Secure your place at the Digiday Publishing Summit in Vail, March 23-25

In Graphic Detail: Why YouTube is a genuine threat to Netflix

The most telling point (so far) of Netflix’s proposed acquisition of Warner Bros Discovery, HBO and streaming businesses came from the company itself. In pushing back on claims that the deal would be anti-competitive, Netflix co-CEO Greg Peters pointed to YouTube as a bona fide rival that it would still trail with Warner Bros stack — a point that would’ve sounded far-fetched not that long ago.

That framing reflects a broader shift in how competition in video is actually playing out. The fight is no longer just about who owns the biggest library or who can stack the most subscribers. It’s also about who captures attention, who sets the viewing habits and who becomes the default place people go when they open a screen.

Which helps explain why Netflix increasingly frames itself not only against other streamers but to YouTube — a platform that dominates watch time, reaches a far broader audience and is quietly reshaping what “television” even means. Read on to see where that shift is now, in clear graphic detail.

YouTube already far outdoes Netflix in terms of TV watch time

When it comes to watch time, there’s no question that YouTube is already ahead of its competition, particularly Netflix.

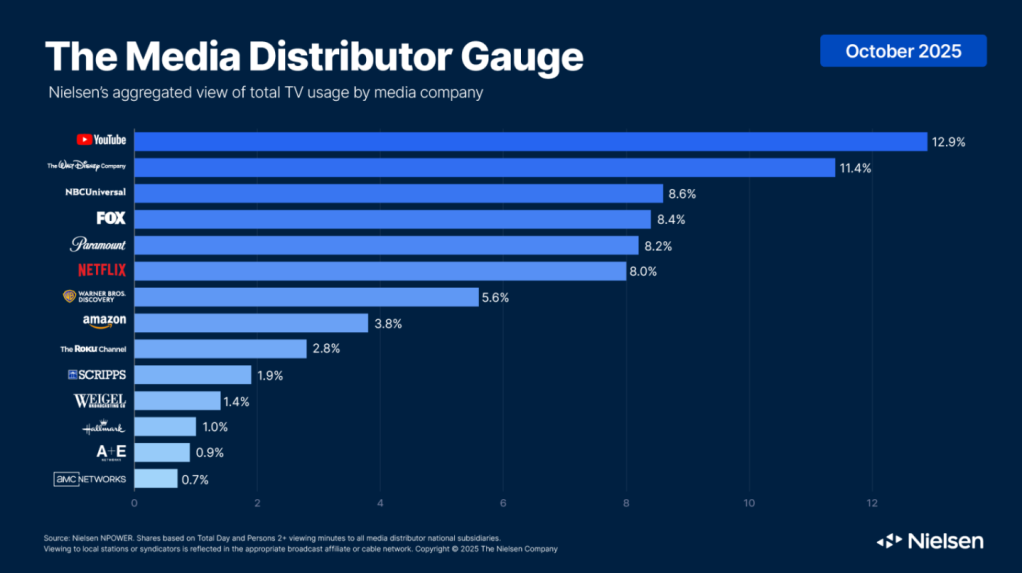

According to Nielsen’s October gauge, YouTube takes the top spot among its streaming peers for total TV usage. And by top spot, YouTube took 12.9% of total watch time, up 4% on the previous month. By comparison, Netflix sat in sixth place with 8% of total watch time.

And even if Netflix’s deal works out and the company is able to buy just HBO and HBO Max, its watch time would still trail behind YouTube. Netflix’s co-CEO Greg Peters admitted as much while talking during UBS’ 2025 Global Media and Communications Conference in New York on Dec. 8.

“We go from 8% of viewed hours today in the U.S. to 9%. We’re still behind YouTube at 13%,” Peters said.

YouTube surpasses Netflix in terms of users

While Netflix continues to expand its global user base, YouTube still dominates overall usage at scale.

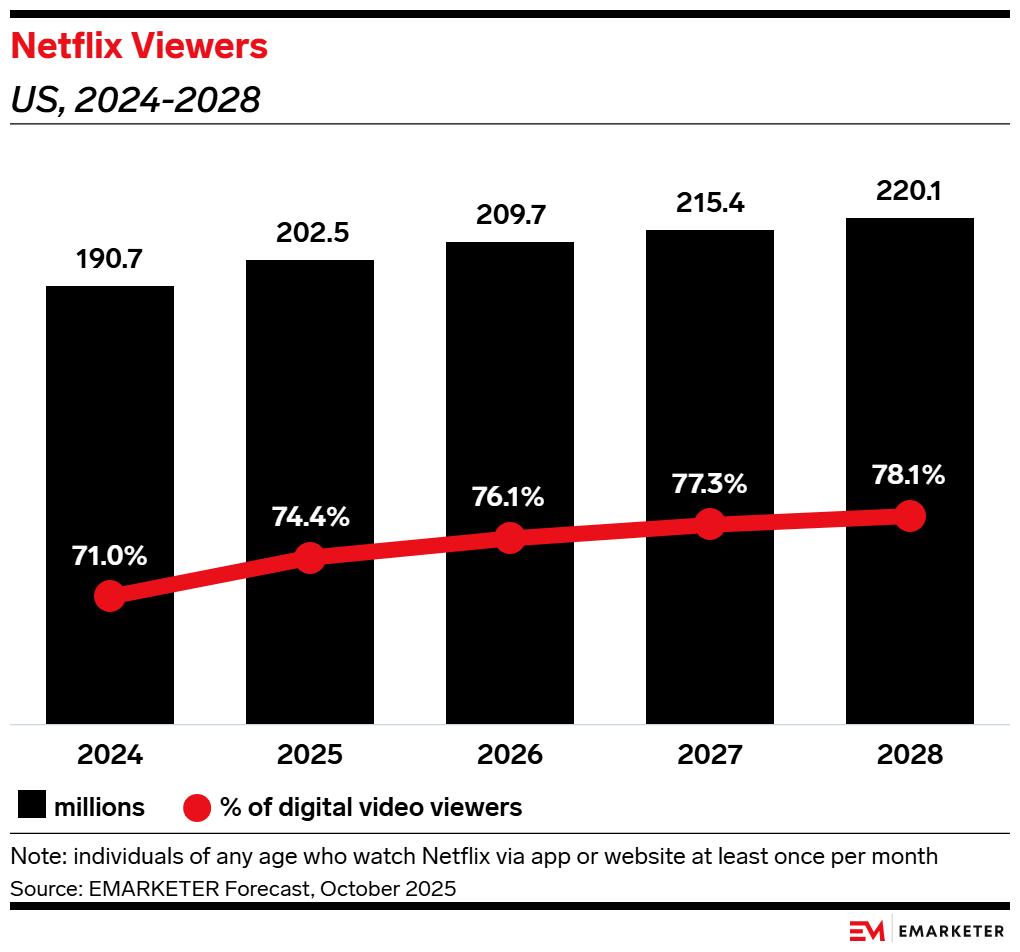

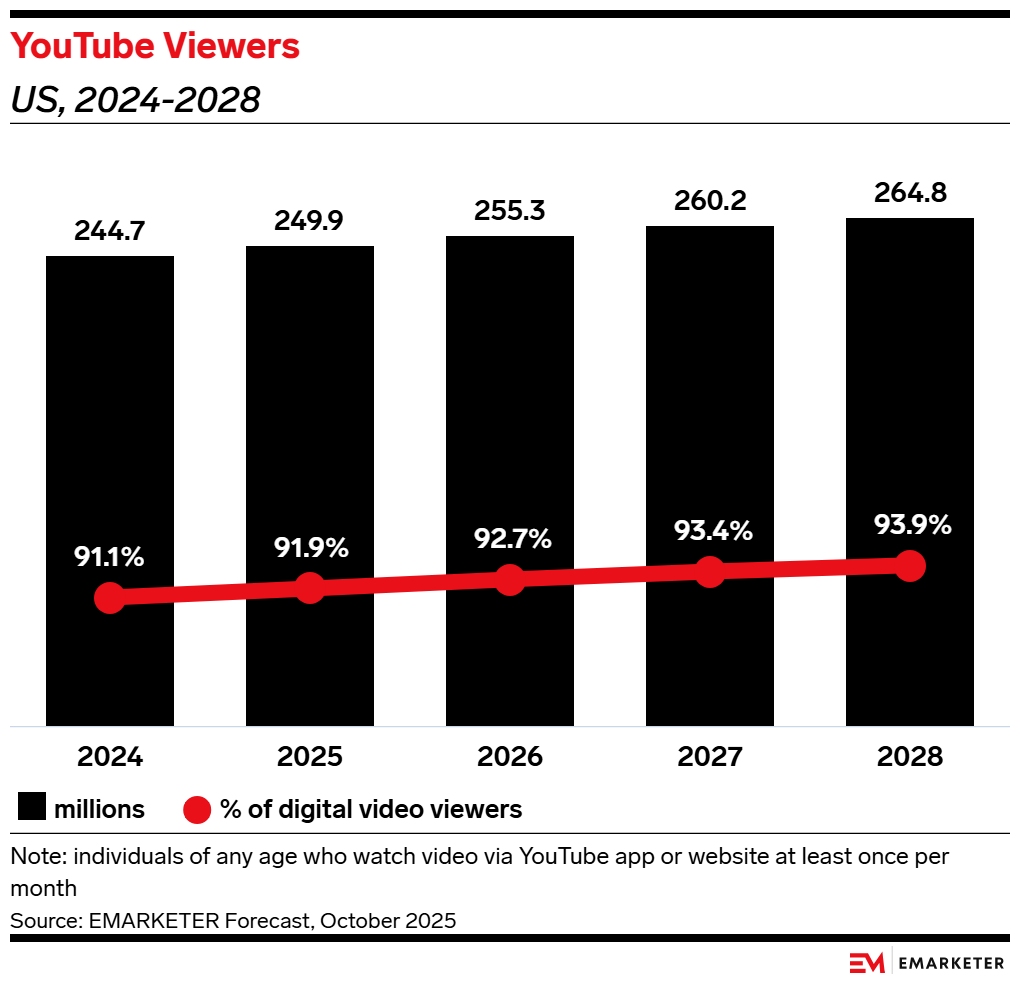

According to eMarketer’s October forecast, which counted individuals of any age who watch Netflix and YouTube via the app or website at least once per month, Netflix is expected to reach a total of 202.5 million users by the end of 2025, rising to 209.7 million in 2026, 215.4 million in 2027.

By comparison, the same eMarketer forecast has predicted that YouTube will reach 249.9 million users by the end of this year, increasing to 255.3 million in 2026 and again to 260.2 million by the year after.

YouTube is already ahead when it comes to revenue and viewing hours

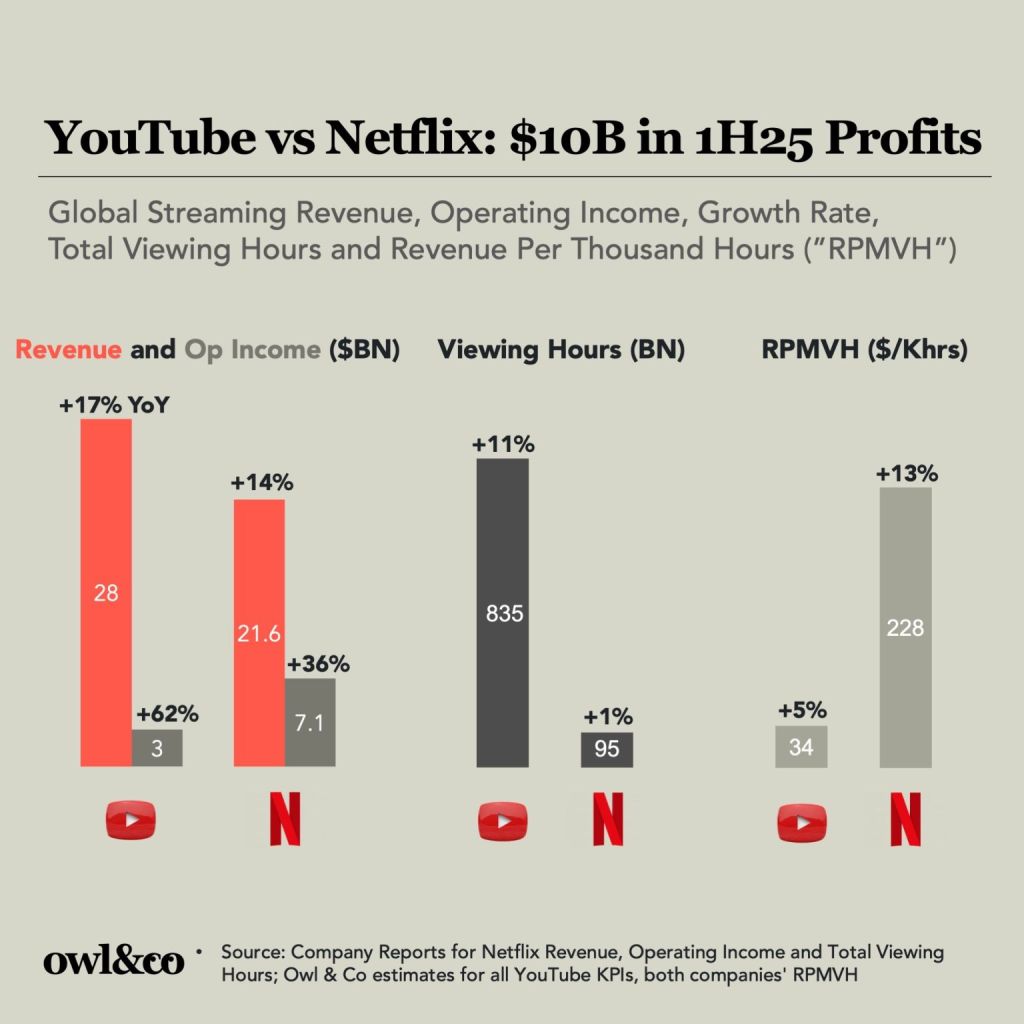

During the first half of 2025, YouTube and Netflix raked in an aggregate $10 billion in profits, according to data collected by Owl & Co. But what’s interesting is how those figures were split.

YouTube raked in $28.1 billion in revenues, up 17% year-over-year, compared to Netflix which pulled in $21.6 billion, up 14% year-over-year, for the same 1H25.

Which makes sense then why YouTube managed to top viewing hours, bringing in 835 billion during the first half of the year, compared to Netflix’s 95 billion, per Owl & Co.

In the U.K. YouTube’s viewer growth is driven by heavy users of both YouTube and Netflix

As you’d expect, most consumers typically sign up to more than one streaming platform. So it’s rare to see an either or situation.

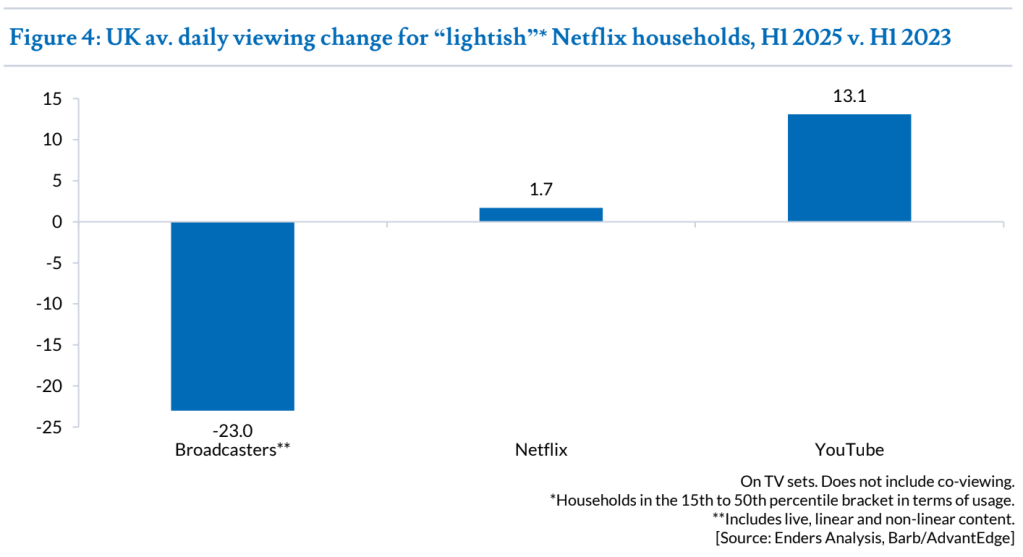

Specifically in the U.K. the people increasing YouTube’s growth on TV are already very heavy users of both YouTube and Netflix — rather than users which have picked one platform over the other, according to Enders.

Which means there’s a huge overlap: the biggest YouTube users are also the biggest Netflix users.

While it does mean Netflix has serious competition with YouTube when it comes to competing for watch time, Netflix isn’t worried about its heavy users. The real risk comes from those users who don’t watch Netflix very often, as they could potentially cancel their subscriptions.

For the last two years, people have been spending around 13 more minutes per day on YouTube, while Netflix viewing has stayed relatively flat, per Enders.

When in doubt, consumers go to YouTube

It’s no surprise that consumer behavior around watching content has shifted, and streaming has become a popular mode for that. But while Netflix mostly changed where TV happens, YouTube reshaped daily behavior — not just what consumers watch, but how they watch it.

“YouTube dominates video and the biggest thing that’s changing right now is the way content is changing,” said Hermelinda Fernandez, svp, digital investment at Canvas Worldwide. “Podcasts are huge and all the really big podcasts are on YouTube, and people are watching it like a primetime show on their CTV in their living room. Shorts really exploded for YouTube and even though it’s a vertical format, people are watching them on their CTV screen in their living room. So it’s not just reality shows, scripted content or live TV. They now own the vodcast space and even vertical video, both of which are on CTV.”

Shamsul Chowdhury, former Jellyfish exec and paid social media expert agrees. “YouTube has evolved [over the past 10 years] and now with YouTube TV, I’m sure Google is trying to figure out how to drive a compelling sales narrative to show cost efficiencies between linear and CTV.”

When people can’t find something to watch on TV or other streaming devices, the majority head to YouTube, according to HUB Entertainment Research.

In fact, 80% of those surveyed said they sometimes or frequently turn to YouTube when they can’t find anything else.

In other words, YouTube isn’t just another app, or a backup plan when linear TV, Netflix or other streaming platforms fall short. YouTube has the ability to capture the moments of boredom and indecision that any other platform can’t.

Broken down, that’s 90% of 16 to 34 year olds who frequently or sometimes turn to YouTube in those moments, along with 73% of those aged 35 and upwards.

More in Marketing

Yahoo pauses IAB membership amid a series of quiet cost-saving measures

Yahoo pulls IAB board memberships, following job cuts as PE-owner reportedly reconsiders ad tech investments.

Target looks to e-commerce, advertising investments to help grow the business

Technology is one of the most important areas in which Target will invest with the hopes of returning to profit growth.

‘The conversation has shifted’: The CFO moved upstream. Now agencies have to as well

One interesting side effect of marketing coming under greater scrutiny in the boardroom: CFOs are working more closely with agencies than ever before.