Secure your place at the Digiday Publishing Summit in Vail, March 23-25

How Chandon gets Instagram-happy millennials to guzzle down sparkling wine

Sparkling wine maker Chandon has plenty of reasons to raise a glass to Instagram.

The bubbly brand, owned by luxury conglomerate LVMH, started its Pinterest page almost two years ago but recently has felt that it does not have the engagement or momentum as the Facebook-owned photo-sharing phenomenon.

“Right now, from all of our social channels, Instagram is No. 1, over Pinterest, Facebook and Twitter,” said Korinne Munson, director of communications at Moet Hennessy USA. While Chandon still maintains its Pinterest account, Munson said that Instagram is much more “shareable” and has the potential for images to go viral, so she has pulled a lot more resources away from Pinterest to that platform.

Millennials are a big reason for the switch, too. L2 reports that 27 percent of adult millennials now choose beer as their favorite alcoholic drink. That’s down from 33 percent in 2012. Which means there is room for vodka, tequila and bubbly to pour more out.

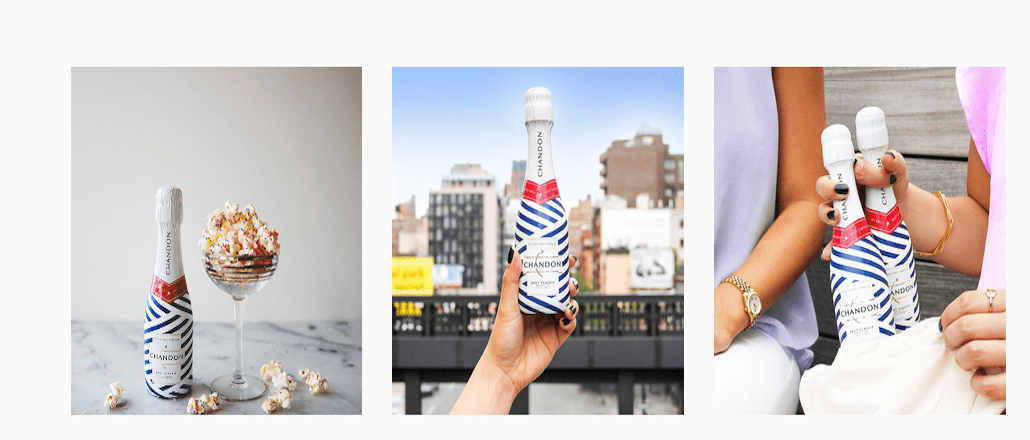

Millennials, of course, are very active on Instagram, especially female millennials, a core focus for Chandon. The company has gone as far as to make sure that its bottles, which are colorful and feature phrases like “Today calls for Rosé,” are “Instagrammable,” said Munson.

Chandon, which doesn’t classify as a champagne since it’s made in Napa, also makes it a point to distance itself from its French-owned heritage. That can be seen, for example, in the red, white and blue-striped bottles it created last year as a “limited edition” design — bottles that make up, overwhelmingly, its Instagram presence (an example of the bottleshot tactic favored by many alcohol brands, such as Stoli).

Unlike champagne and sparkling wine brands, the company also doesn’t overwhelmingly focus its social marketing on the fourth quarter, when those brands become more active in preparation for the holidays. Instead, it’s gone American, choosing to create summertime images of drinking wine on the patio for Fourth of July, for example. “We’re trying not to be European-esque,” said Munson. “We need to get it out of the holiday rut.”

It’s also priced lower — under $25 — and easily available. (Moët & Chandon, the more expensive champagne that is also part of the LVMH portfolio, is completely separate from Chandon and retails for almost $50.)

Last year, its parent put some muscle behind promoting Chandon in the U.S., starting new female-targeted lines like the Délice, a blend of Chardonnay, Pinot Noir and Pinot Menunier. Impact Databank said Chandon is one of the most popular sparkling wine brands in the U.S., with 400,000 cases sold last year.

Chandon’t isn’t alone in its platform proclivities: Beauty company Elizabeth Arden also recently told Digiday that it has moved away from Pinterest in favor of Instagram. Forrester analyst Nate Elliott had also found that Pinterest’s limited targeting has created confusion as to ad performance on Pinterest. “Many marketers just can’t seem to find success [on the platform],” wrote Elliott. Munson agrees: “We had to prioritize something, and that something had to be Instagram,” she said.

More in Marketing

‘Nobody’s asking the question’: WPP’s biggest restructure in years means nothing until CMOs say it does

WPP declared itself transformed. CMOs will decide if that’s true.

Why a Gen Alpha–focused skin-care brand is giving equity to teen creators

Brands are looking for new ways to build relationships that last, and go deeper than a hashtag-sponsored post.

Pitch deck: How ChatGPT ads are being sold to Criteo advertisers

OpenAI has the ad inventory. Criteo has relationships with advertisers. Here’s how they’re using them.