Secure your place at the Digiday Publishing Summit in Vail, March 23-25

With the new year approaching, ’tis the season for advertising forecasts.

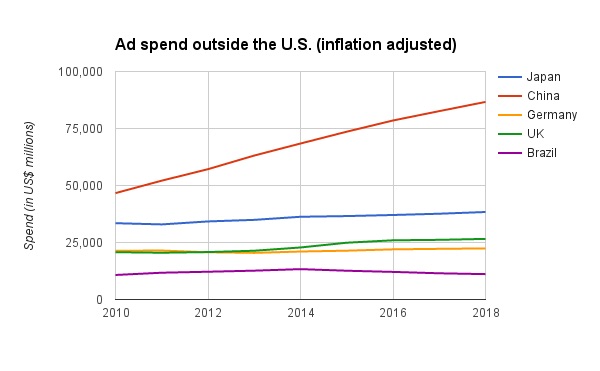

Recent reports from Magna and Zenith indicate that China’s advertising growth will continue to outpace other large international markets and that digital ad spend will finally usurp TV ad spend next year. Researchers also predict that mobile will take up nearly all of the global advertising growth and that social video will be a major driver of mobile’s growth.

Here are five charts that provide an outlook into global advertising in 2017.

China keeps growing

The U.S. is expected to bring in about $180 billion in global ad revenue in 2016, which is about 37 percent of the global total, according to Magna data. Although the U.S. market is still about double the size of the Chinese market, ad spend in China is expected to continue to close the gap. Aside from the U.S., China is blowing everybody else out of the water.

Some factors contributing to China’s growing advertising market are its size, its growth in per capita GDP and its improving online connectivity, said Brandon Verblow, an analyst at Forrester.

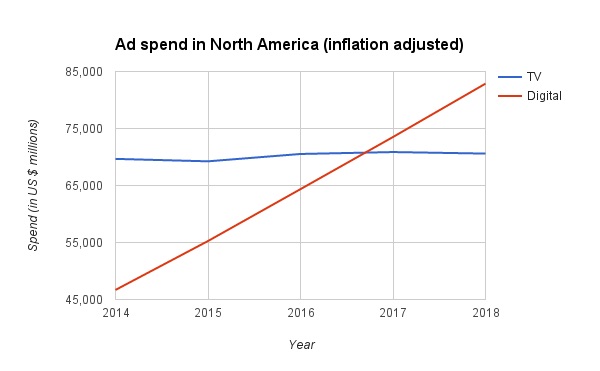

Digital will exceed TV

According to Zenith data, next year will the first time that digital ad spend exceeds TV ad spend in North America. Zenith forecasts that digital spend will keep climbing while TV spend stagnates.

“It was going to happen eventually,” said Anne Austin, publications manager at Zenith. “It was just a question of when.”

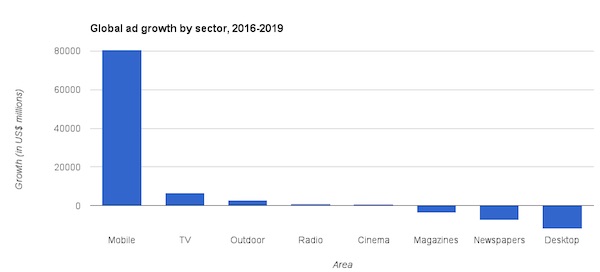

Spend shares shift

Between now and 2019, mobile’s share of global ad spend will increase while other major advertising sectors will see their share decline.

“Besides being the device of choice for engaging in social media, consuming email, and engaging with brands and retailers [through mobile apps], phone handsets are not subject to ad blocking software, and they often afford marketers key location data that drives relevance and response rates,” said Nick Einstein, vp of research at The Relevancy Group.

Mobile takes all the growth

While mobile’s share of ad spend grows, mobile will suck up virtually all the advertising growth, Zenith forecasts. Desktop advertising in particular is expected to decline while mobile surges.

“Ultimately, you have to look at where people spend the most amount of time to see where ad spending will increase,” said Omar Akhtar, an analyst at Altimeter Group. “And more and more, the answer to that question is mobile.”

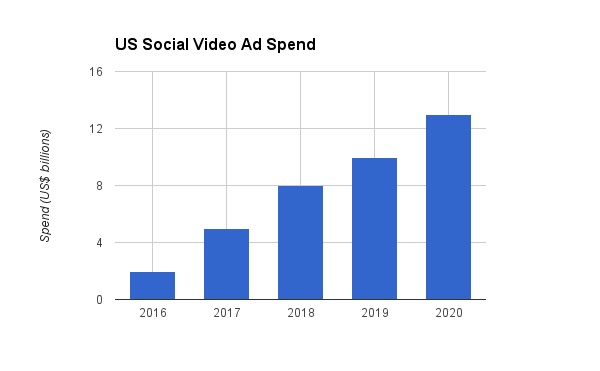

Social video growth

Social video is a major driver of mobile’s projected growth. From Facebook Live to Snapchat Discover, platforms have ramped up their video products in recent years, and researchers predict that trend will only continue. Magna projects that social video ad spend will jump from about $2 billion in 2016 to $8 billion in 2018.

“Since a large amount of mobile time spent occurs on social, social video will benefit from higher mobile video consumption,” Verblow said. “I think increasing social video consumption will also come from social platforms doing more to promote video.”

Image courtesy of Creative Commons

More in Marketing

Best Buy wants to be the hub for AI-powered hardware like glasses, laptops

The tech retailer is looking for growth, as its revenue was essentially flat this past fiscal year from the year before, at almost $42 billion.

The in-house entertainment studio is having its social media team moment

Brands are becoming media companies (again). This time they mean it.

TikTok after the legal fight and why it’s coming for Meta’s ad dollars

With legal issues behind it, TikTok is stepping up marketing and making a stronger play for Meta’s ad budgets.