Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

‘Geared to a millennial’s lifestyle’: Engagement and wedding rings have gone DTC

In 2015, Anubh Shah founded Four Mine, a direct-to-consumer engagement ring company as a “proof of concept.” Shah believed that the business of buying diamond engagement rings was ripe for a revamp, as people are not only now more comfortable purchasing big-ticket items online today, but they are looking for a more personalized experience that DTC brands can offer.

“In my research, I found that 90% of millennials were researching their ring online but only 10% of purchases were done online,” said Shah. “Why should there be such a gap? We set out to bridge that gap.”

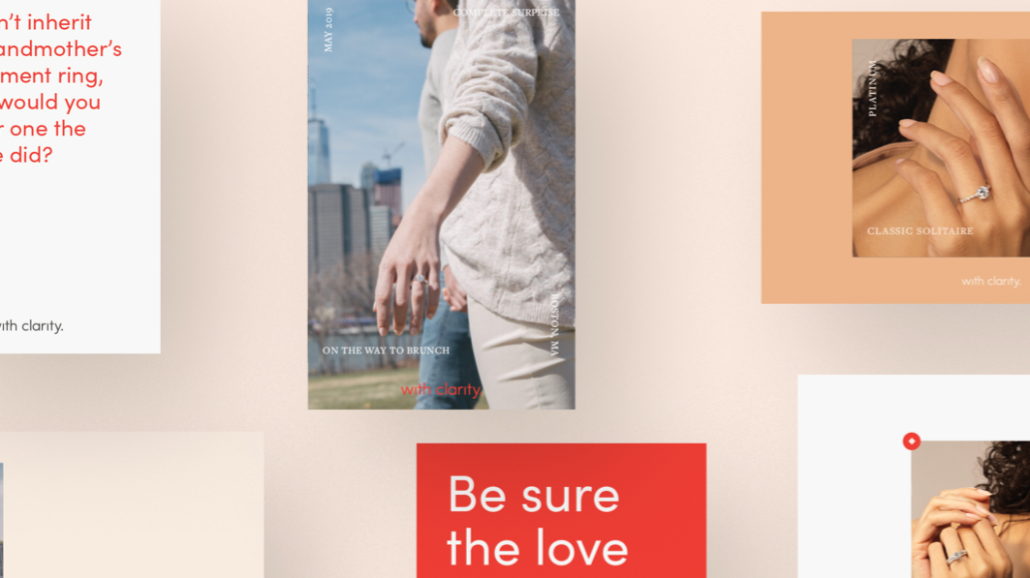

Last year, the company — now known as With Clarity following a rebrand this past June by Frank Collective — generated $18 million in revenue with the average order value coming in at roughly $7,000. Shah isn’t alone in his mission to DTC-ify engagement and wedding rings. A glut of DTC brands have cropped up recently, all with the aim of changing how you shop for an engagement ring. Instead of going to a brick-and-mortar jewelry store, brands like With Clarity, Erstwhile Jewelry, Manly Bands, Majesty Diamonds, Brilliant Earth and Vrai, among others, are looking to sway millennial consumers to purchase engagement (and wedding) rings online.

Founders of DTC engagement and wedding ring brands believe that millennials would rather research and buy their rings at home, free of the pressure to plunk down thousands from a pushy jewelry store sales rep. Engagement rings aren’t cheap — the average ring costs $5,764, per research from The Knot. The founders also say that the wave of DTC mattress companies making big purchases online has been normalized for younger generations.

“It’s a high-priced item, and it’s not an impulse buy,” said Manly Bands founder Johnathan Ruggiero, adding that this year Manly Bands will garner nearly “eight figures” in sales. “What really blazed the trail for the rest of us were the mattress companies. Never in my life did I think I’d buy a mattress online. But we’ve seen the online advertising. You get used to it, and it’s lifted the barrier to entry [into DTC] for luxury items. People are comfortable buying a $2000 mattress online, so they might as well buy a wedding ring.”

It makes sense that DTC founders would eye the cash cow that is the wedding industry. It’s big business: The wedding industry is expected to generate $76 billion in revenue this year alone, according to IBIS World research. There are roughly 2.4 million weddings every year in the U.S., per U.S. Census data, which also calculated that as of 2017 there are approximately 5,800 weddings a day.

“The wedding industry was long overdue for reinvention,” said Caroline Seklir, strategy director at YARD NYC. “Millennials are looking for brands that fit into and understand their lifestyles — and many of the traditional players in the space had begun to feel stuffy — more like their parents’ brands than their brand. So we’ve seen everything from wedding dresses to registries move online and into styles that are geared to a millennial’s lifestyle and price point. They want quality, but without the markup, and that’s what DTC can offer.”

As for the wealth of DTC engagement and wedding jewelry companies, Erstwhile Jewelry co-founder Alisa Klusner sees a shift in the jewelry business in general. “It used to be very insular,” said Klusner. “People would study at the GIA [or Gemological Institute of America]. Then they would apprentice. Now, all the information is at your fingertips. Because it’s so accessible you can be a little bit of an expert in a field without apprenticing. It’s become democratized.”

It’s not just the democratization of the jewelry business, said Klusner, but the way “the internet and social media has democratized access to customers. Jewelers used to rely solely on department stores and smaller retailers for an introduction to clients, unless they could afford to open their own brick and mortar store, which often was out of range. But launching a website is far more cost-effective and launching a social media account is free.”

The DTC engagement and wedding ring brands use the typical DTC playbook of Google, Facebook and Instagram ads to get consumer attention. Some, like With Clarity, are careful not to mention price in those ads as they don’t want to make the experience feel less premium. Others, like Majesty Diamonds, have leaned into the price differentiation.

“With the amount of time people spend on Facebook and Instagram, it’s the perfect place to push anything, even wedding rings,” said Paula Serafino, vp, Integrated Media Director at GYK Antler. “[People] are searching and pinning their dream wedding venue, dress and ring. Facebook and Instagram’s algorithm will make certain those DTC brands are front and center of the consumer at the right time, fully understanding their level of intent, and once they find the right consumer, it’s an easy sale.”

“It’s ironic that people would rather be targeted with ads than be bothered by in-store salespeople, but overall, the DTC model does put less pressure on people to make immediate decisions and gives them more control,” said Jason Miller, vp of social media and public relations, OH Partners. “Imagine being able to tag your partner or fiancé in a few Instagram posts of rings you like versus having to take a day or longer to drive around and visit ring shops. It’s a game-changer and fits seamlessly into how the next generation of couples likely want to plan their big day.”

People often ask friends for recommendations as to where to buy an engagement or wedding ring, and DTC founders believe their brands will benefit from that as people tend to tag the brands they purchase from online and tout them in their posts. “One of the most shareable moments in your life is when you get engaged,” said Shah.

Of course, simply being able to target consumers with ads and give millennials the kind of online experience they desire doesn’t guarantee it will work for everyone. A millennial male who asked for anonymity as he is planning to propose this weekend and doesn’t want to blow the surprise shared that while he tried Brilliant Earth and With Clarity after being targeted with Instagram ads, the online purchase route wasn’t for him.

“It didn’t feel personal, and I feel like you need to be walked through a purchase like this from start to finish,” he said. “I also had photos of what she might like and trying to build that stuff online was miserable. My friends stressed that they were able to secure deals by dealing with jewelers directly as well. I’m a big fan of many of the DTC brands out there, but this wasn’t one of the situations where I was going eschew tradition.”

More in Marketing

Thrive Market’s Amina Pasha believes brands that focus on trust will win in an AI-first world

Amina Pasha, CMO at Thrive Market, believes building trust can help brands differentiate themselves.

Despite flight to fame, celeb talent isn’t as sure a bet as CMOs think

Brands are leaning more heavily on celebrity talent in advertising. Marketers see guaranteed wins in working with big names, but there are hidden risks.

With AI backlash building, marketers reconsider their approach

With AI hype giving way to skepticism, advertisers are reassessing how the technology fits into their workflows and brand positioning.