Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Digiday+ Research: Cookie concern is real — 71% of agency, brand execs worried and don’t know what’s next

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

Agencies and brands are obviously concerned about the death of the third-party cookie and the impact on their marketing businesses, but the reality is most don’t have a solid plan regarding what exactly post-cookie measurement and marketing will look like. It is clear that this uncertainty is widespread across the industry. What is not so clear is what comes next.

To find out more, Digiday surveyed 146 agency and brand professionals about their concerns and what actions are being taken by their businesses to address them. The survey, conducted in April, revealed that most agency and brand executives see advertisers losing the most following the death of the cookie and there is real worry about what will happen to measurement once their businesses enter a cookieless world.

However, Digiday’s research also found that, while brands and agencies still don’t know what will come next, many are working through different options in preparation for the end of third-party cookies in 2023.

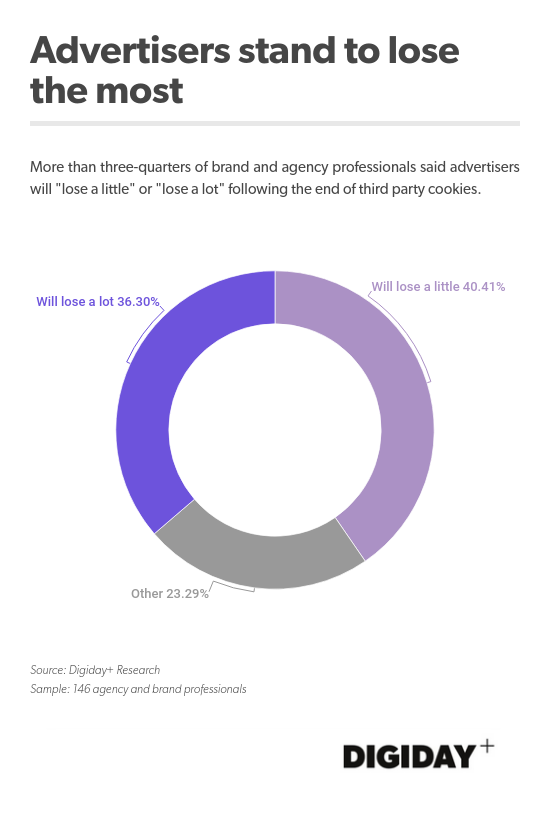

And as the industry prepares for the looming change to the digital advertising ecosystem, more than three-quarters of agency and brand professionals surveyed by Digiday said that advertisers stand to lose in the post-cookie world. More specifically, 40% of respondents said advertisers “will lose a little” following the death of the cookie, and 36% said they “will lose a lot.”

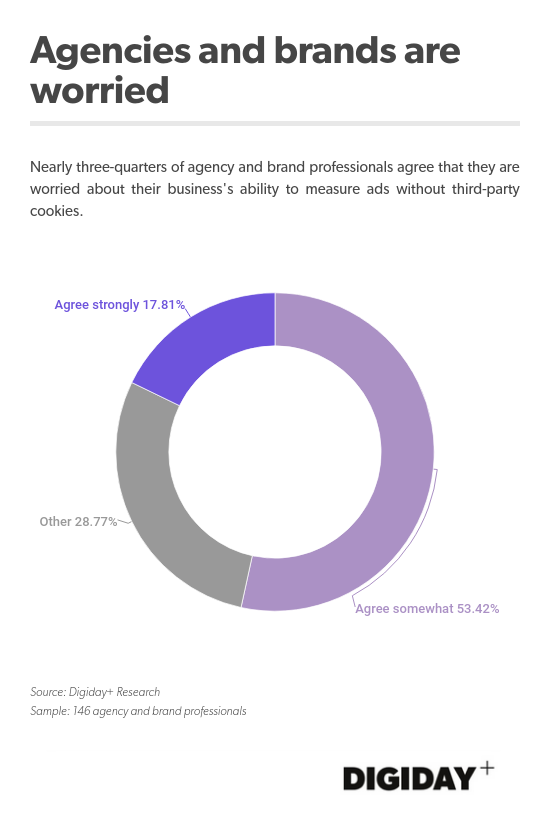

This stat is resonating among brand and agency pros: Just under three-quarters of respondents to Digiday’s survey said they worry about their organization’s ability to measure ads without third-party cookies. Fifty-three percent “agree somewhat” that their ad measurement ability post-cookies is a concern, and 18% “agree strongly.”

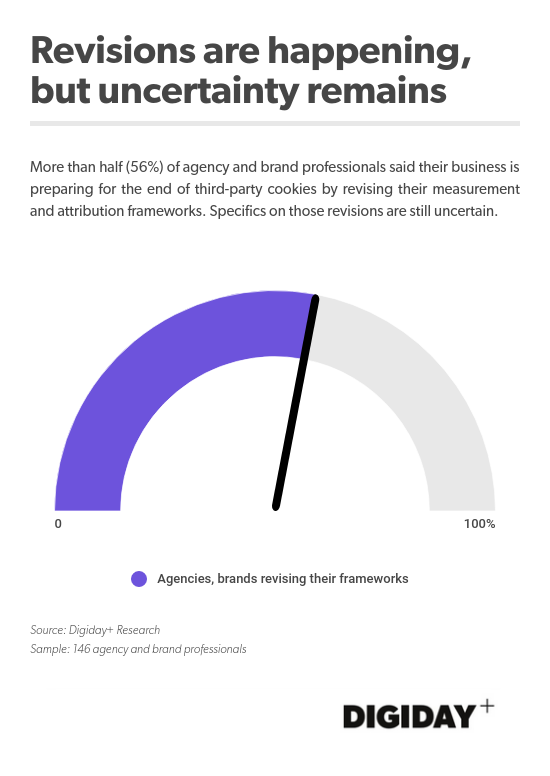

But agency and brand professionals are not letting themselves be paralyzed by their concern. According to Digiday’s survey, more than half of respondents said they are actively revising their measurements and attribution frameworks to prepare their businesses for the end of third-party cookies.

However, uncertainty is rife when it comes to what those revisions will look like. Will the new norm be contextual solutions? First-party data? Attention metrics? The list of possibilities is long — and the answer depends on who you ask.

More in Marketing

In graphic detail: How Anthropic’s Pentagon refusal is paying off in downloads, brand trust and enterprise deals

OpenAI’s Pentagon deal seemed to spark uproar among its users, many of whom were against it. Anthropic’s refusal to agree to the terms was seen by users as the more trustworthy alternative.

How AI could disrupt retail media’s $38 billion search ad market

ChatGPT and other AI chatbots could divert shoppers from retailer sites, putting the $38B retail search market at risk.

‘Brand safety is moving from fear to curiosity’: Zefr’s Raddon on content-level accreditation – and what it exposes about the industry

The threat is no longer a discrete piece of bad content that a keyword list or a domain block can catch. Its volume.