Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

After cutting back site list in March, JPMorgan Chase has doubled the number of sites it advertises on in the past six months

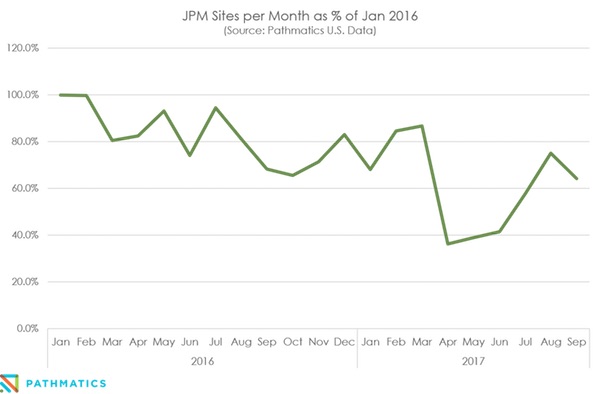

JPMorgan Chase became a cause célèbre for brand safety after The New York Times reported in March that the mega bank drastically reduced the number of sites it ran ads on from 400,000 websites a month to 5,000 sites a month. But since the Times report, the bank has increased the number of sites it runs ads on.

The company declined an interview request, but a JPMorgan Chase spokesperson said the brand now runs ads on about 10,000 websites — still just 2.5 percent of its original, impossibly broad site list. Ad tracking firms show a similar trajectory. Although the company’s ads appear on more sites now than they did in the spring, the bank still runs ads in far fewer places than it did a year ago. What this indicates is that despite how they’re talked about at industry conferences, brand-safety tactics are malleable.

“The whole strategy is probably more fluid than the firm stance that has been talked and written about,” said Ken Van Every, senior business development manager at programmatic buying platform DataXu. “But the end goal is still the same, and it’s a good one to protect their brand.”

After the number of sites with Chase ads cratered in March and April, the brand saw a 50 percent increase in the number of sites it ran ads on in May, according to MediaRadar, which declined to share raw numbers. Since May, there has been a steady uptick in the number of sites with Chase ads, but the growth has slowed significantly. In August, Chase ads ran on only 6 percent more sites than they did in July, according to MediaRadar.

As seen in the chart below, which shows month-to-month percentage changes in the number of sites Chase has ads on, Pathmatics data also indicates the bank is running ads in more places since the Times report came out.

After the Times story began making the rounds within the media industry, the bank probably received a barrage of requests from publishers requesting that their sites be included on its whitelist, Van Every said. The expansion of the number of sites Chase runs ads on was likely an accommodation of these requests. Although cheap reach is appealing to most brands, a doubling of sites doesn’t necessarily increase reach by that much since the most popular sites (most of which were likely already included in Chase’s campaigns) have exponentially more traffic and inventory than long-tail sites, Van Every said.

Marc Goldberg, CEO of brand-safety firm Trust Metrics, said whitelists and blacklists need regular monitoring and updating in order to be effective, so it’s not that surprising to a see brand open up its campaigns to more sites after testing a new strategy.

“Neither a whitelist or blacklist is a static document designed to set and forget,” he said.

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.