeing CPMs between $35 and $40 on Amazon Prime, while Netflix rates range from $32 to $42. Disney+ sits between $30 and $38.

“It’s a buyers market, and we expect it to remain this way until ad load decreases or publishers find more ways to add value so they can increase pricing or at the very least sustain where they are,” said Alex Block, evp of programmatic at Jellyfish. “Whether it be creating packages of more desirable content, adding more audiences into inventory packages, or coming up with new offerings.”

For competitors, keeping up with all of this from Amazon means lowering their prices too.

“We are seeing the same trends as depicted in this chart. I wouldn’t call it “sinking” but I would agree the CPMs are coming down and making the marketplace more efficient for brands,” said Jennifer Kohl, chief media officer at VML. “It’s clear Amazon is leveraging its humungous scale and ginormous e-commerce infrastructure to disrupt the streaming video landscape”.

Bit by bit, Amazon dragged streaming ad prices down.

It kicked off last January when Prime Video started running ads. To lure marketers in, Amazon did what Amazon does — turned its rivals’ margins into its own own advantage. The result? Rather than pay $39 to $45 per 1,000 viewers on Netflix, advertisers suddenly found themselves shelling out in the low-to-mid $30 rage, per the Wall Street Journal’s reporting at the time. Just like that, Amazon reset the market.

At first, no one knew if this repricing of streaming ads would stick. Maybe prices would creep back up once Amazon settled in. They did — just not anywhere close to the heights streamers once enjoyed.

Call it the Amazon effect.

Like Disney, it made its main Prime Video subscription tier ad-supported. In doing so it shifted the foundation of its streaming business to advertising, unlocking more revenue per viewer, especially with a massive built-in audience of 115 million monthly U.S. viewers at the time. But unlike Disney, Amazon played a different game on price. Instead of going high, it flooded the market with cheaper inventory (50 billion ad impressions, according to MoffettNathanson). Advertisers jumped at the bargain, but not enough to soak up the sheer volume of impressions now available. More supply than demand never keeps prices high.

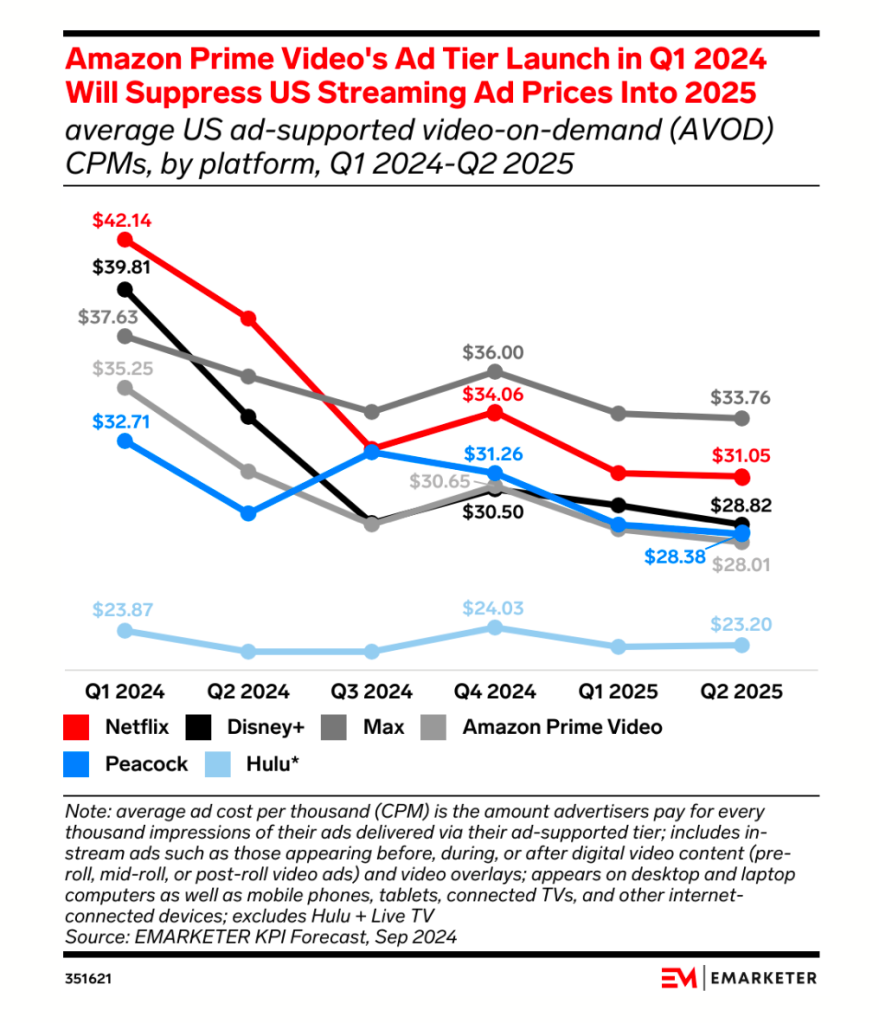

Netflix has taken the biggest hit. eMarketer’s analysis (see chart below) makes that abundantly clear. Since the first quarter of 2024 (i.e. when Prime Video introduced ads), Netflix CPMs have fallen more than those of Prime Video, Disney+, Max, Peacock and Hulu. They dropped from $42.14 to $31.05 by the end of the year. In comparison, Prime Video CPMs slid from $35.25 to $28.01.

While streaming ad inventory is abundant, spending on these platforms, and the broader CTV market, is still growing. Even so, another dip isn’t out of the question, though it likely won’t be as steep as in 2024. Too many forces are still in play, from Amazon gaining more subscribers (and with them, more ad inventory) to its plan to introduce more ads during shows. More inventory always puts downward pressure on prices.

“There isn’t going to be anything as major as Amazon flipping a switch on a lot of ad inventory when it comes to driving prices down but there are definitely going to be other factors at work,” said Ross Benes, a senior analyst at eMarketer. “Just consider the fact that the streamers are pushing more people into ad-supported plans by raising the prices of their ad-free ones. That’s going to create more ad inventory. Plus, more people are spending time streaming, not to mention the fact that there’s more live sports on these services now. All of that is going to increase supply, which will probably reduce CPMs a little.”

For now though, Amazon’s gamble has clearly paid off. It didn’t just surpass its $1.8 billion goal in ad spending commitments for its video streaming services including Prime Video last year, its total ad revenue topped $56.2 billion for the first time. But those gains weren’t just ad dollars per se, they were about control. Marketers had more control over impressions and audiences than ever before following the arrival of ads on Prime Video.

“The pricing levers Amazon offers allows us to make true apples-to-apples comparisons with other publishers like Netflix and Disney+, ensuring we’re maximizing every advertising dollar for our clients,” said Robert Avellino, vp of Innovation & Growth at Tinuiti. “This evolution isn’t just about cost efficiency — it’s about driving real outcomes at scale. We’re excited to lean in even further in 2025 and continue unlocking the full potential of Amazon’s STV offering.”

Amazon did not immediately return requests for comment.

More in Marketing

‘The conversation has shifted’: The CFO moved upstream. Now agencies have to as well

One interesting side effect of marketing coming under greater scrutiny in the boardroom: CFOs are working more closely with agencies than ever before.

Why one brand reimbursed $10,000 to customers who paid its ‘Trump Tariff Surcharge’ last year

Sexual wellness company Dame is one of the first brands to proactively return money tied to President Donald Trump’s now-invalidated tariffs.

WTF is Meta’s Manus tool?

Meta added a new agentic AI tool to its Ads Manager in February. Buyers have been cautiously probing its potential use cases.