Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Marketers are ‘hopeful yet reasonable’ ahead of Q4 and holiday season

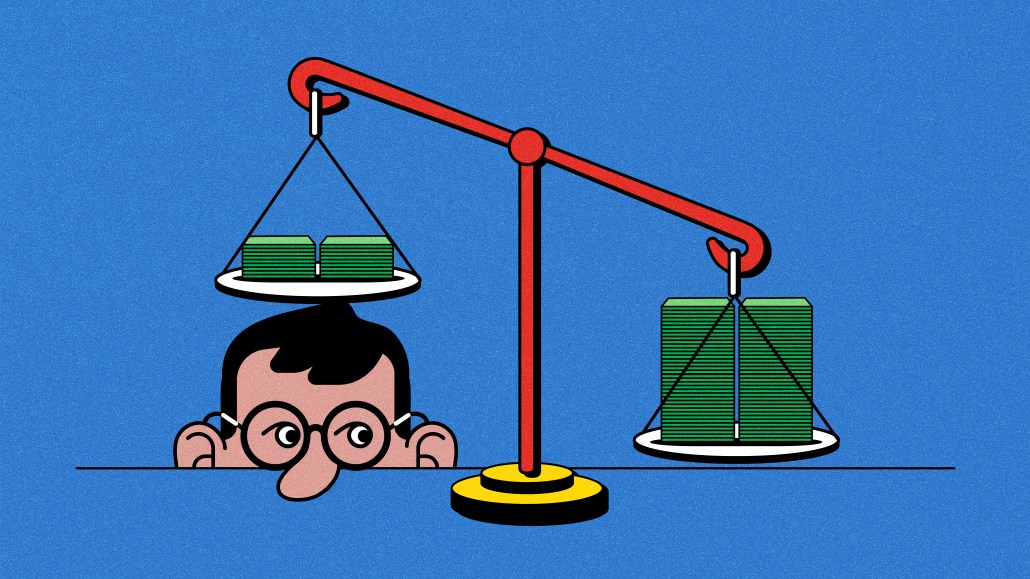

Ad spend may be heading back to the mid-single digit levels seen in the 2010s, but that hasn’t stopped clients from approaching Q4 ad spend with a general sense of uncertainty, agency executives say.

Multiple, compounding issues are causing continued uncertainty. Lingering Covid outbreaks, labor issues, the writer’s and actor’s strikes and inflation have caused the industry to push for contingency plans, adding clauses and flexibility to contracts making it easier for them to be reactive when something occurs. That push for flexibility has been the norm for at least the last two years when it comes to marketing plans and ad budgets. Client ad spend is expected to remain flat through the rest of the year, neither significantly increasing nor significantly decreasing, six agency executives told Digiday.

“Generally, clients are going into Q4 with an assumption that it’s been a tough year; inflation has been tough,” said Robin Cohen, executive vice president of integrated media investment and planning at Rain the Growth Agency.

Industry experts expect to see advertisers invest in linear television and digital video, like YouTube and streaming ads to reach their target audiences. Agency executives agreed that linear and digital video is and continues to be an integral part marketing budgets, despite current writer and actor strikes. (More on how the Hollywood strike impacts the TV business here.)

“TV and streaming will continue to be a big focus area for Q4 ad spending, especially with live sports and other big event programming airing within the November-December time frame,” Stephen Magli, CEO and founder of programmatic consultancy firm AI Digital, said in an email to Digiday.

At Rain the Growth Agency, Cohen said clients are continuing to buy streaming ads, testing interactivity like pause ads, or static brand ads that take over the screen after a video has been paused, or banner ads that direct to a retailer. On average, the agency said clients are spending 60%-70% of their budgets on linear TV this year. Depending on the client, that figure is either flat or down slightly from 2022 spending, per Cohen. The streaming ads work in tandem with linear television, “because [linear television] has a lower cost from a CPM perspective and it gives us mass reach,” Cohen said, referring to the linear television ads. Notably, networks have been offering discounts as the TV industry struggles to collect ad dollars.

Overall, marketing budgets remain under scrutiny even as global ad spend is forecasted to speed up after getting off to a slow start earlier this year. Given the holiday season and an uptick in spending, Q4 growth is an industry norm. Ad spend for the year is expected to reach $360 billion in the U.S., marking a 5% increase from 2022, per Digiday reporting.

Meanwhile, shoppers are spending freely and are more confident in the U.S. economy this year versus last year. According to the Commerce Department’s recent report, retail sales rose better than expected, 0.7% in July from June. In time for this year’s holiday season, eMarketer expects holiday season retail sales to grow by 4.5%, slightly down from last year’s holiday season retail sales, which grew by 4.8% year over year.

Still, advertisers are taking a nuanced and flexible approach to budgets heading into the end of the year given 2023 has been economically tumultuous — a similar narrative to years prior. Out of the six agency executives Digiday spoke with for this story, none said clients are spending significantly more or less going into Q4, and media investments have remained consistent throughout the year. In fact, clients and their agency partners are working to make their ad dollars stretch as far as they can as inflation continues to be an industry-wide worry, per the execs.

“Candidly, we’ve been in this space for a while, where we are having this more flexible approach, where we know things are changing and we don’t want to lock ourselves necessarily into things that we’re not really feeling confident about,” said Nashira Babooram, senior director of marketing at SPARK agency, a collaborative creative agency. She added that clients are maintaining investments from earlier this year in media channels like digital, streaming video ads and social media. She did not offer further details about client ad spend.

While budgets may be under scrutiny, Babooram said that the agency isn’t suggesting clients cut ad spending, adding that brands that do cut so going into the holiday season may find themselves shelling out more to play catchup when the economy picks back up. That’s a familiar refrain as ad agency execs often cite the 2008 recession and clients that maintained spend at that time as having been winners.

James Galland, global commerce director at VMLY&R Commerce, made a similar statement, noting that brands that over invest in brand awareness campaigns stand to garner “tangible long term market share gains versus market average.”

While still in the single digits, advertising’s new normal ad spend has lit an air of hopefulness in Chris Cardetti, chief strategy officer at Barkley ad agency. By Q2 of this year, clients were more willing to plan further ahead than they have been in recent years, he said. “Last year, actually may have been mission critical for budgets,” he said. “But there’s reasonable expectations for the holidays. Marketers are matching that with their media plan — still heavily scrutinized, but hopeful.”

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.