Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

5 things to know from this week: Walmart vs. Amazon, ads.txt adoption and more

This week’s things to know cover Walmart’s fight against Amazon, ads.txt, the European Union’s ePrivacy law and more.

Walmart continues battling Amazon

Walmart is attempting to draw in affluent customers in an effort to capture market share from Amazon, which has struggled to attract and retain luxury brands.

Walmart’s approach:

- Marketing Jet.com as a channel to sell its higher-end e-commerce brands like Bonobos to metropolitan millennials

- Launching private label Uniquely J to serve those consumers with essential yet premium products

- Arranging for premium brands like Godiva to sell items on walmart.com

Walmart is also reportedly near a deal to give Lord & Taylor dedicated space on its website.

Jason Goldberg, svp of commerce and content at SapientRazorfish, described the Walmart-Amazon fight as the “Godzilla versus King Kong battle of retailers.”

Meanwhile, Walmart is trying to grow its advertising business, positioning itself as a media platform. Walmart’s pitch: Scale and brick-and-mortar locations that can connect online and offline data differentiate it from Amazon.

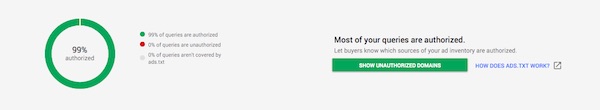

Google helps boost ads.txt implementation

In May, the Interactive Advertising Bureau Tech Lab released ads.txt, a text file on publishers’ web servers that lists their authorized inventory sellers to help ad buyers avoid fraud. In the 100 days afterward, 13 percent of the 10,000 most popular domains that sell digital ads implemented it. Between mid-September and the end of October, that number increased to 44 percent, according to data from Ad Ops Insider publisher Ben Kneen.

How Google pushed adoption during this uptick:

- Announcing that some of its most popular ad products will filter for ads.txt

- Adding an ads.txt management tab to its ad server that shows publishers the sellers listing their domains without authorization

- Helping publishers create ads.txt files

- Spelling errors in ads.txt files could cause drop-offs of legitimate inventory sellers.

- It doesn’t specify the inventory format authorized sellers can carry, creating an opportunity for inventory arbitrage.

- Demand-side platforms might not refer to ads.txt and stop buying inventory from unauthorized sellers.

As Mike Moore, associate director of programmatic partnerships for GroupM, put it: “I don’t think it is the silver bullet to solve all of our problems that we are hoping it might have been.”

The ePrivacy law looms

While the General Data Protection Regulation has received most of the industry’s attention lately, another law concerning data privacy, the ePrivacy regulation, is supposed to take effect next year. Under the proposed new ePrivacy law, European businesses must get explicit consent to use certain cookies — the prime method of ad tracking — and provide clear opt-outs to users.

One loser of the new regulation: Businesses reliant on behavioral advertising, which depends on cookies that require consent to use to build a picture of people’s interests. One beneficiary: Publishers that can explain the value exchange for consumers will likely get more users to grant consent for cookie use.

Consent isn’t needed for all cookies. Here’s a guide to the most common types and what the law means for each.

The flyby visitor’s value

Publishers have considered flyby readers, who aren’t loyal and don’t view many ads, low value. But new research from digital analytics firm Parsely found that people who bounce, or leave a site, after one article are more valuable than often thought.

Parsely examined 1.6 billion “bounced” visits to text pages on news and entertainment publishers’ sites in its network over a six-month period. Key takeaways:

- Sixty-eight percent of bounced visits lasted at least 15 seconds, and 77 percent of those were longer than 30 seconds.

- The average engaged time for visits longer than 15 seconds was 81 seconds, compared to 56 seconds across all bounced visits.

UK publishers aren’t going all-in on video

U.K. publishers haven’t pivoted to video in the way their U.S. peers have. Here’s why:

- The U.K. has fewer venture-backed media companies scrambling to live up to lofty expectations.

- Facebook’s shift to video prompted publishers more dependent on the platform for traffic to follow suit, but U.K. publishers are less reliant on Facebook than those in the U.S.

- The market for video is smaller in the U.K.: eMarketer forecasts video ad spend there to account for 13 percent of total digital ad spend in 2017, compared to 16 percent in the U.S.

More in Marketing

Thrive Market’s Amina Pasha believes brands that focus on trust will win in an AI-first world

Amina Pasha, CMO at Thrive Market, believes building trust can help brands differentiate themselves.

Despite flight to fame, celeb talent isn’t as sure a bet as CMOs think

Brands are leaning more heavily on celebrity talent in advertising. Marketers see guaranteed wins in working with big names, but there are hidden risks.

With AI backlash building, marketers reconsider their approach

With AI hype giving way to skepticism, advertisers are reassessing how the technology fits into their workflows and brand positioning.