Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Digiday Research: Over half of publishers see the majority of ad revenue from programmatic

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

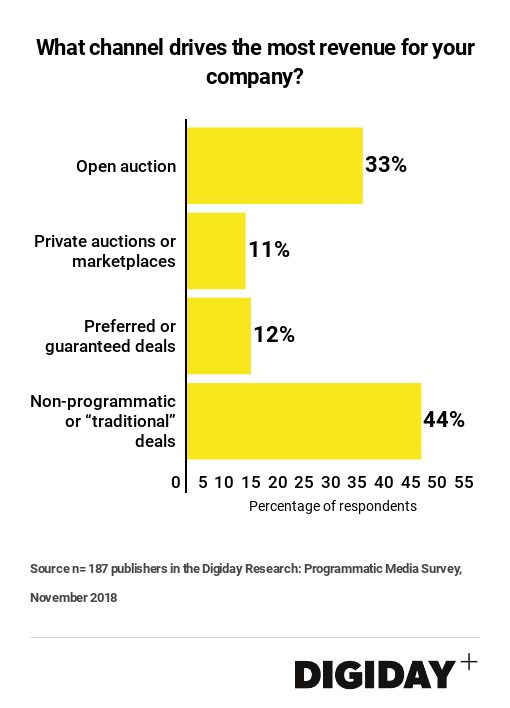

Over half of publishers now generate more revenue from programmatic advertising than any other channel. Fifty-five percent of 187 publishers surveyed by Digiday in November said programmatic advertising is now their largest driver of ad revenue, and 23 percent of respondents said private marketplaces or programmatic direct or guaranteed deals specifically are their biggest sources of ad revenue.

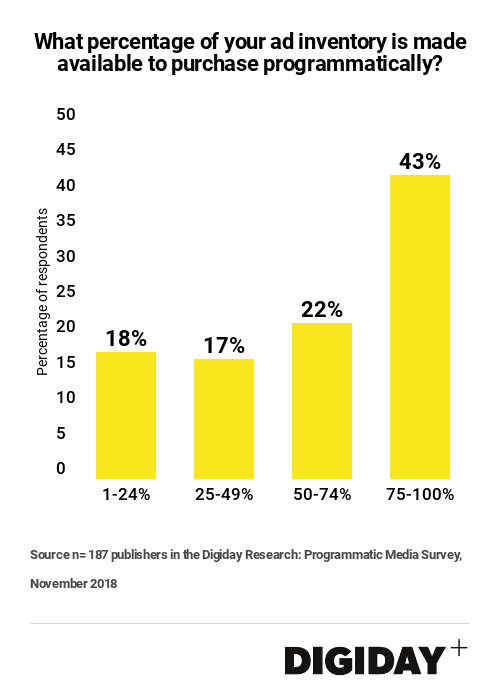

Publishers have proven their willingness to allocate their inventory to programmatic buying. Roughly two-thirds of publisher respondents in the Digiday survey said over half of their inventory is now made available to programmatic purchasing, signaling that programmatic isn’t just about remnant inventory anymore.

But pricing challenges persist for publishers. Sixty-eight percent said they receive less than half of their digital ad revenues from programmatic, despite committing much of their inventory to it.

As a result, publishers have turned to private marketplaces and programmatic guaranteed deals in an attempt to boost their yield and fight back against the downward pricing pressure that programmatic can inflict.

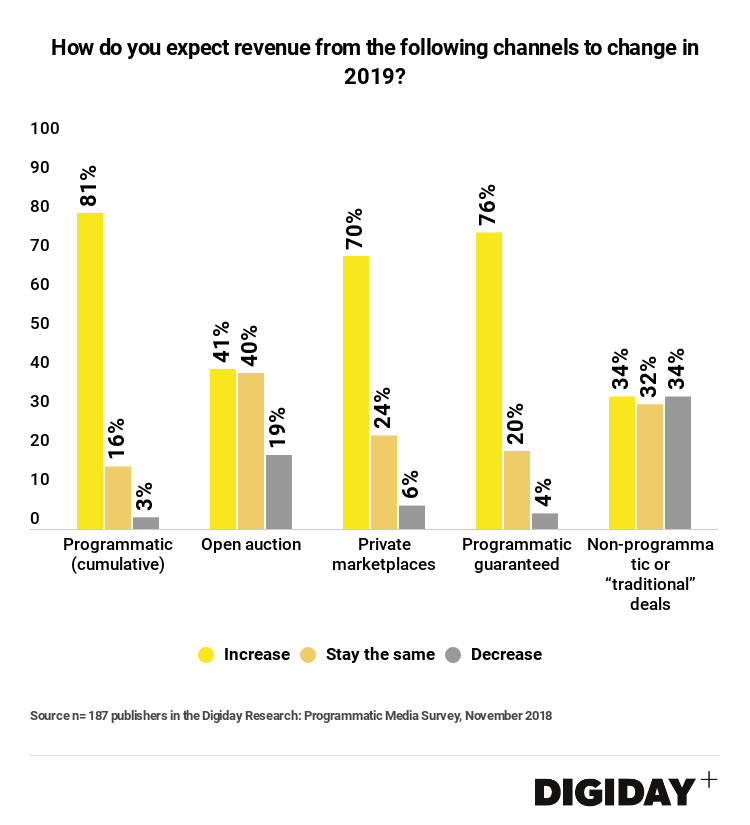

Seventy percent of publishers surveyed said that they expect to increase their revenues from PMPs in 2019. Publishers are also upping investments in advertising technologies in 2019, some of which could go towards improving PMP efficiencies. Seventy-six percent said they expect revenues from programmatic guaranteed deals to increase next year.

Creating PMPs can be a cumbersome process for publishers, however. Deals can fail to transact due to marketer’s overly specific targeting requirements or brand-safety tools that can limit the amount inventory advertisers can bid on, among other variables.

“With every PMP deal I’ve worked on, for example, the actual spend ended up being at least half of what the advertiser budgeted for,” said one publisher. Another respondent said, “It takes resources from us to implement and set up the deals and especially solve all technical issues.”

Publishers can also offer access to the first-party audience data buyers crave through programmatic guaranteed deals. In a post-General Data Protection Regulation-era where there’s a premium on first-party data, this makes such deals more desirable to marketers.

However, not all publishers are sold on programmatic guaranteed deals. A publisher who took the survey said it was frustrating that marketers “think programmatic guaranteed is a better way to do business than direct deals — from experience, it is worse for both performance and efficiency.” If publishers are going to lean increasingly on programmatic guaranteed deals, then these two issues must be solved.

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.