Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Digiday Research: Media buyers question quality of addressable TV targeting

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

At the Digiday Hot Topic UK: Data-Driven Publishing event last November in London, we sat down with over 20 media-buying executives from major agencies across the country to discuss developing trends such as the General Data Protection Regulation and addressable TV’s potential. Check out our earlier research on advertisers’ lack of concern about brand safety here. Learn more about our upcoming events here.

Top findings:

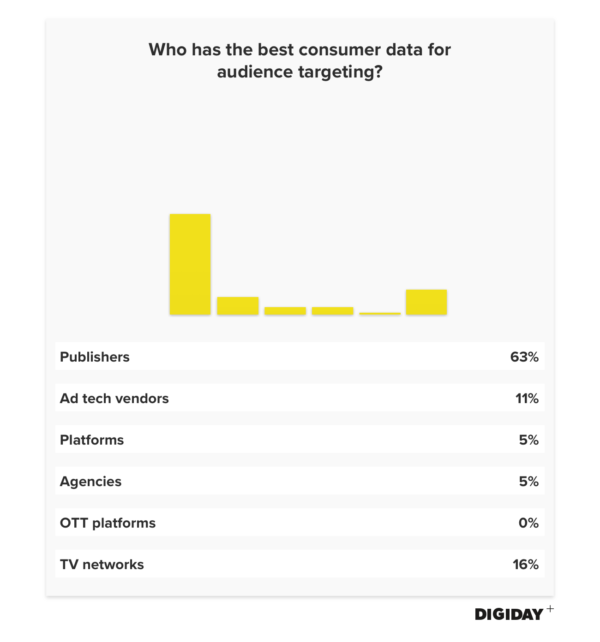

- Addressable TV has a long way to go to match digital advertising. Only 16 percent believe TV networks or OTT platforms collect the best data for consumer targeting.

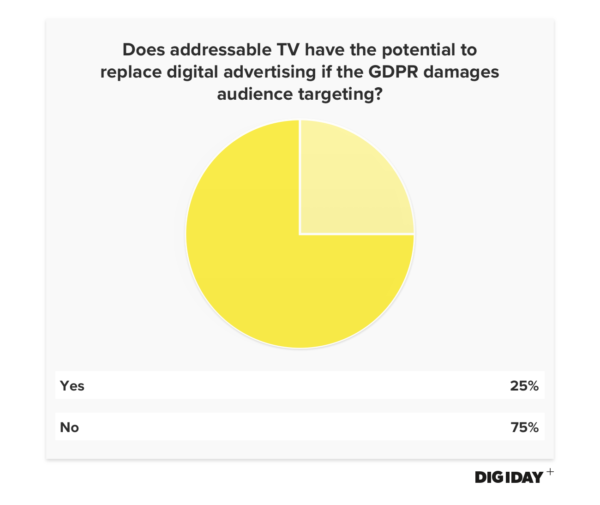

- Seventy-five percent of respondents don’t believe addressable TV can replace digital advertising if the GDPR damages audience-targeting capabilities.

- $600 million was spent on addressable TV in 2017, up from $450 million in 2016.

The enforcement of the GDPR on May 25 has most in digital media on edge. The GDPR will upend how data is collected from consumers and then used to target them. Some advertisers have noted the GDPR’s potential to improve the quality of data collected, but many are apprehensive about what the GDPR means for their ability to accurately target consumers. Location-based ad tech vendors that supply the data necessary for audience targeting are particularly susceptible to the GDPR’s effects because of how they collect their data.

This has some advertisers turning to different media channels to reach consumers, including addressable TV. However, Digiday’s survey found that only 25 percent of respondents think addressable TV has the potential to replace digital advertising, should the GDPR harm advertisers’ ability to target consumers.

Addressable TV offers marketers similar opportunities to digital advertising like location-based targeting. Dish Network, owner of OTT platform Sling TV, is betting heavily on addressable TV until more advertisers warm to programmatic TV ad buying. But compared to digital advertising, addressable TV is a drop in the bucket in terms of media spend. In 2017, marketers spent just $600 million on addressable TV, while they dumped $33 billion into programmatic display ads alone.

Although addressable TV ad spending is growing significantly, up 33 percent between 2016 and 2017, there are limitations. Both TV networks and OTT platforms fall far behind publishers in terms of the quality of data they collect. Two-thirds of respondents to Digiday’s survey believe publishers have the best data for targeting consumers, whereas just 16 percent said the same about TV networks. No respondents chose OTT platforms, which could be because over 80 percent of the 200 OTT streaming services offer ad-free subscription products. A lack of reliable TV audience measurement metrics has dissuaded advertisers from buying addressable TV, which must be improved before advertisers will spend their money on it.

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.