Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Digiday Research: Social commerce is still a small piece of the pie

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

Earlier this month, Digiday’s sister site Glossy gathered executives from top brands and retailers in Miami for its first Glossy Summit, focused on mastering the modern retail experience. We asked top luxury marketers from Gucci, Chanel and Alexander Wang their views of top trends and opportunities in the industry. The following research is based off a pool of 26 respondents, all of whom are executives at fashion and luxury brands.

Influencer marketing is evolving.

Influencer marketing is growing quickly, but many brands are questioning whether their effectiveness is waning. “Is the best way to get customers today through a traditional, storytelling side or through an authentic or influencer side? That’s what we’re trying to figure out,” one brand executive said.

However, when surveyed, 73 percent of attendees said campaigns featuring influencers are easier to pull off than those without. Executives also reported comparable ROI on both types of campaigns, which somewhat explains influencers’ continued appeal.

Those reporting positive experiences with influencer campaigns largely attributed their success to hiring micro-influencers boasting engaged audiences. “We use a lot of smaller influencers, and they’re a huge opening for user-generated content, and that helps a business generate content quickly. We can then see the return on our investment in them. That gives us metrics to prove impact,” one brand rep said.

Instagram isn’t yet driving sales.

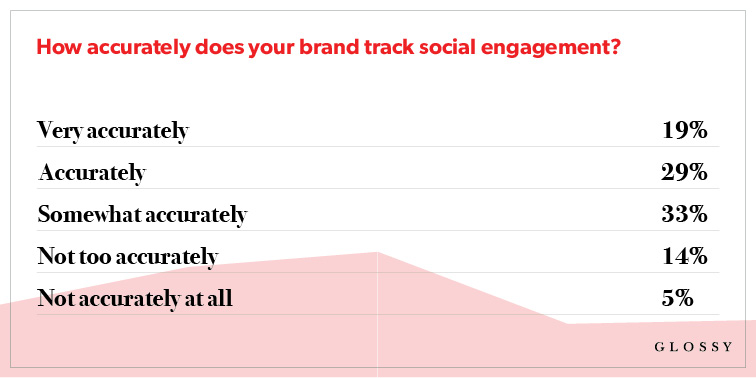

Brands are placing significant focus on social media but so far aren’t seeing sales. Over 80 percent of respondents said their brand currently tracks social engagement somewhat accurately or better.

Among their findings: Though now shoppable, Instagram is not yet a significant point of sale. Over 90 percent said social commerce accounts for 20 percent or less of their current revenue. For now, they’re relying on Instagram to connect with customers. “Authenticity is important — but an Instagram caption is not a KPI or an ROI,” one executive said.

E-commerce is growing.

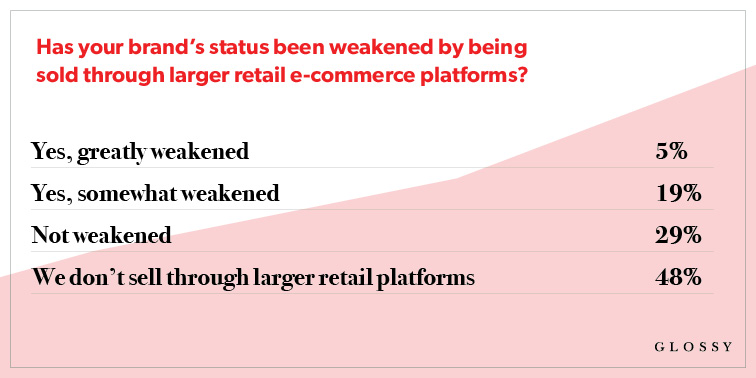

Selling through wholesalers is continuing to lose its appeal, as department stores struggle and brands look to form strong customer bonds. “It’s so hard to build a brand through retailers at this point, because they’re not good partners. If you don’t own the customer, there’s no way to find out who the customer is,” an executive said.

Only 52 percent of brands reported selling through department stores. Many are instead opting for the direct-to-consumer model, owing the decision to “giving customers value” and having “leeway to give good service, like free returns and exchanges, or customization.”

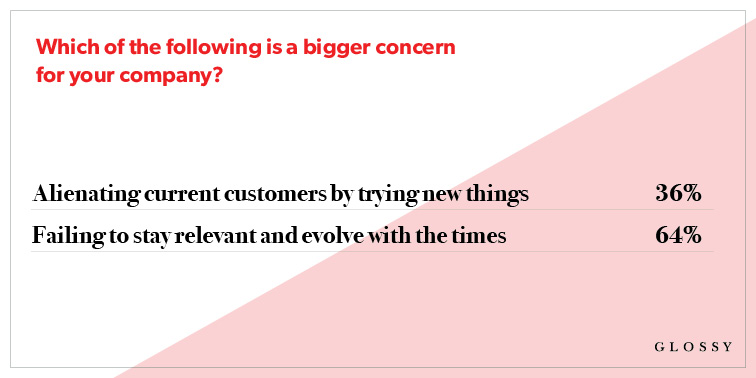

Brands fear falling behind.

Brands know that, more than ever, evolution is crucial to survival. Some are still fearful of change, knowing they’ll likely lose customers in the process, but most (64 percent) are more afraid of staying stagnant and losing relevance. “Not everything will succeed — there will be a trash heap of attempts. But it’s about continuous development and engagement,” one executive said.

More in Marketing

Brands at eTail Palm Springs share lessons on the ‘messy middle’ of building AI tools

Here’s a rundown of lessons brands have shared about their AI implementations so far.

Despite 2025 revenue beats, The Trade Desk’s stock price falls sharply after earnings update

Despite 2025 revenue nearing $3 billion, lower-than-expected Q1 guidance disappoints, as CEO Jeff Green pushes back against competitors and detractors.

Brands celebrate tariff reprieve, but fresh uncertainty looms

After the Supreme Court struck down Trump’s tariffs, brands welcomed the relief but say ongoing trade uncertainty and unanswered questions about refunds are keeping business decisions on hold.