Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

How Authentic Brands Group has positioned itself as the 2020 repo man

This story is part of Endgames, a Digiday Media editorial package focused on what’s next, what’s coming, and what’s being phased out in the industries we cover. Access the rest of our Endgames coverage here; to read Modern Retail’s Endgames coverage, click here; Glossy’s coverage is available here.

2020 was a tough time to be a retailer, unless you happen to be a billionaire with an eye for retail.

Nearly 30 retailers have filed for bankruptcy so far in 2020, closing thousands of stores. But a few of those businesses have been acquired by consortia like Authentic Brands Group. Most recently ABG has purchased Brooks Brothers, Forever 21 and Barneys — all ailing for their own set of reasons.

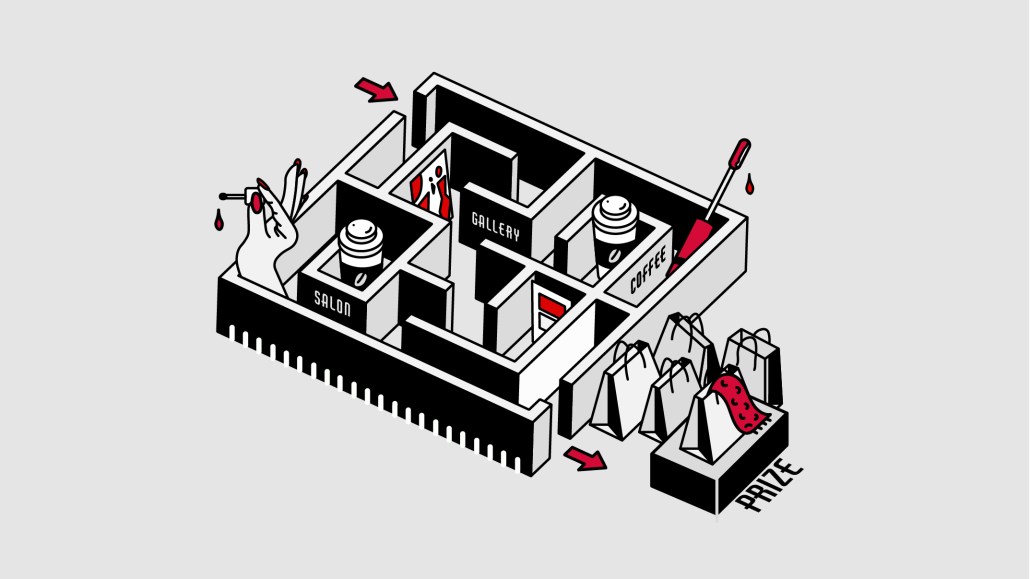

ABG’s philosophy seems simple, and predicated on past wins: buy low and eke out profit any way you can, every step of the way. That includes brand partnerships, licensing and keeping only the aspects of the business that have been shown bring returns. In 2020, that model was able to reach a scale never before seen. Retailers left and right have been crashing and burning, and ABG has been waiting in the wings to scoop up the right properties.

In August, ABG and Simon Property (via a combined entity called SPARC — Simon Properties Authentic Retail Concepts) scooped up Brooks Brothers at the discount price of $325 million. ABG expects to sign partners for Brooks Brothers furnishings, underwear, neckwear, hosiery, footwear, fragrance, beauty and other categories, or, as ABG’s CMO and Nick Woodhouse put it, “redefine the brand promise and reclaim its heritage with an eye focused on the future.” The project was one of cutting costs, focusing on the most profitable locations and quadrupling its online presence.

For years, ABG has purchased different businesses with the tying bind being that they had instant customer recognition. The portfolio includes Sports Illustrated, Juicy Couture, Frederick’s of Hollywood and Elvis Presley. For most of these, the play has been to license the name out and bring in cheap revenue. According to the New York Times, these names put together have brought in $15 billion annually.

But the coronavirus has laid bare how vulnerable many of these businesses are. Indeed, the long-term problem facing many legacy retailers came to a head over the course of weeks. Businesses like department stores, which have spotty e-commerce footprints and long relied on mall locations and in-store traffic, saw sales dry up. This past September, J.C. Penney reported $694 million in revenue, compared to $1.01 billion the same period a year earlier. Even Nordstrom — a department store considered to be better prepared for industry headwinds than most legacy players — saw sales drop 53% during the second quarter of 2020.

ABG’s counter is to add real estate to the mix. Working with a leading developer means more options open up in the game of buying retailers on the cheap. “By having your business partner be one of your biggest landlords, you can get a break on rent and make sure your locations are very strategic,” said retail consultant Rebekah Kondrat.

It’s a mutually beneficial relationship, said Kondrat; ABG gets to wield its axe to whittle down a brand, and “Simon gets to keep its mall occupancy and anchor tenants in those malls.”

Still, the time is ripe for more moves. Older brands are continuing to stumble, and repo men are preparing for the almost certain fire sale. Who’s next? Some experts believe Sur La Table or even a mall staple like AMC theaters. “What happens if those [mall] tenants go under?” asked Kondrat. “Do you buy them too?”

Whoever it is, the billionaires are keeping an eye out. “We are certainly not done with the fallout,” said retail analyst Steve Dennis. “There are going to be incredibly great names and assets that are available at incredible prices.”

More in Marketing

WTF are tokens?

When someone sends a prompt or receives a response, the system breaks language into small segments. These fragments are tokens.

AI is changing how retailers select tech partners

The quick rise of artificial intelligence-powered tools has reshaped retailers’ process of selecting technology partners for anything from marketing to supply chain to merchandising.

YouTube’s upmarket TV push still runs on mid-funnel DNA

YouTube is balancing wanting to be premium TV, the short-form powerhouse and a creator economy engine all at once.