Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

This article is part of an ongoing series for Digiday+ members to gain access to how platforms and brands are pitching advertisers. More from the series →

After a year of testing, excitement and occasional turbulence, TikTok Shop hit its biggest milestone to date: it’s now officially launched in the U.S. and the platform is swiftly gearing up to convince marketers to spend their money on it.

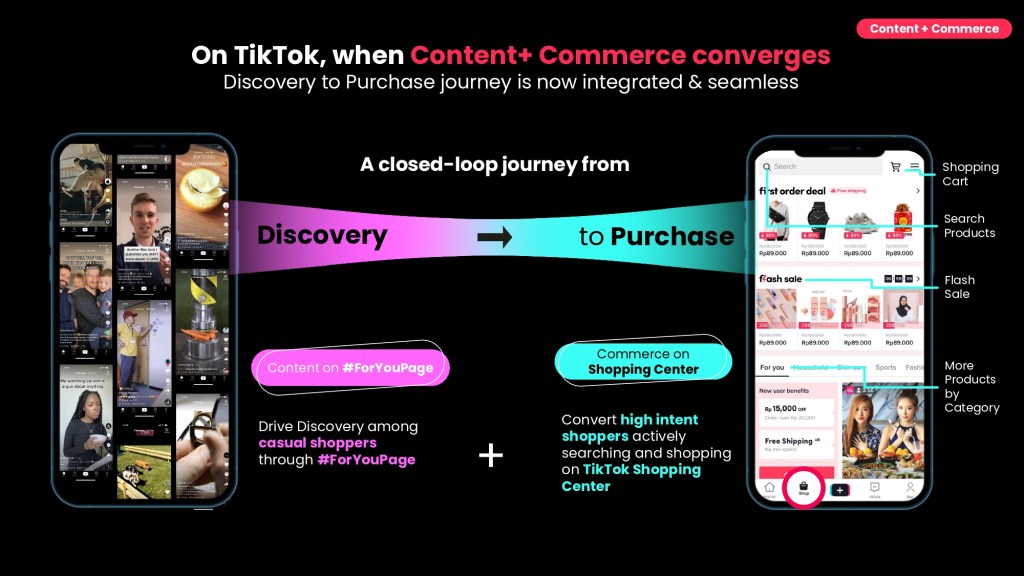

The idea behind it is simple: TikTok already has the ability to make products go viral and sell out, just by being the platform those videos are watched on, so why not become the actual Shop that sells those products and make some cash in the process? Get it right and TikTok can take a significant cut from those purchases.

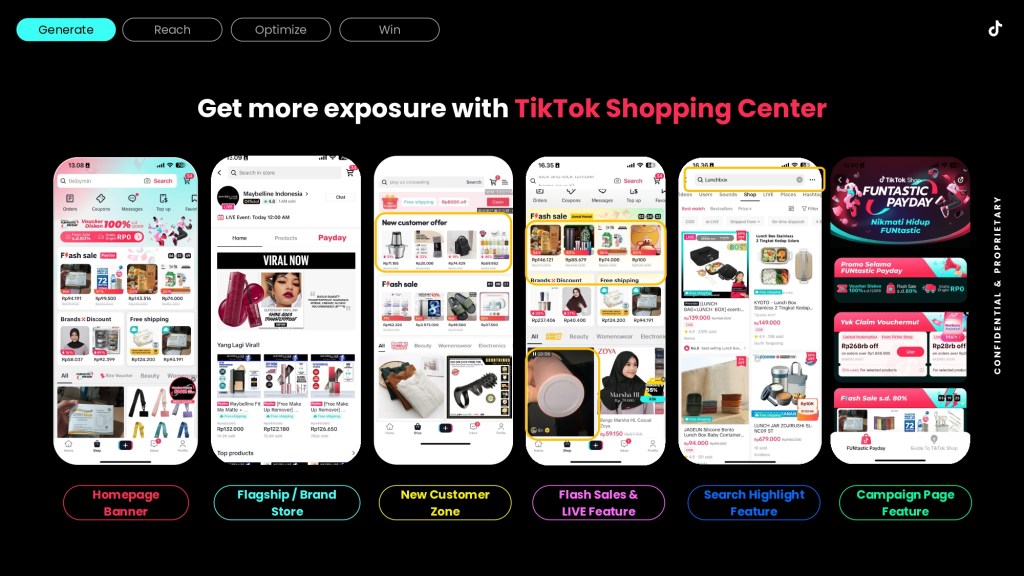

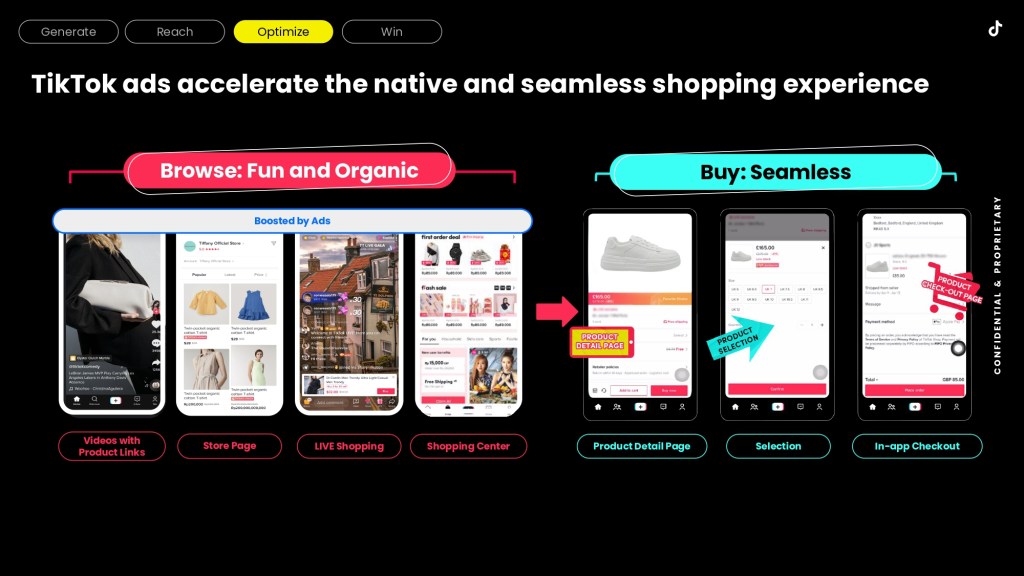

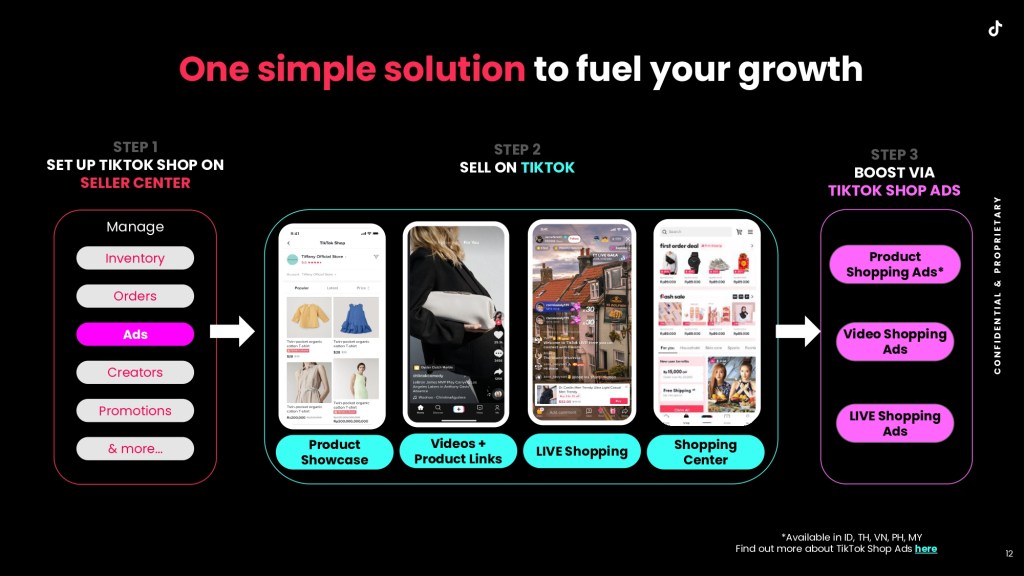

TikTok launched the offering with a few key features — it is the first time users can access the Shop button from the app’s home screen, where they are redirected to a marketplace or have access to videos and live streams that contain Shop buttons for specific products. And, similar to Amazon, both options let users buy products from a number of sellers, in one cart in a few clicks — all without leaving the app.

TikTok launched to fierce competition — e-commerce is something industry giants like Meta, Google and Amazon have been trying to accomplish for years. And the industry is already comparing TikTok to those giants.

“Instagram has already tried something similar for a few years, even having a dedicated Shopping tab,” said Annie-Mai Hodge, director and founder of Girl Power Marketing. “I see TikTok Shop sharing a similar fate due to the change in buyer habits, cost of living crises, etc.”

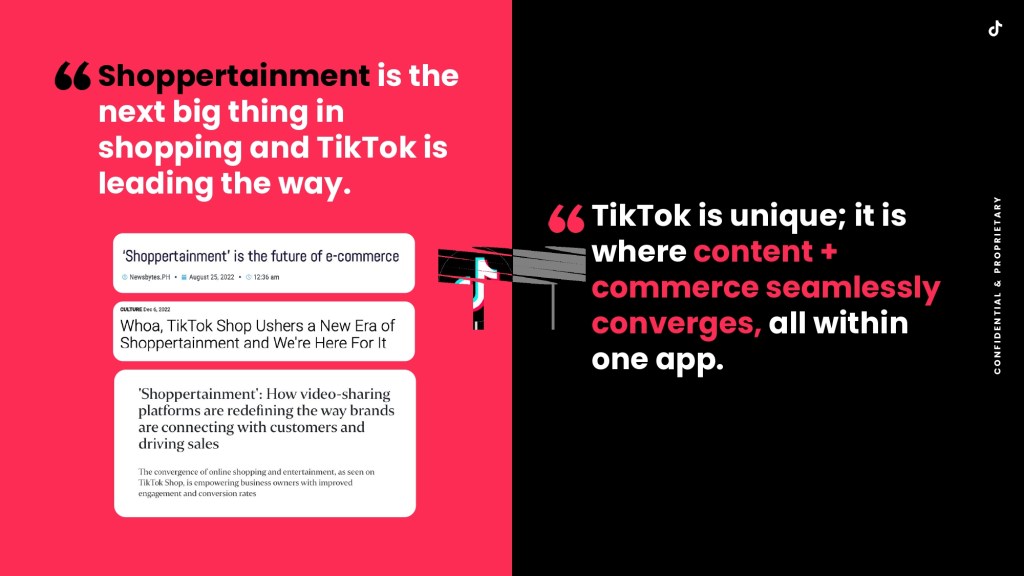

But TikTok is laser focused on what it thinks it can offer to stand out, selling its platform as a place that sparks inspiration, fosters affinity, and highlights trending products that go viral. It believes it is a unique shopping experience centered around discovery and creativity.

“If they [TikTok] can encourage enough people to make TikTok into this place where you go for that kind of shopping, it can succeed in commerce without taking away too much from Amazon, in terms of the value proposition,” said Jasmine Enberg, principal analyst, social media at Insider Intelligence.

Think of it like QVC on your phone. On TikTok, users aren’t just buying what they already knew they wanted; they’re discovering products they never knew they needed. It’s the type of impulse shopping marketers have dreamed of ever since the concept of social commerce was first floated. Naturally, TikTok is eager to demonstrate how that dream has now become a reality.

“There’s nothing like a viral trend to get TikTok users to open up their wallets,” said Enberg.

The pitch

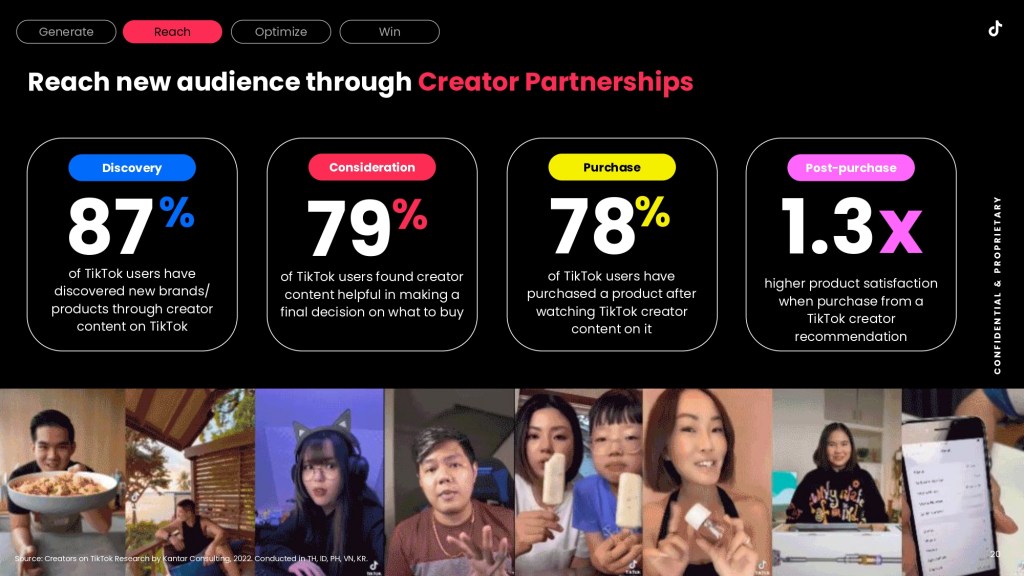

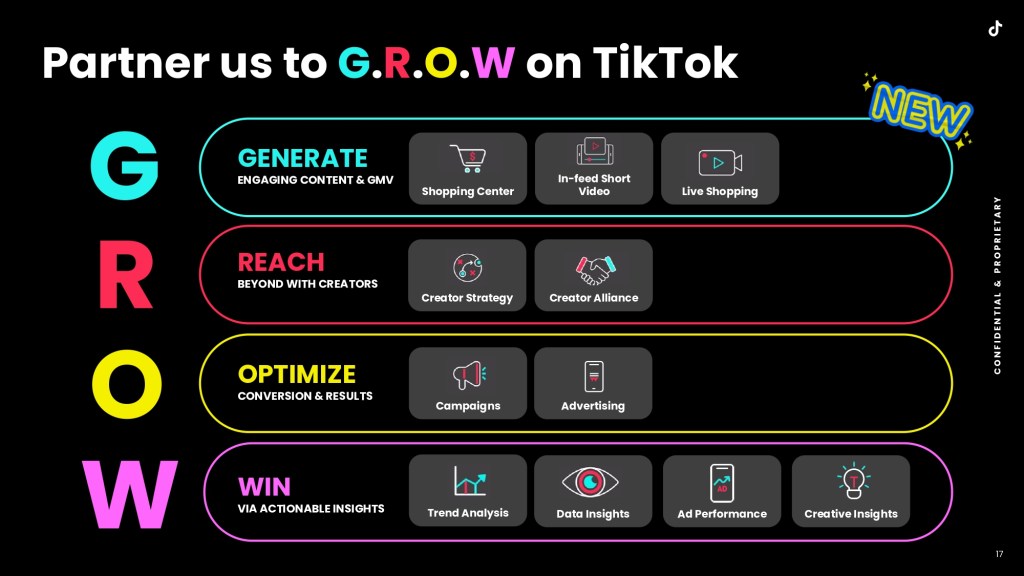

When news broke that TikTok was investing in social commerce, a pitch deck made the rounds with a particular focus: creators. The move made sense given how essential they have become for brands wanting to effectively engage with a Gen Z target audience. That trend will likely only increase as marketers strive to achieve comprehensive goals on TikTok that go beyond brand awareness.

But before they commit to anything, marketers want to know how much appetite for this sort of commerce there is on the app.

The platform has been actively engaging with advertising executives, both through direct meetings and at industry events in recent months. TikTok has been offering educational webinars and sharing tailored pitch decks designed to cater to the unique needs and interests of these brands. In fact, in some cases, the platform has even partnered with marketing influencers to run some of its webinars, and encourage them to recommend TikTok Shop to their clients on an affiliate basis, added Hodge.

- New sellers don’t pay sellers fees for the first 90 days from now through October 2023

- After this period, TikTok will start taking its cut of 2% (per customer payment and platform discount) plus $0.30 cents per order

But TikTok isn’t just relying on its algorithm to win over advertisers. Two sources with insider knowledge said that TikTok is currently running a referral fee promotion, to further incentivize brands and marketers.

Another marketer from an ad tech company, who asked to speak anonymously to protect their relationship with the platform, said TikTok touted Shop as a major focus for Q4 in a recent meeting and offered a slew of resources, including an integration with Shopify, to set up a TikTok Shop.

“They [TikTok] described the process as though they can help brands get matched with a concierge to help them navigate the new program from beginning to end (set-up, recommendations on different ad bundles to help drive sales, and so on),” they said.

In that same meeting, TikTok reps alluded to ad incentives available to new Shop brands, to onboard them ahead of the holiday period in Q4. While the specific details of TikTok’s ad incentives were not disclosed, other platforms have used a similar tactic. For instance, X (formerly known as Twitter) previously provided ad discounts to advertisers to entice them back after Elon Musk’s takeover.

For the first two weeks of September, through September 14, TikTok was offering “valued Shopify merchant[s]” $1,000 free ad credit when they spent $100 on Shop ads, according to an email shared with Digiday.

The deck

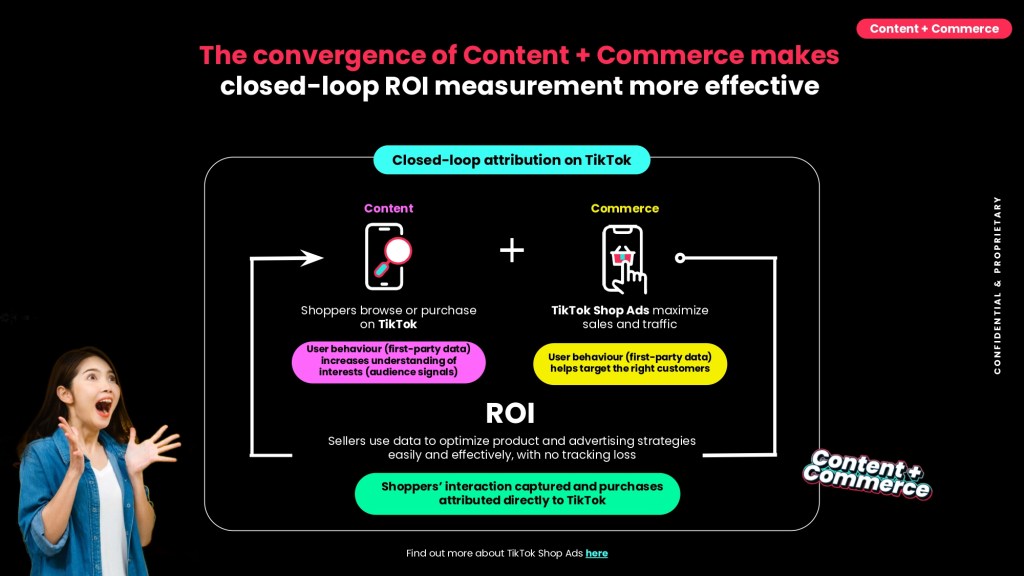

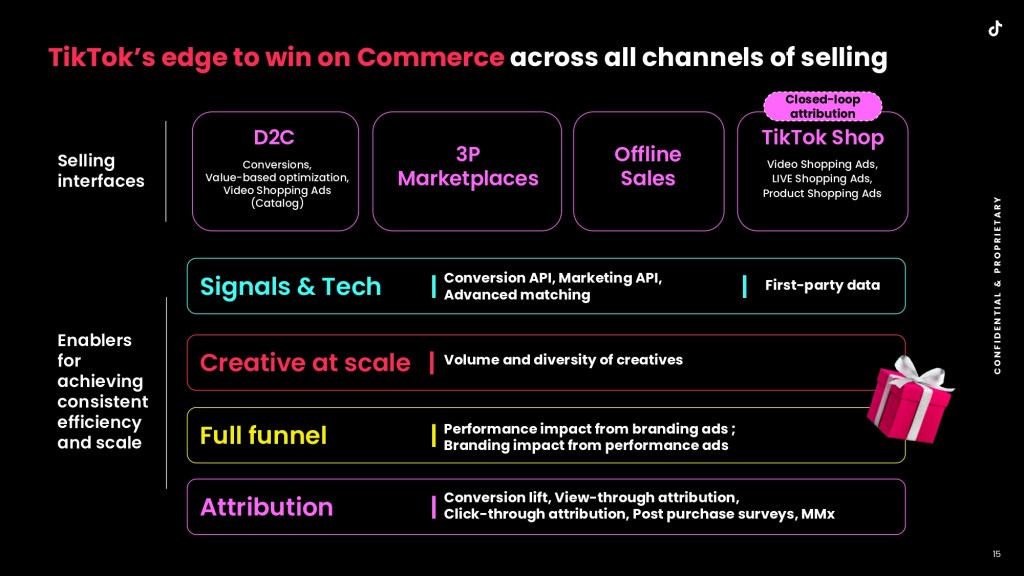

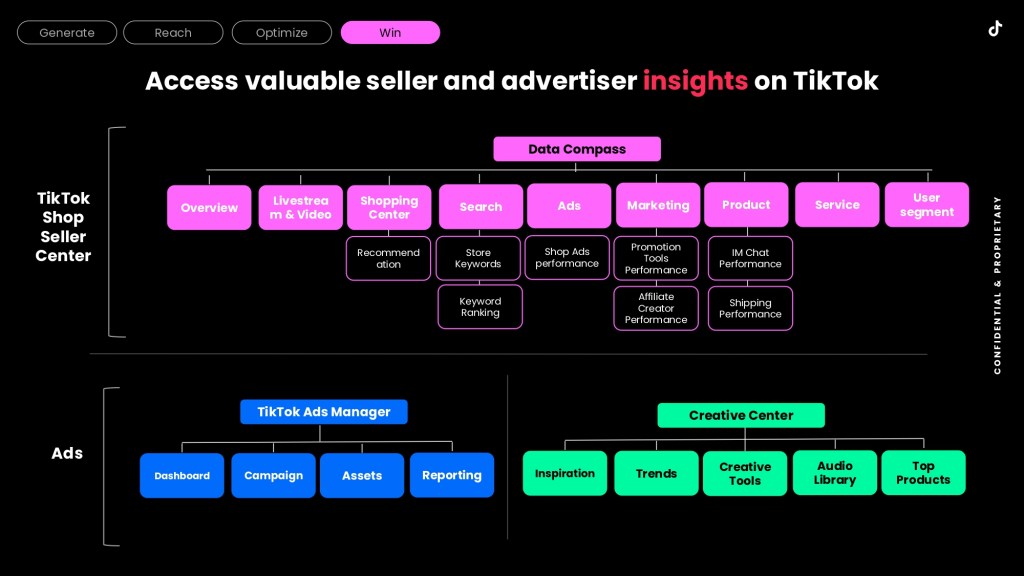

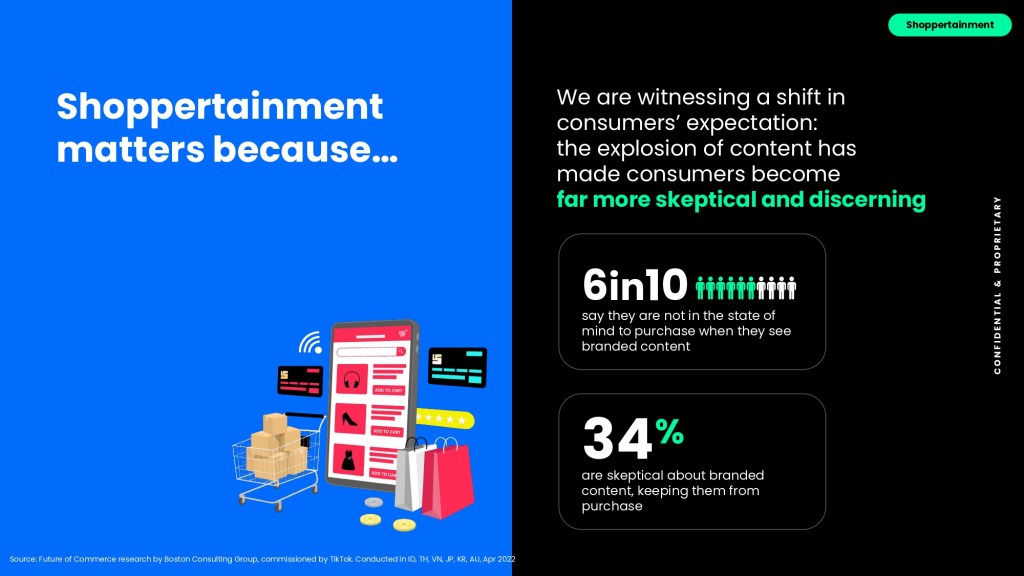

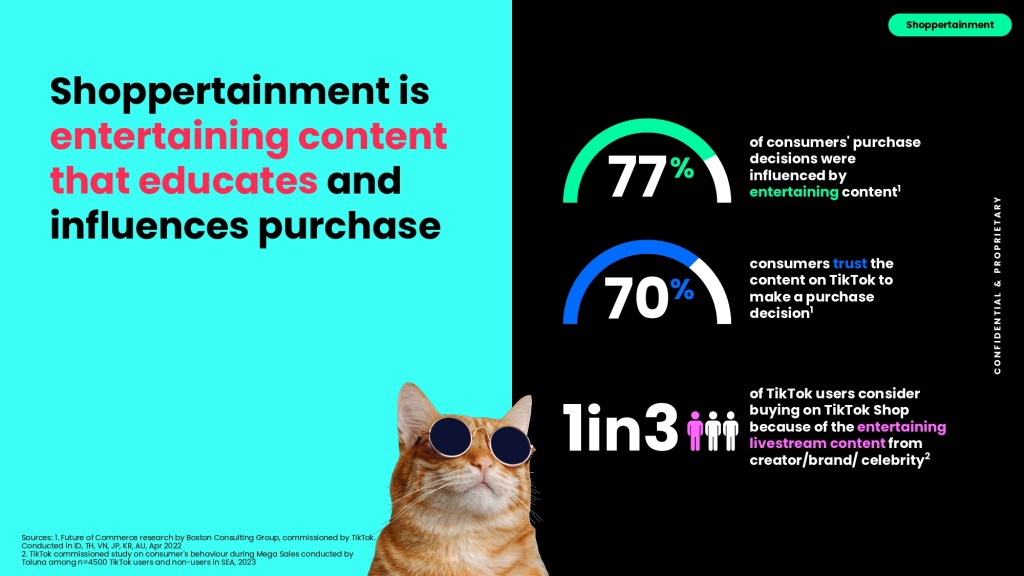

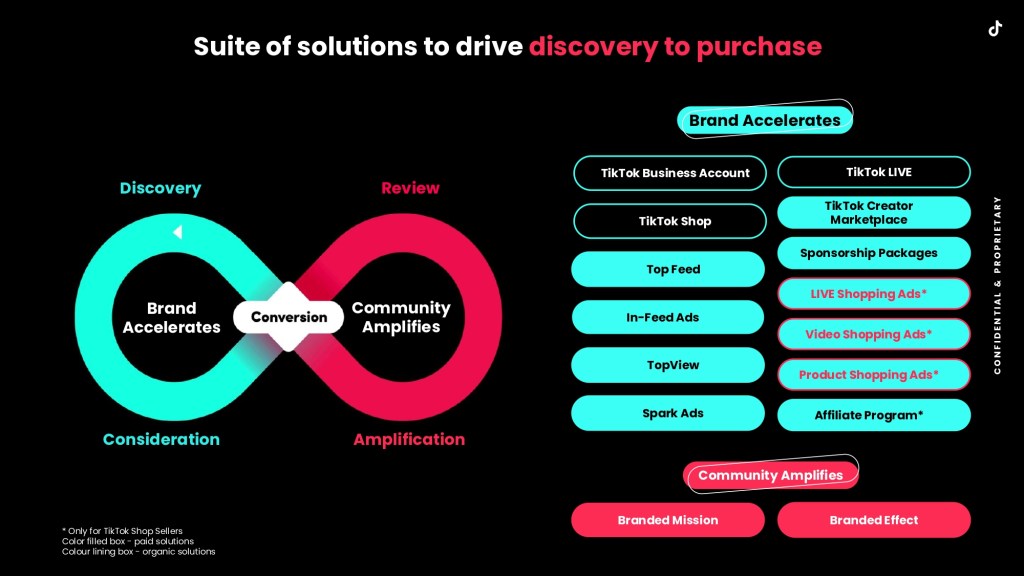

According to the deck, TikTok is pushing what it calls “Shoppertainment” to assist marketers in achieving more effective closed-loop ROI measurement. This is essentially the holy grail for many ad-supported platforms: the ability not only to be the place where people search for products but also where they discuss, view, and ultimately make purchases. The reality, however, is that most platforms struggle to excel in all three aspects. Not surprisingly, TikTok believes it can. The deck highlights that one in every two users discovers new products and brands via their For You feeds, with a substantial 63% performing a search after encountering an ad on TikTok.

What’s more intriguing is the fact that 65% of TikTok users are planning to buy from TikTok Shop because of the simplicity of the in-app shopping experience.

Still, it’s important to approach these statistics with a degree of skepticism. They are taken from a study involving approximately 4,500 participants, both TikTok users and non-users, in Southeast Asia. It’s worth noting that this region tends to exhibit a greater inclination to consolidate their various digital activities within a single app.

So, while this serves as a valuable case study, TikTok’s next challenge lies in encouraging Western users to embrace similar habitual activities. No mean feat despite TikTok’s efforts to present itself as a comprehensive platform covering the entire customer journey, rather than just a stereotypical social network. TikTok Shop serves as a clear demonstration of this vision, harnessing creativity (through creators and videos), alongside brands’ shopping ads and data, to facilitate purchase activity.

Working with creators

TikTok’s commitment to fostering creator partnerships is an integral part of its identity, and this ethos continues with Shop.

According to the deck, most (87%) TikTok users discover new brands or products through creator content on the app, while the majority (78%) actively purchase a product after watching TikTok creator content on it.

Talking about TikTok’s creator affiliate program on a recent webinar, Cjoe Anaya, e-commerce operations manager at TikTok Shop said it “makes the difference between us and every other platform.”

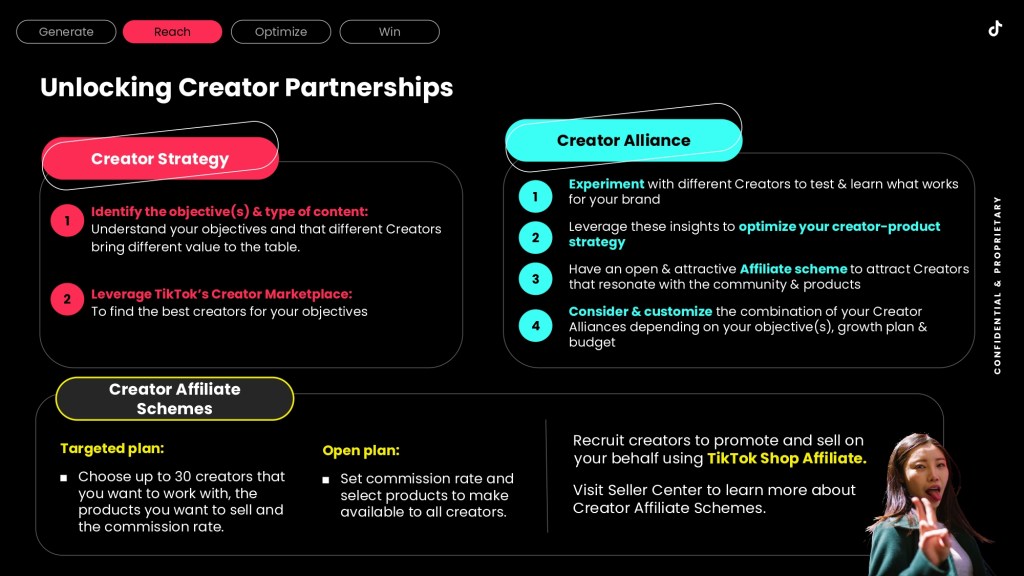

Once sellers have signed up to TikTok Shop and products are live, they have the option to opt-in to the platform’s Creator Affiliate Program which is divided into two buckets.

The first, dubbed the “open plan,” is where creators that have already been vetted and meet a criteria set by TikTok, just start creating videos and tag the brand’s product. Creators then earn a predetermined commission set by the brand.

The second, called the “Targeted plan” is for those brands who are more conscious about brand image. Think of it like matchmaking: brands can view creators profiles (their followers, niche, performance) and can reach out to up to 30 creators they want to work with and vice versa. Creators in this bucket also earn a similar commission.

Available ads

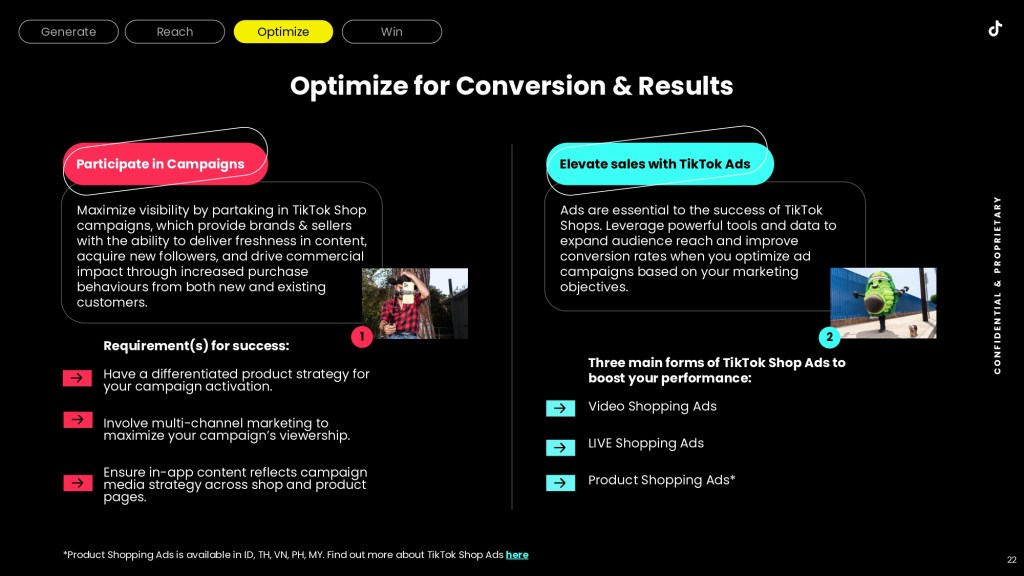

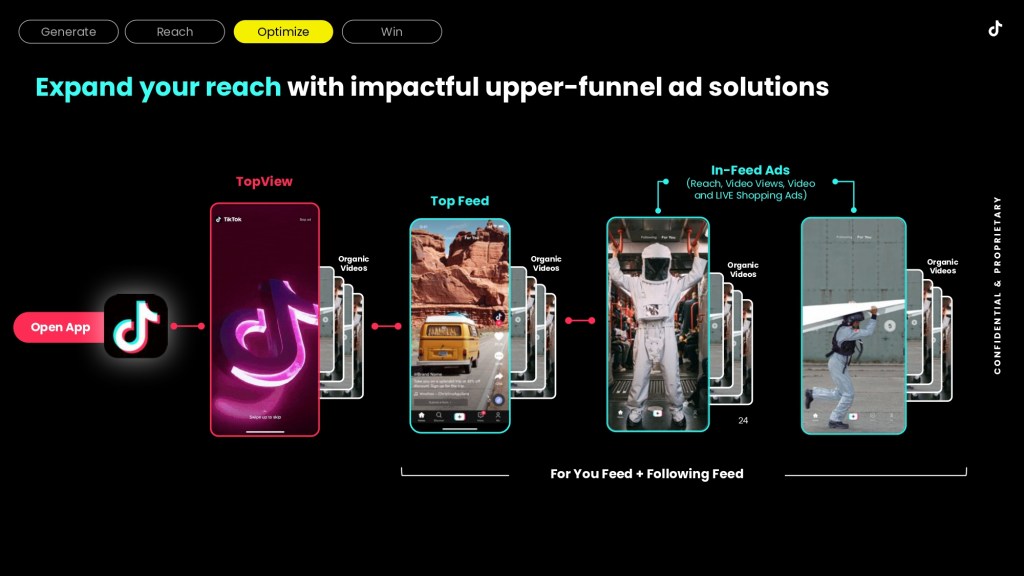

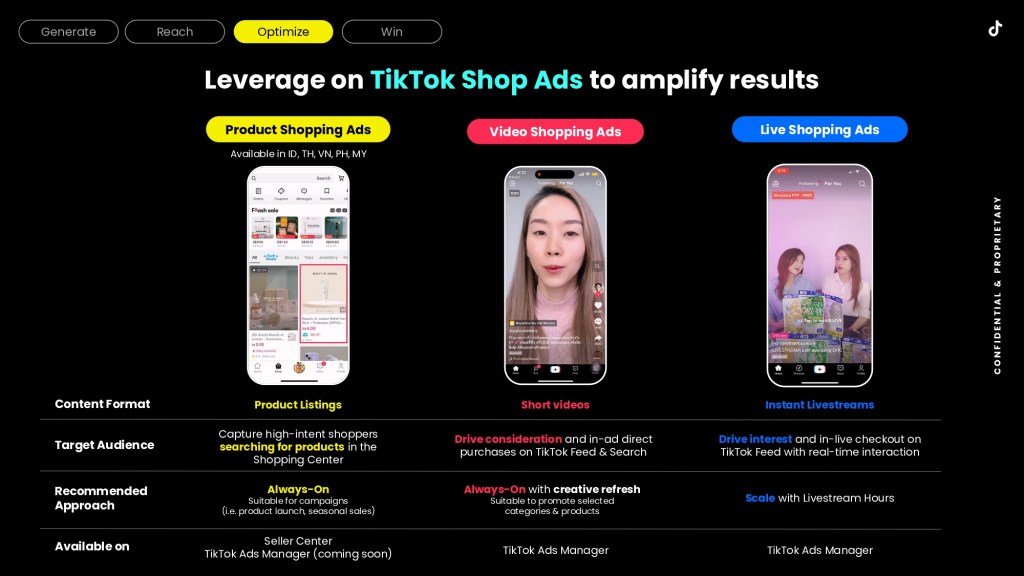

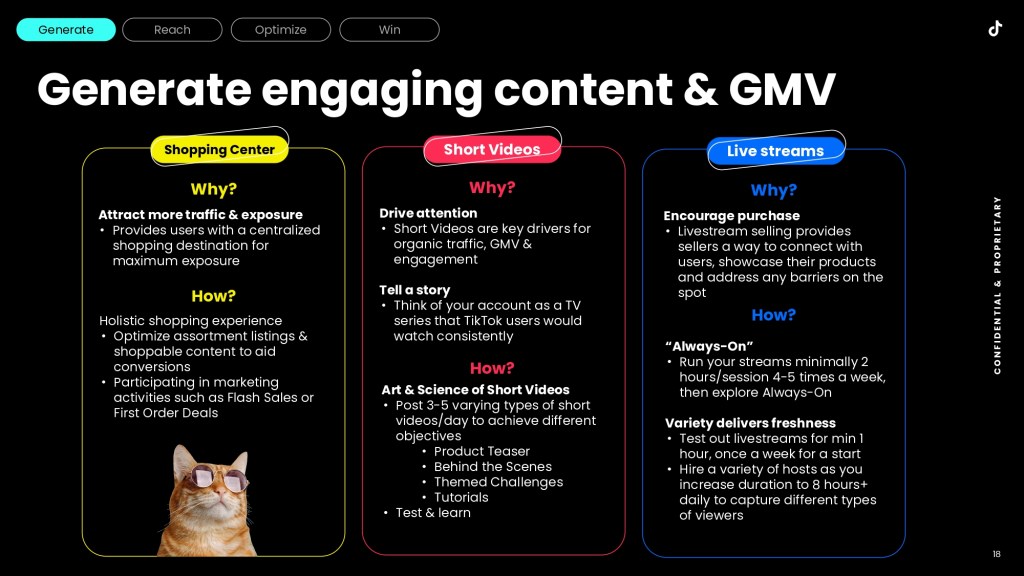

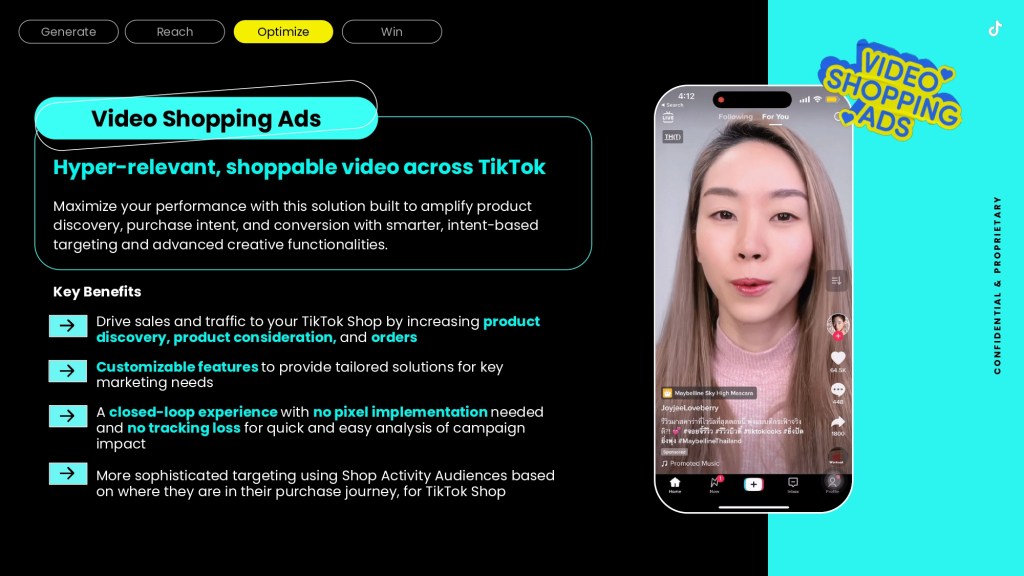

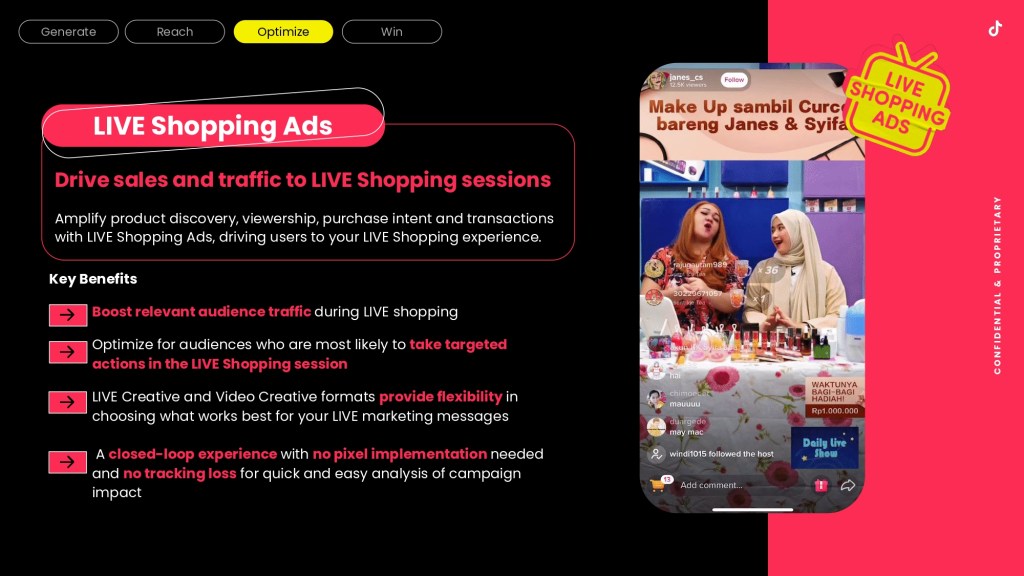

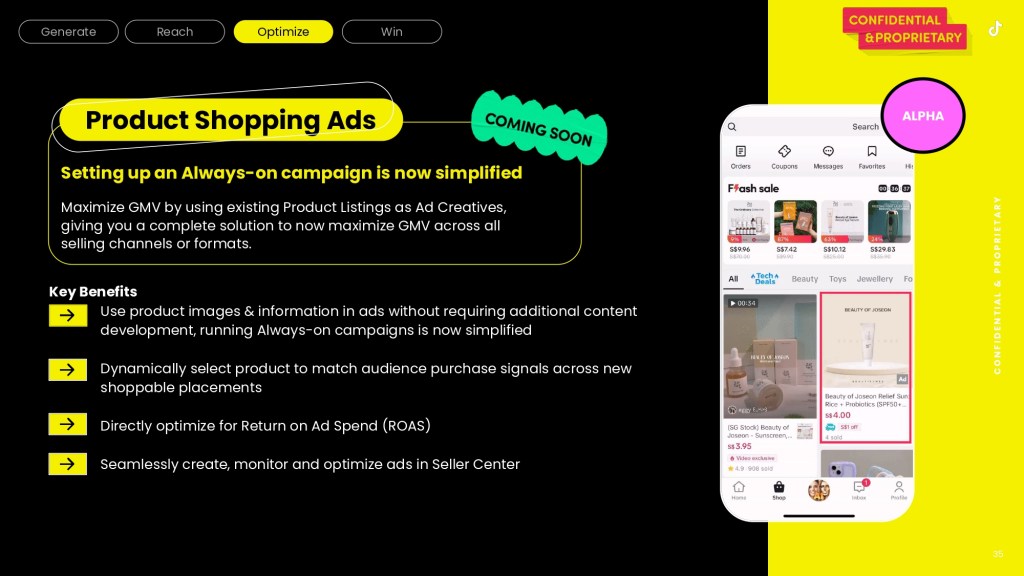

Given that to do well on TikTok, content has to be native to the platform, TikTok Shop has its own ad formats, which include product, video and live shopping ads.

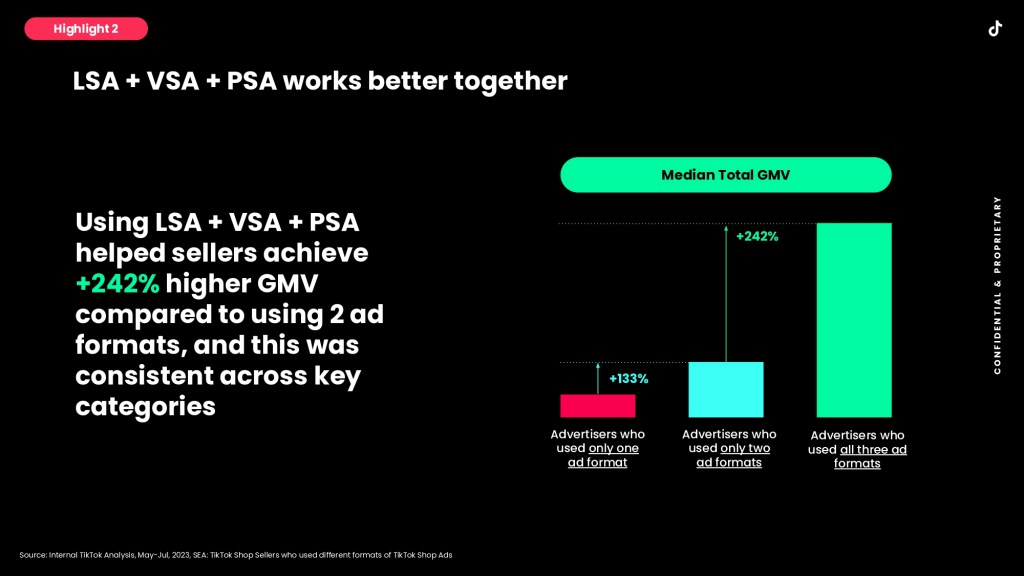

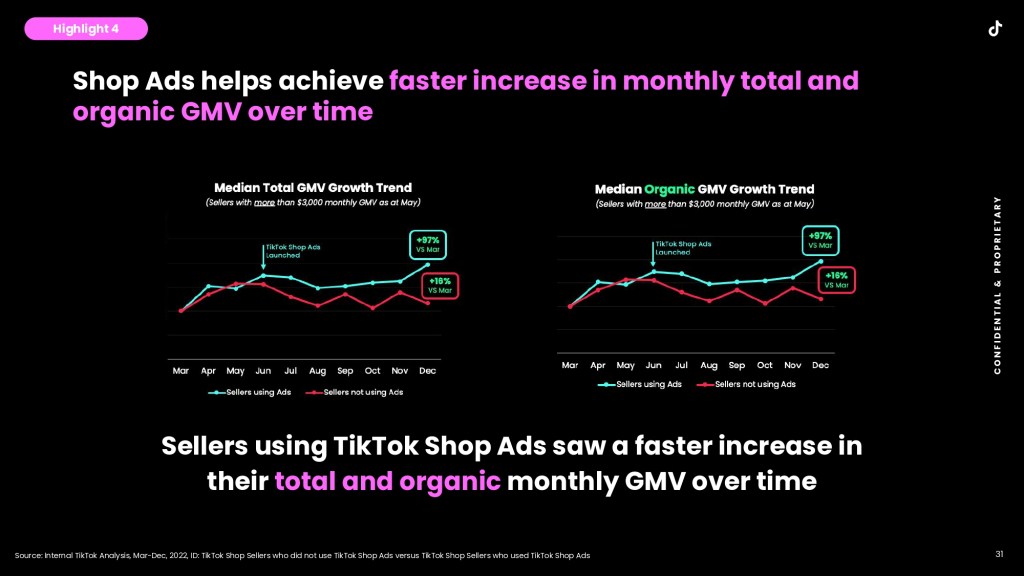

The deck addresses how these formats positively impact both paid and organic Shop gross merchandise value (GMV). According to the document, generally using the Shop ads helps sellers achieve +129% higher median GMV, while using a combination of all three formats has helped sellers achieve +242% higher GMV, rather than just using one or two of the ads.

Undoubtedly, there’s a lot riding on this pitch. TikTok Shop is effectively uncharted territory that no other social platform has managed to master through buy-in, or seamless tech behind the scenes making the customer journey worthwhile. And TikTok’s e-commerce business is relying on the Shop to be a significant money maker.

Added to that, last month it was reported that TikTok Shop specifically is expected to lose more than $500 million this year in the U.S. — not the kind of stats anyone would want circulating around launch. It’s believed the loss is due to the company’s excessive hiring, building a delivery network and subsidizing merchants which offer double digit percentage discounts.

“TikTok was able to grow and scale due to the creativity of the people on the platform; the creators made it into the zeitgeist,” said Enberg. “They made it into an entertainment platform. I think the missing piece so far is that TikTok not only needs to build out the tech, it also needs that dose of creativity which will encourage TikTok users to open their wallets. We’ve seen some early signs of successes, particularly from smaller DTC brands that have been selling well on TikTok Shop already.”

More in Marketing

Thrive Market’s Amina Pasha believes brands that focus on trust will win in an AI-first world

Amina Pasha, CMO at Thrive Market, believes building trust can help brands differentiate themselves.

Despite flight to fame, celeb talent isn’t as sure a bet as CMOs think

Brands are leaning more heavily on celebrity talent in advertising. Marketers see guaranteed wins in working with big names, but there are hidden risks.

With AI backlash building, marketers reconsider their approach

With AI hype giving way to skepticism, advertisers are reassessing how the technology fits into their workflows and brand positioning.