Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Programmatic icon: The Trade Desk playbook for growing a thriving ad tech business

When Procter & Gamble overhauled its programmatic buying operations this month, the brand decided to switch its demand-side platform in North America from AudienceScience to The Trade Desk.

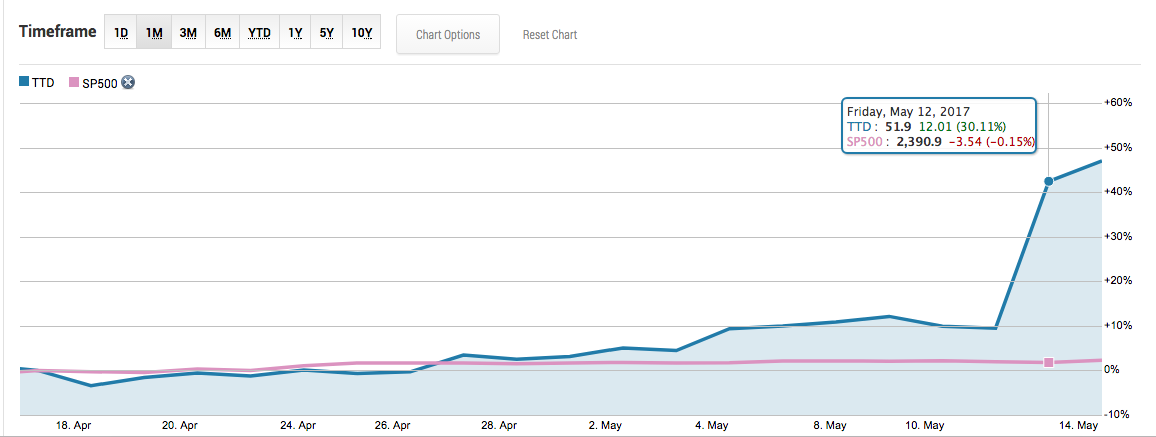

That ranked as another big win for The Trade Desk, which reported last Thursday that revenue reached $53.4 million in the first three months of this year, up 76 percent from the same period a year prior. Right after The Trade Desk posted better-than-expected quarterly financial results last week, its stock price hit $51.90 per share last Friday, up by over 30 percent from Thursday.

Ad tech has suffered its fair share of slings and arrows. In March, the Guardian filed a lawsuit against Rubicon Project, alleging that the ad tech firm didn’t disclose buy-side fees. In September 2014, Rocket Fuel faced a class-action suit from investors for alleged breaches of federal securities laws. And the stock market shows no love for ad tech firms. For example, the share prices of Rubicon, Rocket Fuel and Tremor Video are down 43 percent, 89 percent and 75 percent, respectively, compared to their initial public offering prices.

Jeff Green, founder and CEO of The Trade Desk, thinks the company’s growth can be largely attributed to its focus on agencies and buy-side technologies, as well as an omnichannel strategy.

“More than 50 percent of our revenue comes from agencies. We never compete with them and we have no interest in managed services,” said Green. “We are also omnichannel and global. You need to have a charter that is big enough to be defensible, but small enough to create strategic alignment with your partners.”

The Trade Desk’s success looks like the antithesis of the fear of getting into the DSP business. As Boris Mouzykantskii, CEO and chief scientist for media trading tech firm Iponweb, described, DSPs are caught in a vise today. On one hand, they’re feeling pressure from advertisers and agencies looking for greater performance and efficiencies. On the other hand, escalating hardware costs from bid duplication are eating into their already thin margins.

“To relieve these pressures, DSPs are rapidly trying to evolve how their businesses look, exploring new lines of revenue from data vendors, supply partners, publishers and alternative business models,” said Mouzykantskii.

For The Trade Desk, that means an agency-first focus and a platform model. Green thinks many DSPs are trying to do “too much”: They go directly to brands, pitching that they can offer both the tech and the service. But The Trade Desk never wants to compete with agencies for brand clients, Green said. This is because a big brand may need hundreds or thousands of people to run ad campaigns globally, and there is ad customization involved in each country. If a DSP acts like a tech provider and an agency concurrently, it would be spread very thin.

“I don’t know how a DSP can be an agency and offer the best tech at the same time,” he said.

The Trade Desk’s agency-first focus makes it the second-biggest ad tech partner in terms of market share (AppNexus is No. 1) for WPP-owned GroupM. Brian Gleason, global CEO for mPlatform, said The Trade Desk has done a great job with educating GroupM executives on how to optimize its DSP features.

“The Trade Desk often gives us deep dive in its products or sits with us during the office hour to help us understand programmatic tools,” said Gleason. “It’s very smart of the company to do more education, less selling.”

The Trade Desk is competing with omnichannel DSPs like MediaMath and Turn, as well as channel-specific solutions like TubeMogul and Videology. But the company also embraces a platform model — where it offers agencies a tech infrastructure to let shops add their own features — to rival AppNexus, Iponweb and Beeswax.

For instance, Goodway Group, a programmatic agency that runs managed services for brands, used The Trade Desk’s bidder and integrations as the foundation from which the shop built its proprietary DSP.

Jay Friedman, COO for Goodway Group, thinks The Trade Desk and AppNexus have more built-out integrations with third-party vendors like Moat and Integral Ad Science, while Iponweb and Beeswax provide more “raw materials” that agencies can use for the bidder and traffic.

“When we make a suggestion for The Trade Desk, it has a 100 percent track record of building that feature or product,” said Friedman. “We also have an ongoing dialogue with multiple people in The Trade Desk engineering department (weekly, at least) because of the depths of our product that builds into its API.”

An agency-first focus and a platform model have helped The Trade Desk become a well-established DSP. When asked if the ongoing trend of brands moving programmatic in-house would shake The Trade Desk’s business strategy, Green said that in spite of the media coverage, most brands are not doing programmatic on their own. In the case of Procter & Gamble, The Trade Desk is still working with the brand’s media agency, Hearts & Science, for instance.

“I don’t think brands are actually moving DSPs or DMPs in-house. What is more common is they set up an in-house programmatic department to do rich analytics and work with agencies,” said Green. “Netflix and Amazon are doing their own programmatic, but most brands are not.”

We’ll talk more about how brands are handling programmatic in-house at the Digiday Programmatic Summit. Learn more about attending here.

Image courtesy of The Trade Desk

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.