Secure your place at the Digiday Publishing Summit in Vail, March 23-25

What more fitting place for retailers to discuss the store of the future than Seattle, home to Amazon. Against a backdrop of store closures and job losses, retail and brand execs tried to remain upbeat about the future of the physical store. Brick-and-mortar stores aren’t dead, only in need of being rethought. After all, Amazon just bought 431 Whole Foods stores — and now has stores of its own.

“If stores were dead, Amazon would not be opening them,” said Eric Collier, the head of retail for Godiva.

At Future Stores Seattle, a three-day retail conference focused on the modern in-store experience, execs from brands and retailers like Samsung, Neiman Marcus. Westfield and Fabletics came together to discuss their vision for the store of the future. Turns out, the future store has less to do with digital touchscreens and VR experiments, and more to do with reorganizing internal teams, empowering store associates, and bridging the gap between digital activations and physical stores.

Here are the biggest takeaways on the state of the store of the future.

Actually, it’s customer of the future, not store of the future.

Too often, store-of-the-future technology and activations are hung up on expensive hardware and buzzworthy PR stunts that are impossible to scale.

Scott Emmons, the head of innovation at Neiman Marcus (and the lone employee of the department store’s iLab), decided to discard that terminology.

“We rapidly realized we weren’t thinking about it right,” said Emmons. “It’s not about that store of the future, it’s about the customer of the future.”

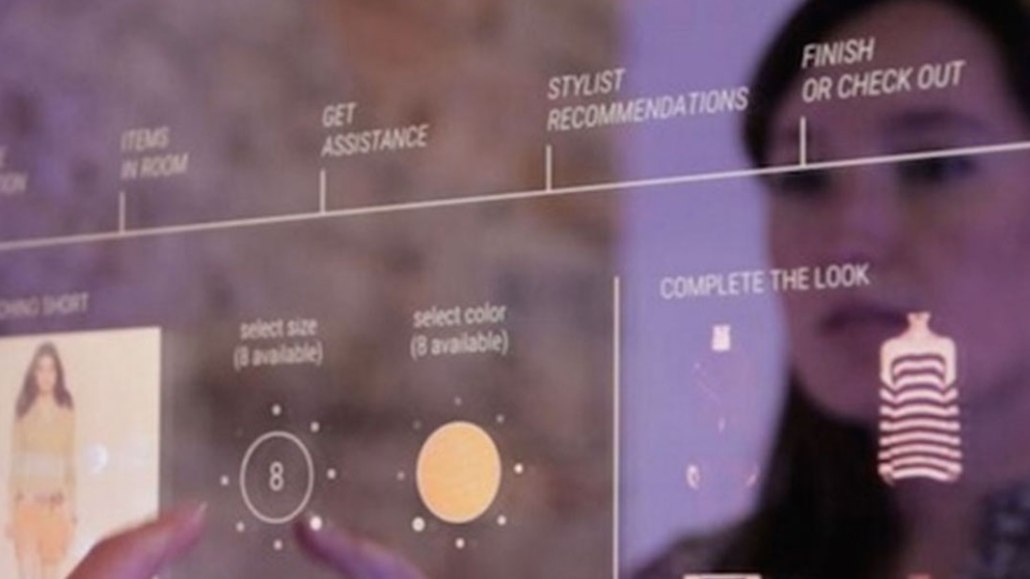

For Neiman Marcus, having that mindset means that new technology and experiences coming out of the iLab are focused on removing friction from the mobile, online and in-store shopping experience. Technology that doesn’t stick with customers — like a digital wall in the shoe department that let shoppers pick a personal selection of shoes from an iPad — is ditched.

The in-store channel can’t be in competition with the online channel.

Samsung’s senior director of retail strategy and innovation Matt Austin doesn’t care where Samsung customers are making purchases, whether it’s at a Best Buy, online or in Samsung’s own brick-and-mortar store.

“You have to be OK with someone walking away without making a purchase,” said Austin. “As long as they’re walking away more educated about your product.”

For retail partners, like Best Buy and other department stores, that wisdom is harder to swallow as they’re seeing declining foot traffic and increasing competition coming from individual brands and online companies like Amazon.

“Wholesale brands aren’t wedded to retailers anymore,” said Logan Rodriguez, director of retailer at SaaS platform Square Root. “It’s tough when your store is just a container for brands on a shelf that are making sales elsewhere.”

Stores should be used as customer data hubs.

To Collier’s point, in-store customer interaction is valuable even for companies like Amazon. Pure-plays are moving into the brick-and-mortar space in order to learn more about their customers, build brand awareness and see a halo effect of sales, as online transactions see a lift in areas where there are physical stores.

While Fabletics still does most of its sales online, physical stores are key for testing new products, perfecting design and educating shoppers about the brand’s membership model. The company’s internal teams are prepared to respond quickly to all data gathered from the personal interactions customers are having with product, and that affects how the online store operates.

“You can see it in the market — we see an overall lift of sales where we have a physical store,” said Gregg Throgmartin, the president of Fabletics. “Adding a brand touchpoint is going to improve business.”

Retailers and brands can work together to cut costs and offer new experiences.

Westfield’s svp of retail experience, Steve Dumas, said that while technology is currently causing malls to struggle, it’s opening up opportunities. He pitched an idea to help malls drive traffic while getting stores to work together to improve the space: a universal mobile experience would let shoppers browse across-mall inventory for items, and results would pull from all stores in the mall.

“The goal is to create a space where people want to hang out and linger, while including our retailers in a new experience,” said Dumas.

To push through new technology at Neiman Marcus, Emmons is also pitching its brand partners. When rolling out its augmented reality Memory Mirror to beauty counters, Neiman Marcus’s iLab demonstrated what was in it for the brands: namely, a personalized customer experience, with direct ownership, as each beauty counter could have its own AR mirror. As a result, the brands shared the cost of the technology roll out, making it easier for Emmons to scale it.

“When you can say your partners are going to help you pay for something, you get a yes,” he said.

More in Marketing

Sephora announces partnership with F1 Academy

As the official beauty retail partner of the series, the beauty giant will appear on a dedicated Sephora-branded car.

Customer reviews become a key battleground as AI revolutionizes product discovery

AI Platforms like ChatGPT and Perplexity are reshaping how customers discover products online.

As AI creative moves upstream, one production firm is pitching brands a model built on that trend

As production budgets tighten, Ritual Labs is betting brands will use AI to prototype and test campaigns earlier in the creative process.