TikTok’s latest round of layoffs has proven that not even the popular entertainment app is safe in this seemingly uncertain social landscape.

The platform’s latest cuts, its first of 2024, impacted around 60 staff, most of which were from the app’s sales and advertising team, and appears to be the product of a cost-saving measure. That’s not necessarily a bad thing for a platform often considered bloated. But it does suggest holes in the integrity of the business.

While Meta’s CEO Mark Zuckerberg coined the phrase, “year of efficiency” for 2023, it looks like TikTok bought into a similar narrative.

From late 2022 to early 2023, the company reportedly restructured to appease federal criticism from the U.S. Congress about how the company handles user data. Another reorg followed in May 2023, as the entertainment app invested in its e-commerce efforts to crack Western markets. The company underwent another shuffle after former COO V Pappas’ exit last summer, which saw hundreds of staff redistributed across three focus areas: creators, content strategy/policy and publishers.

But with internal chaos comes outward confusion.

The constant changes at TikTok have left some marketers in a bit of a tizzy. There’s creative confusion over how to continue standing out on the platform now that it’s more crowded with ads. Creators can find it hard to know where they stand. Not to mention the prospect of TikTok prioritizing Shop to the detriment of its user experience.

Digiday unpicks five challenges that TikTok faces in 2024.

Streamlined ad operation

TikTok’s latest “routine shakeup” impacted staff in Austin, Los Angeles, New York and abroad. Despite this, its parent company ByteDance still has over 900 vacancies available for the app across various divisions including creator operations, search and its data science team.

Nevertheless, the cuts do indicate an effort to address a longstanding concern for marketers about TikTok’s ad sales team. Up until now, they have had mixed feelings.

On the one hand, ad execs sing TikTok’s praises, having cited the fact that they hear from their app reps at least weekly, in a proactive sense, with new opportunities to spend ad dollars.

On the other, some ad execs have experienced high turnover. But as Kolin Kleveno, svp of partnerships at Tinuiti previously told Digiday, there’s such a huge demand from clients for TikTok, that those losses have never impacted spending too much. After all, when deals are flowing in, salespeople don’t necessarily need to push too hard.

“It’s still a relatively new [ad] platform and some of the sales people have only been there for a couple of years, so there’s likely some fine tuning, with regards to how to work better with agencies coming into play,” Kleveno said.

App usage decline

Once hailed as the app above all apps, TikTok appears to be having a tougher time garnering attention away from its peers.

Sensor Tower data showed that while the app’s monthly active users (MAUs) grew by an average of 12% year-over-year in 2022, this percentage dropped to just 3% in 2023.

This could be par for the course; When a platform is in its infancy, growth often skyrockets. However, as the platform matures, like in the case of Meta, growth still happens but at a more gradual pace.

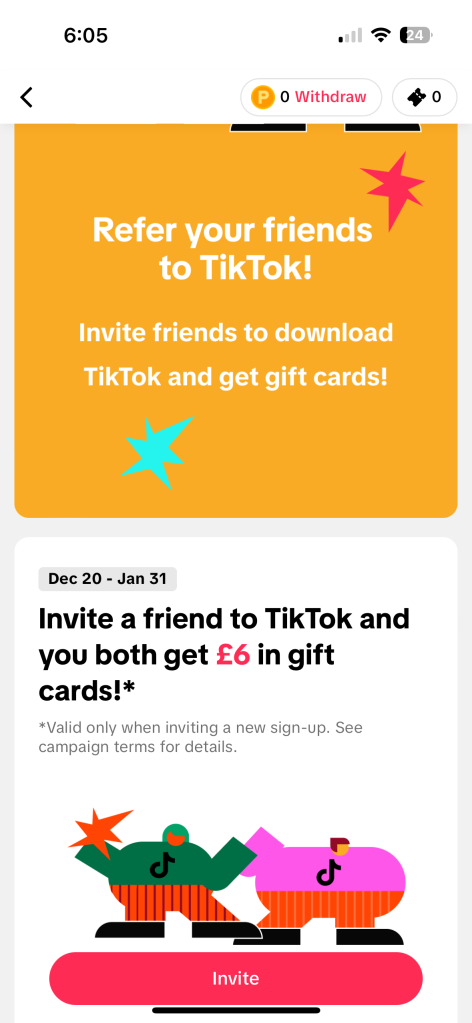

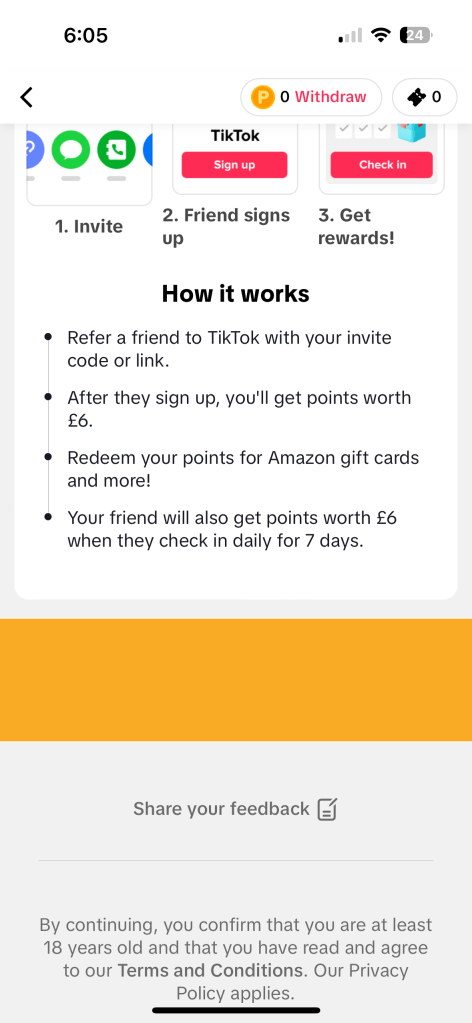

Perhaps this could be why, for the past month, the app has introduced a user reward system to entice new sign ups.

Between Dec. 20 and Jan. 31, users aged 18 and over can refer friends who aren’t on the app to sign up and earn points worth £6 ($7.60) (per friend), which can be redeemed for Amazon gift cards. And the friend will also earn £6 worth of points — provided they check in daily on the app.

Incentives like this could be a great way to entice people on to TikTok. However, with so many users already on the app, it might be tricky to find enough people who haven’t already signed up for this scheme to move the needle.

Furthermore, this comes at a time when YouTube Shorts and Meta’s Reels are garnering more attention — especially since they require less effort compared to crafting TikToks. So while more ad dollars are being spent on the short-form video format, they aren’t necessarily being spent on TikTok.

The waning algorithm

TikTok’s algorithm has been the key reason for its success; drawing users in, and selecting more content for them to ogle over as they scroll their For You page. But as the saying goes, nothing lasts forever, and unfortunately that’s the same for the platform’s algorithm.

Users have been becoming increasingly frustrated with their feeds, as they have to search harder to get that hit of dopamine from watching entertaining TikToks. And if it’s not that, they’re being bombarded with Shop ads, left, right and center. As one user posted on X, formerly Twitter, “Is anyone else’s TikTok feed just… garbage now? I feel like I have to suddenly scroll forever to get content I want to watch, where[as] before almost every video was interesting? What happened?”

It’s something ad execs have also made a note of, including Amy Gilbert, vp of social innovation at The Social Element who previously discussed the matter with Digiday. “I think as the platform’s evolving, the challenge is how do they [TikTok] keep that piece [the algorithm] which makes it different, but also find new ways to bring those other elements [such as Shop, music, etc.] in.”

TikTok Shop

Arguably its biggest U.S. launch in 2023, TikTok Shop was, and still is, met with mixed messages. It’s applaudable how quick the company was able to get its U.S. Shop product to market (after only months after testing), and especially for Gen Z, it certainly seems to be a success for impulse buys. But by and large it’s also been tarnished with dupes, which have made potential buyers hesitate. Not to mention, it requires marketers to give up their right to first-party data, because consumers are not driven to the brand’s own site to check out.

Generally speaking, users aren’t as taken with Shop right now as TikTok — mostly because its ads have taken over much of their feeds, to the point of overkill. It’s certainly something that marketers highlighted to Digiday last year. Perhaps this could be one of the reasons for slowing usage? Regardless, it seems like TikTok still needs to get the balance right when it comes to going all in on social commerce, without destroying users’ experience.

Creator friction

TikTok’s relationship with creators continues to be transactional. A marriage of convenience, if you will. Every new product for creators is marred by TikTok’s slow response to their needs. The much-hyped Creativity Program? It’s still unclear how many creators are part of it, or how much of the $1 billion creator fund they actually distributed. And those longer videos? They’re not about what creators want; they’re about TikTok’s relentless quest to keep users glued to the app, and subsequently boost revenue.

One TikTok employee, who exchanged anonymity for candor, said that most senior people at TikTok and a lot of the ByteDance leadership in China see creators as replaceable. “If you remove the top 5% of creators from TikTok, the platform lives on, and there isn’t really a big impact on the business,” they said.

That’s because TikTok is all about creator content — not content creators. It’s a subtle shift from the likes of Meta and YouTube, both of whom have always put value on an influencer or creator’s reach and popularity. Put another way, when brands work with a top influencer on a Meta platform, for example, they can almost predict that the content will perform well, because that individual has reach and is popular. But on TikTok, those vanity metrics don’t fly — a creator could have 4 million followers and their TikTok could tank, while someone with 200 followers could go viral overnight.

That’s not to say TikTok hasn’t made any efforts with creators — quite the contrary. The platform often runs workshops and hosts events and invites select creators to attend — though it’s unclear about which creators have a real relationship with the platform, and why.

Stephen Hart (@realstephenhart) for example, who has amassed around 486,400 followers and 35.6 million likes, said there’s so many users now and the platform has grown so much, it’s hard to say if he feels valued by TikTok. “I feel as though there are so many moving parts and pieces it’s most likely hard for TikTok to zero in on individual creators. I’m just thankful that the platform exists to be honest.”

More in Marketing

YouTube’s upmarket TV push still runs on mid-funnel DNA

YouTube is balancing wanting to be premium TV, the short-form powerhouse and a creator economy engine all at once.

Digiday ranks the best and worst Super Bowl 2026 ads

Now that the dust has settled, it’s time to reflect on the best and worst commercials from Super Bowl 2026.

In the age of AI content, The Super Bowl felt old-fashioned

The Super Bowl is one of the last places where brands are reminded that cultural likeness is easy but shared experience is earned.