Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Leading department stores like Macy’s and Nordstrom are digitizing their in-store experiences, and according to a new report by L2, they’re shaping the future of retail as a result — more so, even, than Amazon.

“Stores have been cast as a liability in an Amazon era, but they’ve been making a comeback as something that’s critical to a retail strategy,” said Claude de Jocas, manager of L2’s Intelligence Group. “Digital is the connective tissue between online and in-store.”

To compete, a seamless online-to-offline experience is imperative for department stores to go the way of the dinosaurs. Here’s how Nordstrom’s and Macy’s digital efforts to edge out Amazon stack up.

Click-and-collect

Nordstrom was one of the first department stores to show nearby item availability in its e-commerce store, as well as offer in-store pickup for items ordered online, according to de Jocas. Last week, the retailer began testing curbside pickup, an option for online shoppers to fetch items they’ve purchased by texting or calling customer service as they arrive at the door.

Macy’s, meanwhile, launched in-store pickup for online orders in 2013 and finds items in stores for online shoppers, but it hasn’t tested speedier curbside pickup.

Both retailers offer same-day delivery for a $15 fee but with limitations. Orders must be placed before 1 p.m., and the services are offered in very select locations. According to Yory Wurmser, retail analyst at eMarketer, stores should be focusing on in-store pickup and same-day delivery, while the need for curbside delivery is yet to be seen.

“It’s less appealing than same-day delivery,” said Wurmser. “Department stores should be using their locations to get products from stores to customers who live a few miles away — it’s their advantage over Amazon.”

Winner: Nordstrom. Even if curbside delivery doesn’t catch on, it’s looking for more options that can enhance the customer experience.

Mobile

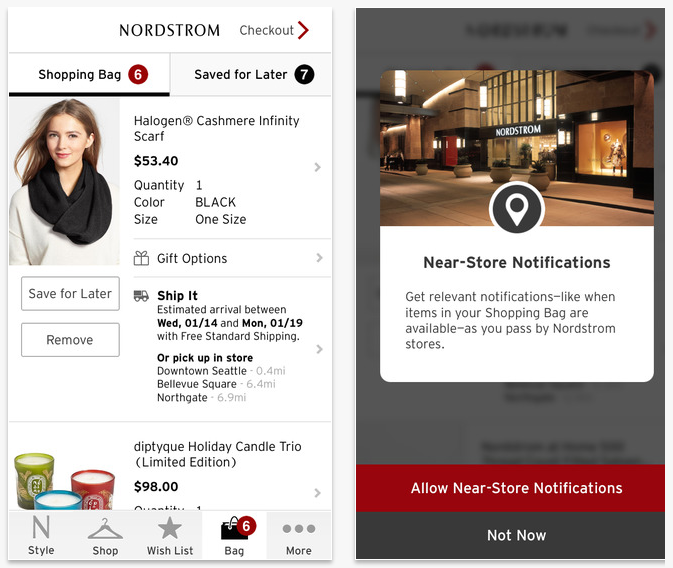

A true omnichannel experience requires easy mobile navigation. Nordstrom and Macy’s apps focus on similar main features: tracking user reward points, locating nearby stores, finding in-stock items in a particular region, scanning barcodes, and utilizing beacon messages (for instance, if you pass by a Nordstrom store that has an item in your mobile shopping bag in stock, the app will tell you, if you opt in).

The apps have similar functions. However, Nordstrom’s app ratings blow Macy’s away: Nordstrom’s latest app version has five stars (from 104 reviews), and Macy’s has 1.5 stars (from 35 reviews). All-version ratings again favor Nordstrom, with 4.5 stars (from 2,687 reviews), compared to Macy’s three stars (from 7,308 reviews).

Outside of their native apps, both Macy’s and Nordstrom’s Instagram accounts are comprehensively shoppable, a tricky point for retailers on the platform. The brands’ followers can find links to products through shoppable third-party service Like2Buy, but Nordstrom enjoys greater reach: The retailer has 900,000 Instagram followers, compared to Macy’s 200,000.

Winner: Nordstrom, again. While Macy’s is employing as many tactics to optimize mobile as Nordstrom, a better user experience gives Nordstrom the edge, especially since, according to Wurmser, those using retailers’ apps are among the most valuable customers.

Plus, a hefty follower account on Instagram is an automatic advantage.

Payment and rewards

The point of purchase has to be as streamlined as possible for shoppers bagging items in-store, online and on their phones. Both Macy’s and Nordstrom have invested in digitizing their point-of-sale systems to enable sales associates to fulfill requests and track customer needs both online and in-store. They both were also among the first to adopt Apple Pay, and their mobile apps store customer credit cards, shipping addresses and rewards points to make m-commerce checkouts easier.

These efforts demonstrate how seriously Macy’s and Nordstrom are taking digitization, apart from the “sexier” tactics like social media, according to de Jocas.

“Incorporating digital into the retail experience, like digital payment methods, doesn’t get as much press, but it’s the less sexy stuff, unlike social media, that really drives returns,” she said.

Macy’s did get press earlier this year when it joined Plenti, a coalition loyalty program that rewards customers who shop within the coalition (Rite-Aid, ExxonMobile, Hulu and others joined with Macy’s) with points and rewards. The My Wallet feature within the Macy’s app is a catch-all way to keep track of all promotions, points and payment methods that users have filed in their Macy’s profile.

Winner: Macy’s. De Jocas said that the retailer has invested heavily in making payments digitized, having put $2 billion into the effort. And testing new programs like Plenti tells us Macy’s is making forward-facing moves.

More in Marketing

Pitch deck: How ChatGPT ads are being sold to Criteo advertisers

OpenAI has the ad inventory. Criteo has relationships with advertisers. Here’s how they’re using them.

Yahoo pauses IAB membership amid a series of quiet cost-saving measures

Yahoo pulls IAB board memberships, following job cuts as PE-owner reportedly reconsiders ad tech investments.

Target looks to e-commerce, advertising investments to help grow the business

Technology is one of the most important areas in which Target will invest with the hopes of returning to profit growth.